Agri-Equities Potential for Significant Profit Expansion

Commodities / Agricultural Commodities Oct 02, 2011 - 10:35 AM GMTBy: Ned_W_Schmidt

A center of global commerce? Connecting to the global Agri-Food system? Helping to feed Japan, Korea, and China? Why yes, Moses Lake, Washington comes immediately to mind. In the Hay Report from World news services via wenatcheeworld.com we discover, "Moses Lake (Sept 16) -- Tonnage this week: 18,180; last week: 19,555; last year: 14,970." That year-to-year increase for bales of hay sold is 20+%, and might have been higher had supply not been constrained in the U.S.

A center of global commerce? Connecting to the global Agri-Food system? Helping to feed Japan, Korea, and China? Why yes, Moses Lake, Washington comes immediately to mind. In the Hay Report from World news services via wenatcheeworld.com we discover, "Moses Lake (Sept 16) -- Tonnage this week: 18,180; last week: 19,555; last year: 14,970." That year-to-year increase for bales of hay sold is 20+%, and might have been higher had supply not been constrained in the U.S.

Discovering that hay was smoking hot we pushed on to "Kittitas Valley hay fetches top dollar in Japan" by E. Lacitus, Seattle Times, 5 September.

"On a recent summer morning, a sales manager from Japan and his assistant were driven to a 1,100-acre hay farm about three miles southeast of town. They had flown into Seattle a few days earlier. At this particular farm, the sales manager, Kenny Miura, of Yoshi International out of Tokyo, went inside a massive barn stacked 20 feet high with bales of timothy hay. Miura pulled some of the hay out of a bale and quickly gave it a grade--in this case, what amounts to about a 'C'."

"To the surprise of many who don't live here, 90 percent of the timothy grown in the valley will never be eaten by an American horse or cow. The closest locals will get to it is when a hay truck goes by, or motorists see stacks covered with vinyl tarps in fields alongside Interstate 90."

"Nearly all of the timothy[hay] from here is shipped by sea to Japan and, in lesser amounts, to countries such as South Korea and China, and also the United Arab Emirates." [Emphasis added.]

A variety of factors have come together to make hay a hot topic in the global Agri-Food export market. High grain prices raise the value of hay as an alternative feed for animals. Global demand for meats means higher demand for feed, both grain and hay.

Interesting aspect of exporting hay to Asia for animal feed is the low food value of hay, relative to grains. What has made hay exports viable is the vast number of container ships bringing cargos to the U.S. from Asia. Normally, many of those containers would return to Asia generally empty. Now, some are filled with hay, distillers' dry grains, and other animal feeds.

All of the above leads to an interesting question. Will consumers be able to afford to eat meat in the future?

While pork and beef prices have risen nicely in the past year, all meat prices are cheap relative to the cost of feed. Either the prices of grains are too high relative to meat prices or meat prices are too low relative to grain prices. In either case, meat producers appear to be poised for a higher level of prosperity, like that being enjoyed by the corn and soybean barons of Iowa.

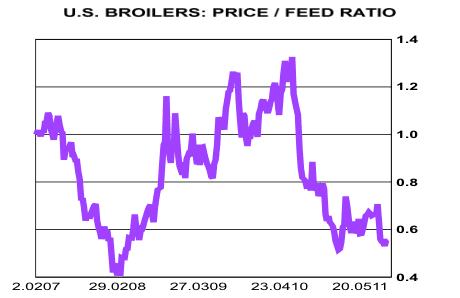

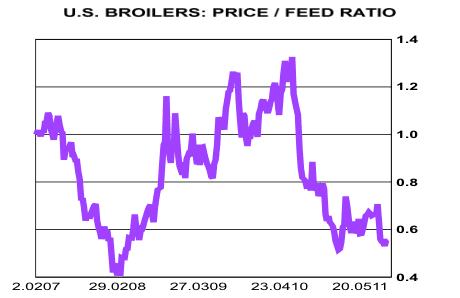

One of the more under valued of the meats is chicken, as shown in the following chart. In that graph is plotted the ratio of U.S. broiler, table chicken, prices to feed costs. When the ratio is low, broiler prices are too low relative to the cost of feed. Poultry farmers are likely losing money on every chicken they raise. While that might be normal business practice in the fantasy world of social networking sites, it is a situation that cannot persist in Agri-Foods where farmers do not have access to unlimited free money from the Street.

As can be observed in the chart, current ratio of broiler prices to feed costs is below 0.6. As indicated by the situation in 2008, that is an unstable level of prices received to the cost of feed. Most likely direction for the ratio over is time is upward. How much could it rise? Certainly something more than 1.0, and 1.2 is quite possible.

What does that potential imply for chicken prices? Chicken prices should rise by~ 80% relative to feed costs to restore profitability, and some type of equilibrium condition. That leads to another question. What will cause the improvement in chicken prices?

In Agri-Meat markets equilibrium pricing is restored through liquidation of herds, or flocks in the case of chicken. Liquidation is what happens when the pain of losing money becomes too great. Producers simply "throw up their hands", and sell the animals for whatever they can get. That liquidation phase can be observed in prices which spike downward in such a period. That seems to be what is being displayed in the graph below of U.S. broiler prices. Are chicken prices preparing to "double"?

We find the above situation prevalent in all the meat markets. Meat prices need to rise by 50-100% relative to grain prices to restore equilibrium in those markets. Given the pricing situation and continued high demand for meats from Asia, Agri-Equities of those producing meats, from hogs to cattle to chicken, seem to have the potential for a period of significant profit expansion. For those tiring of the situation with the Bernanke bear market rampaging equity values, considering U.S. pasture land as an investment alternative might be reasonable. For help on this latter subject see 5th Annual U.S. Agricultural Land As An Investment Portfolio Consideration - 2011, the definitive work on the U.S. Agri-Land. Obtain it at: www.agrifoodvalueview.com/AgriLandAnnual

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.