SPXU on the Way Down and UPRO on the Way Up

Stock-Markets / Stock Markets 2011 Oct 02, 2011 - 03:30 AM GMTBy: George_Maniere

Wow! What a week! Friday ended the worst quarter for the stock market since 2010. After another choppy day, as expected, stocks sold off Friday, 10/28/11, at 3PM to close the day down 240 points o the Dow, 29 points on the S&P and an amazing 65 points on the NASDAQ. The close of 10903 on the Dow was seen as a psychological level of the already fragile economy turning from bad to worse.

Wow! What a week! Friday ended the worst quarter for the stock market since 2010. After another choppy day, as expected, stocks sold off Friday, 10/28/11, at 3PM to close the day down 240 points o the Dow, 29 points on the S&P and an amazing 65 points on the NASDAQ. The close of 10903 on the Dow was seen as a psychological level of the already fragile economy turning from bad to worse.

All summer the markets have been beaten by the growing fears of a possible default by Greece and the likelihood of a global recession. The choppy data has led to bouts of buying and selling and it was not unusual to see 300 point swings on a slow day. The Dow, S&P 500 and the Nasdaq each have lost more than 12% this quarter. That’s the first that has happened since 2008.

The short story is that there has been some technical damage done. The market is broken and weak. I believe that the weakness is the start of a longer decline because bonds are increasing in value (which means a stronger dollar) and interest rates are low. Commodities will continue to sell off which is definitely an indication that the market economic activity is going to be weak.

Add to this that traders have made big moves in response to US economic data, which has suggested a slowdown. Europe continues to struggle and developing countries like China, which have been driving global growth, are showing signs of weakness. All the stars are in a line for a likely recession in the U.S.

The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. If you believe as I do that we are setting up for a leg down on the S&P then SPXU is the best way to profit from this trade. For several weeks I have been writing that SPXU was about to break out and I have taken my fair share of barbs for calling the leg down too early.

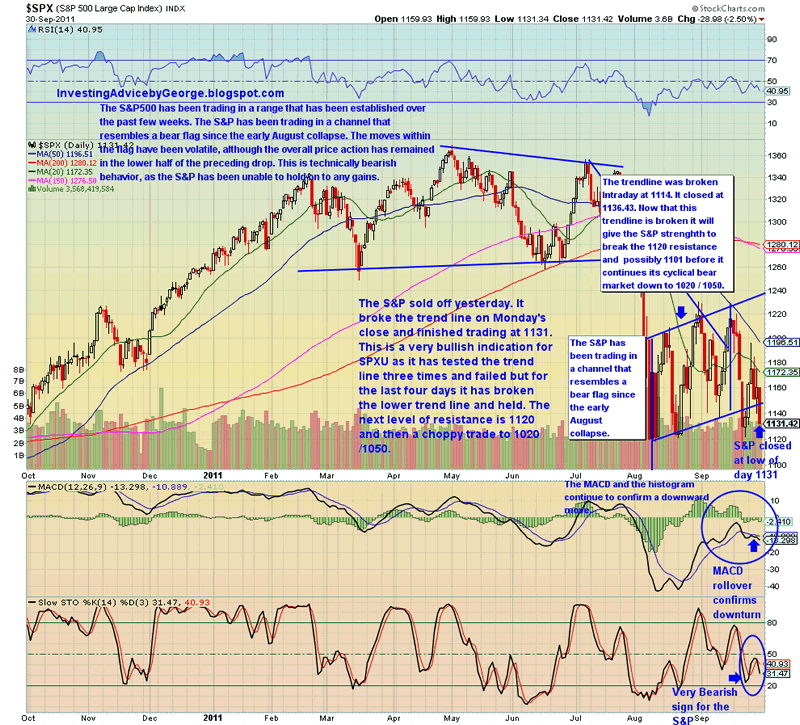

Monday, earnings season begins and if Friday was any indication of what investors have in mind for what they are likely to see and hear then Friday’s selloff was a prelude. Please see chart below.

The chart shows that the S&P has finally capitulated to the trend line. While there will still be resistance at 1120, once the S&P breaks that resistance level it will go to between 1120 and 1150 rather quickly. When it does I will sell the SPXU and buy UPRO. Once the S&P tests 1020 - 1050 it will work its way back up 1200. The best way to profit from this is to use UPRO.

Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day.

In conclusion, earnings report or no earnings report, the market is broken and it needs to heal. The S&P will need to test the 1020 / 1050 level before it can once again begin its assent. While it goes through these growing pains why not profit by using these tailor made stocks SPXU for the ride down and UPRO for the ride up.

Enjoy the ride!

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.