U.S. Consumer Spending in August Puts Q3 Change at Tepid Mark

Economics / US Economy Oct 02, 2011 - 04:05 AM GMTBy: Asha_Bangalore

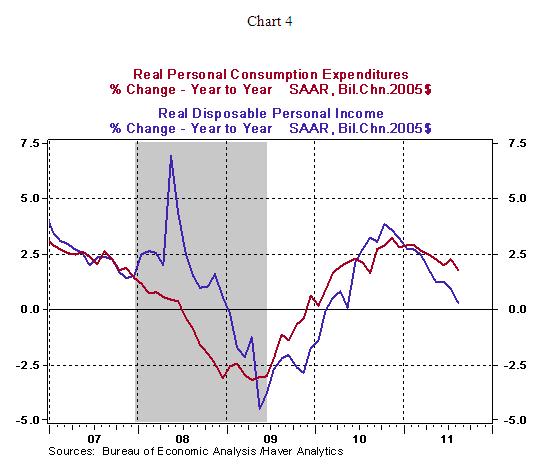

Real consumer spending held steady in August inclusive of a 0.1% increase in spending of durable goods and services and a 0.4% drop in purchases of services. Chairman Bernanke’s concern about the decelerating trend of consumer spending is justified. Real consumer spending grew only 1.77% from a year ago and real disposable income also shows a loss of momentum (see Chart 4). The July-August consumer spending numbers point a tepid increase in consumer spending in the third quarter, roughly 1.5%. This is slightly higher than the 0.7% increase in the second quarter but it is not a barnburner by any means.

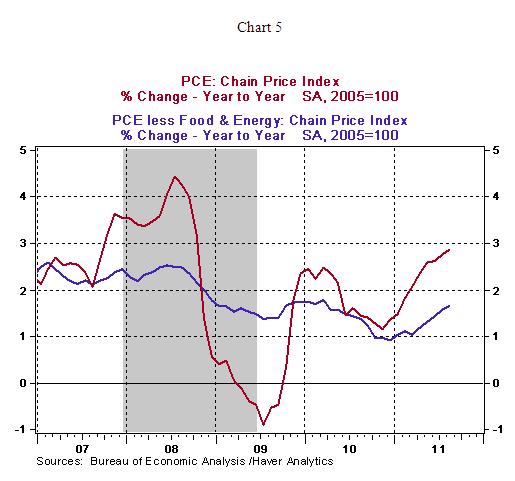

Nominal personal income fell 0.1% in August after a 0.1% gain in the prior month. Wages and salaries dropped 0.2% in August vs. a 0.3% increase in July. The personal saving rate as a percentage of disposable income edged down to 4.5% in August from 4.7% in July. The saving rate in 2011 is likely to average a touch lower than the 5.3% average recorded in 2010. The Fed’s preferred measures of inflation show a continued upward trend. The personal consumption expenditure price index moved up 2.9% from a year ago in August, while the core personal consumption expenditure price index, which excludes food and energy, rose 1.6%. It is widely expected that these price measures should post a moderating trend in the months ahead.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.