The Real Cost of the Credit Crisis Bank Bailouts [So Far]

Stock-Markets / Credit Crisis Bailouts Sep 30, 2011 - 02:17 AM GMTBy: Rob_Kirby

Back on July 21, 2011 – Senator Bernie Sanders [VT] published a paper titled, The Fed Audit, where he made the claim that a GAO [Government Accountability Office] report showed the real cost of the Federal Reserve bailout was 16 Trillion.

Back on July 21, 2011 – Senator Bernie Sanders [VT] published a paper titled, The Fed Audit, where he made the claim that a GAO [Government Accountability Office] report showed the real cost of the Federal Reserve bailout was 16 Trillion.

A snippet from Bernie Sanders’ The Fed Audit:

The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. “As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world,” said Sanders. “This is a clear case of socialism for the rich and rugged, you’re-on-your-own individualism for everyone else.”

Among the investigation’s key findings is that the Fed unilaterally provided trillions of dollars in financial assistance to foreign banks and corporations from South Korea to Scotland, according to the GAO report. “No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the president,” Sanders said.

The entire GAO report can be read here: http://sanders.senate.gov/imo/media/doc/GAO%20Fed%20Investigation.pdf

Here’s a few snippets directly from the GAO report:

“The Reserve Banks’ and LLCs’ financial statements, which include the emergency programs’ accounts and activities, and their related financial reporting internal controls, are audited annually by an independent auditing firm. These independent financial statement audits, as well as other audits and reviews conducted by the Federal Reserve Board, its Inspector General, and the Reserve Banks’ internal audit function, did not report any significant accounting or financial reporting internal control issues concerning the emergency programs.”

[pg. 23] “The Federal Reserve Board is a federal agency that is responsible for maintaining the stability of financial markets; supervising financial and bank holding companies, state-chartered banks that are members of the Federal Reserve System, and the U.S. operations of foreign banking organizations; and supervising the operations of the Reserve Banks.”

And at page 112:

“Emergency Programs That Have Closed Have Not Incurred Losses and the Federal Reserve Board Expects No Losses on Those With Outstanding Balances.”

So how could something that the GAO reportedly claimed cost 16 Trillion at the same time be showing no losses anywhere?

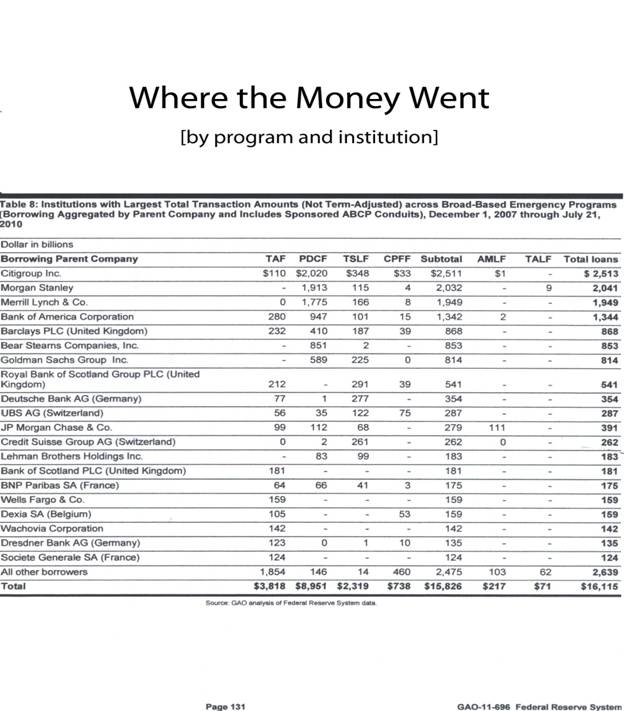

At page 166 we finally begin to get a picture – albeit fuzzy - of how much money [credit] was actually extended during the bailout – with an aggregated breakdown of how much by each institution under broad based programs:

+++Table 8 [above] aggregates [AND AS SUCH IS MISLEADING] total dollar transaction amounts by adding the total dollar amount of all loans but does not adjust these amounts to reflect differences across programs in the term over which loans were outstanding. For example, an overnight PDCF loan of $10 billion that was renewed daily at the same level for 30 business days would result in an aggregate amount borrowed of $300 billion although the institution, in effect, borrowed only $10 billion over 30 days. In contrast, a TAF loan of $10 billion extended over a 1-month period would appear as $10 billion. As a result, the total transaction amounts shown in table 8 for PDCF are not directly comparable to the total transaction amounts shown for TAF and other programs that made loans for periods longer than overnight.

Key to terms on chart:

TAF Term Auction Facility

PDCF Primary Dealer Credit Facility

TSLF Term Securities Lending Facility

CPFF Commercial Paper Funding Facility

AMLF Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility

TALF Term Asset-Backed Securities Loan Facility

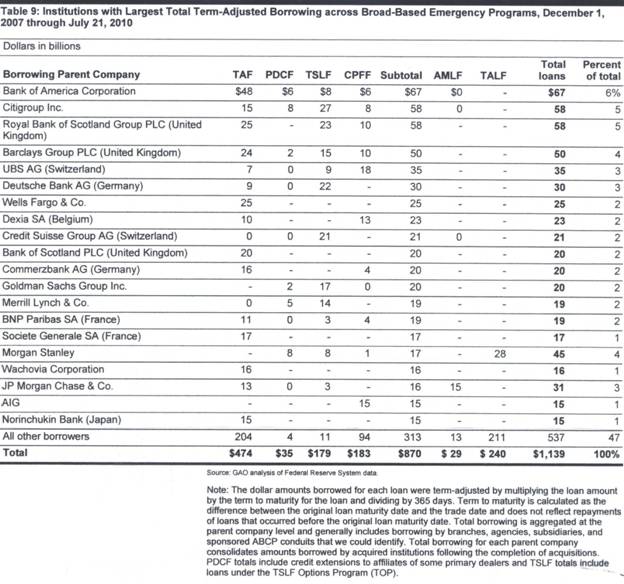

When adjusted for term – a truer and clearer picture of the cost of the bailout is as follows:

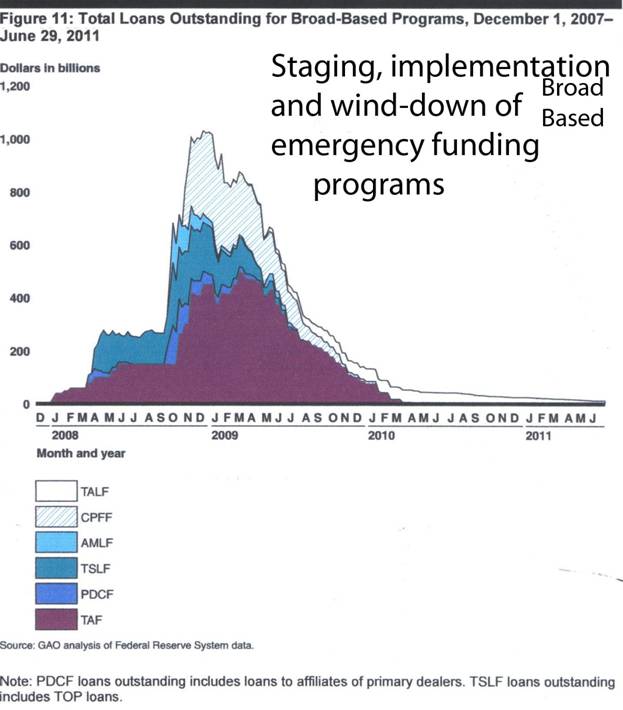

The following graphic shows how and when each broad based emergency funding programme was ramped up – peaking at approximately 1.1 Trillion - and subsequently wound down:

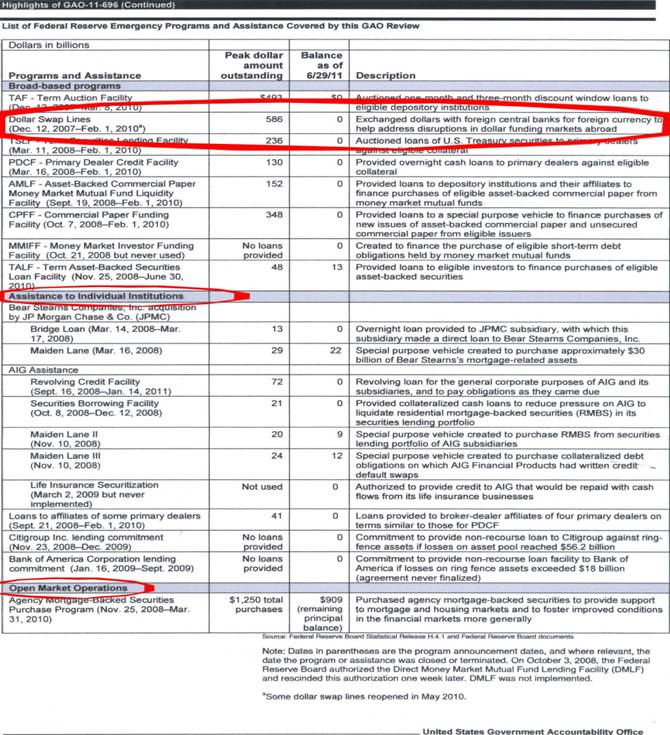

In addition to Broad Based Programs – the Fed also engaged in other liqidity adds which fall under Dollar Swap Lines with other Central Banks [14 of them], Assistance to Individual Institutions and Open Market Operations. These 3 categories – at their peaks – potentially added an additional 2.056 Trillion – bringing the PEAK TOTAL COST of the bailout to a theoretical 3.1 TRILLION.

Subsequently, 943 billion of this “2.056 Trillion add” remains in place – mostly resulting from a remaining balance of purchased Mortgage Backed Securities by the Fed through Open Market Operations:

The unrecouped costs of the bailout [to date] are believed to be:

- 13 billion outstanding on TALF

- 22 bilion outstanding Maiden Lane

- 12 bilion Maiden Lane III

- 909 billion worth of MBS – still held by the Fed

- An undetermined amount of new Dollar Swap arrangements with Foreign Central Banks

So from the standpoint of Bernie Sanders claiming the bailout cost 16 Trillion – this is rankish, misleading hyperbole illustrating that a] the good Senator really doesn’t have a grasp of the manner in which the numbers are being presented, or b] he’s just another politician engaging in erroneous, indulgent, political posturing . To say the cost of the bailout was 16 Trillion is akin to saying a 10 billion overnight loan rolled for thirty days cost 300 billion dollars. This is asinine and blatantly misleading.

The Bigger Picture

How is it that such an erroneous report detailing the size of the bailout is written and published by a sitting senator? Senators have serious budgets with professionally paid researchers and staffs. How could they get something this important and sensitive so ENORMOUSLY wrong – unless it was done with intent?

On the surface, this GAO report [the Fed Audit] appears like it was purposely written to confuse, but a first year economics student would/should have picked this up. Apparently, all of this was lost on Senator Sanders and his paid staff???????

So what could it be? What possible reasons could there be for such an erroneous fabrication – by professionals who should have known better?

Let’s answer this question by asking another related question: namely, where is attention diverted from by focusing on this hyped, manufactured distraction??

The Complete Undermining of Capitalism in the Name of Perpetuating U.S. Dollar Hegemony

By keeping the “bailout” front-and-centre the Federal Reserve / U.S. Treasury are cast in the role of saviours by our mainstream “whore” press. This way, unthinkable acts being committed by Fed and the Treasury’s Exchange Stabilization Fund [ESF] – UNDERMINING CAPITALISM – are largely ignored or go un-noticed. Just think about this: the GAO clearly stated that,

[pg. 23] “The Federal Reserve Board is a federal agency that is responsible for maintaining the stability of financial markets; supervising financial and bank holding companies, state-chartered banks that are members of the Federal Reserve System, and the U.S. operations of foreign banking organizations; and supervising the operations of the Reserve Banks.”

So how is it that Morgan Stanley – a BANK HOLDING COMPANY with a 31 billion dollar market cap – grew their derivatives book by 14 TRILLION in notional over the latest 6 month reporting period Dec. 31, 2010 – June 31, 2011 – and the Fed says NOTHING?

The instruments which Morgan Stanley “piled on” require 2-way-credit –checks” meaning counterparties need to have credit for each other before these trades can be consummated.

WHO ON GOD’S GREEN EARTH HAS CREDIT LINES THIS LARGE FOR MORGAN STANLEY – to enable them to grow their book by 14 TRILLION in 6 months??????

Anyone who believes this occurred “naturally” or in “free markets” must also believe in Santa Claus, the Easter Bunny and Keebler Elves.

The answer to this mystery is posted at kirbyanalytics.com in a power point presentation titled, Derivatives Demystified.

Got physical precious metal yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.