The Economic Recession As Forecasted By The Consumer

Economics / Double Dip Recession Oct 02, 2011 - 03:53 AM GMTBy: Tony_Pallotta

“A vocabulary of truth and simplicity will be of service throughout your life.” — Winston Churchill

“A vocabulary of truth and simplicity will be of service throughout your life.” — Winston Churchill

I prefer to keep things as simple as possible. Take for example the $14 trillion US economy. The most basic of tools, a survey has proven to be an excellent indicator of what otherwise could be a very complex analysis, forecasting economic growth.

Considering that the consumer has averaged 71% of GDP over the past six quarters taking the pulse of the consumer is by far the best gauge of future economic growth. That is why the epic rollover in consumer confidence is of such concern. It’s not forecasting a mild recession. It’s not forecasting “transitory sub par growth.”

As credit markets are forecasting sharp economic contraction so too is consumer confidence. Even more troubling is the duration of this slide. If this drop in confidence was temporary then you could argue it was fueled by the summer fears of a government shut down or the August slide in US equities and was in fact “transitory.” Instead this weakness has not only been sustained but in fact deteriorated to 2008 recession lows.

Making matters worse was the August contraction in personal income which combined with rising CPI will most certainly push confidence levels even lower. So just how concerned is the consumer?

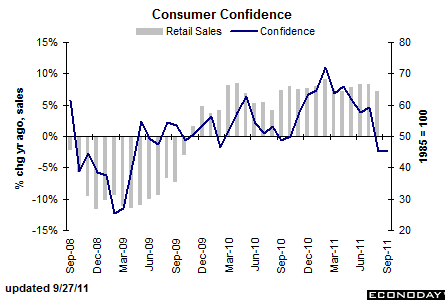

Conference Board Consumer Confidence

After peaking above 70 in March confidence has fallen to 46.5 in September. Notice the similar dive that occurred during September 2008 on the chart below.

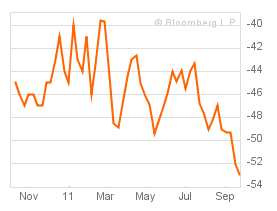

Bloomberg Consumer Comfort Index

A weekly confidence report showing a truly epic dive in confidence from (44) in July to (53) in September. The August reading is the second lowest on record behind that of November 2008 (54) and we know how dire the economy was during that period.

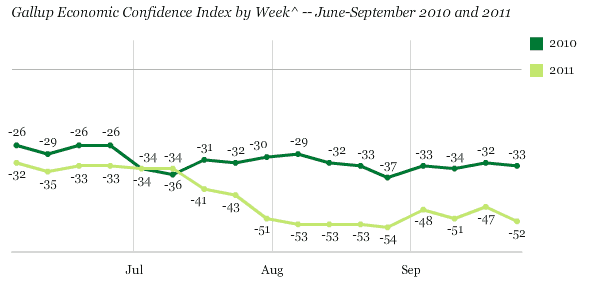

Gallup

Look at the fall off in economic confidence as measured by Gallup and compared to 2010. Record amounts of stimulus were pumped into the economy between 2010 and 2011. Rates fell to historic lows and yet confidence continues to move lower.

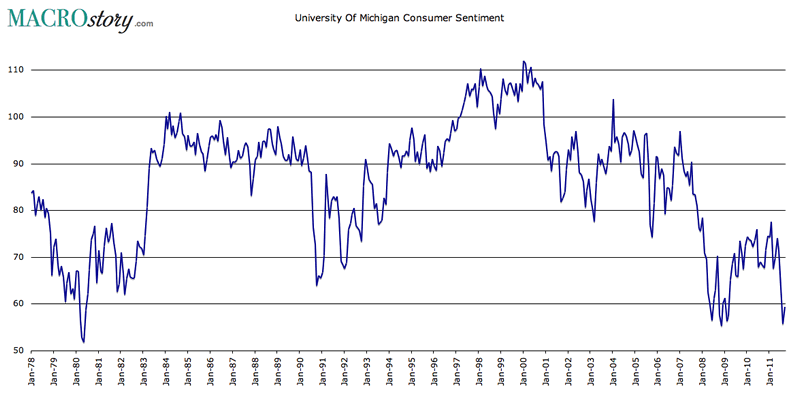

University Of Michigan

Back to levels last seen during the height of the 2008 recession and just above lows of the 1980′s.

So why do we care again? The consumer is fickle and can change their mind in a heartbeat right? I honestly thought that was the case until I truly began studying the correlations within the economy. In a consumer driven economy the consumer is everything.

A less confident consumer means slowing retail sales and services. Slowing sales means a drawdown in inventory. A drawdown in inventory means slowing manufacturing. Slowing manufacturing means job layoffs. Job layoffs puts more pressure on the consumer. A truly vicious cycle ensues.

The charts below show why we should all care. They show why this is not perma-bear chatter. They show why those calling equities cheap are only trying to maintain their assets under management. They show that when you complicate an analysis as most economists do that you truly miss the forest for the trees.

GDP Forecast

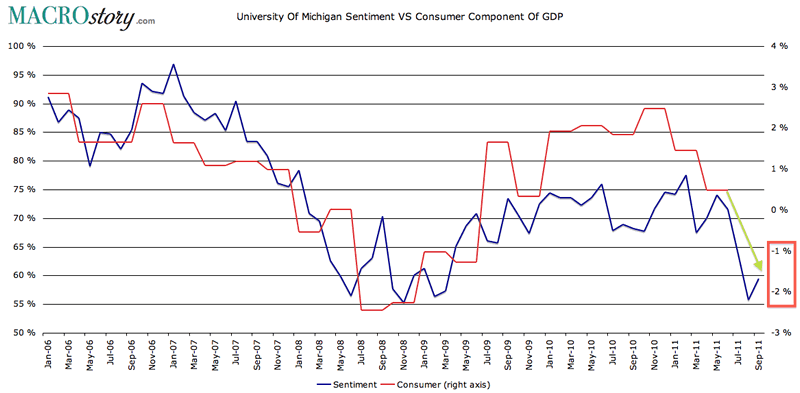

Consumer Component Forecast

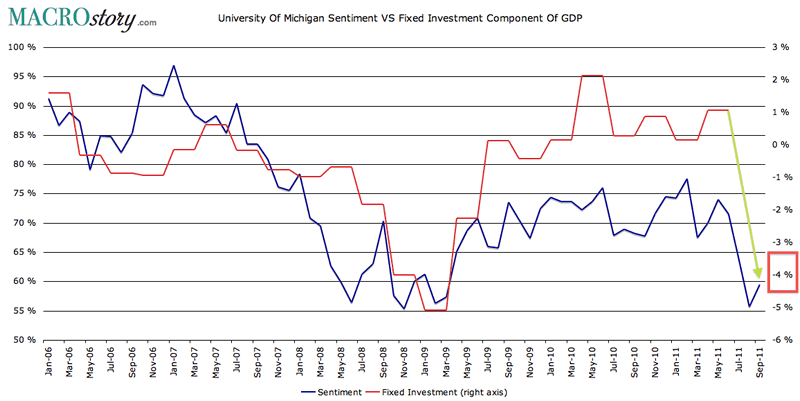

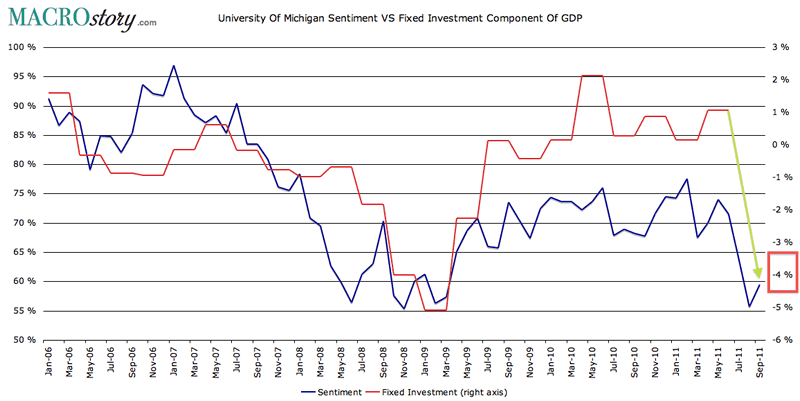

Fixed Investment Forecast

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.