Gold Seasonality and a Convergence of Events at the End of November 2011

Commodities / Gold and Silver 2011 Sep 28, 2011 - 08:45 AM GMTBy: Jesse

As an aside, the lease rates for gold went negative about four days before the recent bear raids in the metals markets began. This was most likely due to an excess of fresh supply being offered on the markets by the Western central banks. The bullion banks saw this and dropped their bids to take full advantage of the knowledge of this operation, or more properly, subsidy.

As an aside, the lease rates for gold went negative about four days before the recent bear raids in the metals markets began. This was most likely due to an excess of fresh supply being offered on the markets by the Western central banks. The bullion banks saw this and dropped their bids to take full advantage of the knowledge of this operation, or more properly, subsidy.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded.

The US Fed was very active in getting the gold price down. So was the U.K."

Sir Eddie George, Bank of England, September 1999

"That day the U.S. announced that the dollar would be devalued by 10 percent. By switching the yen to a floating exchange rate, the Japanese currency appreciated, and a sufficient realignment in exchange rates was realized. Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake."

Paul Volcker, Nikkei Weekly 2004

“Central banks stand ready to lease gold in increasing quantities should the price rise.”

Alan Greenspan, US Federal Reserve Bank, 24 July 1998

The central bank gold is leased to the bullion banks, like the market makers at the LBMA. Among these are JPM, GS, HBSC, BofA, DB, and Barclays. The gold is then sold into the bullion markets in London, or used as collateral for leveraged paper transactions. With a lag, this additional supply affects the futures and ETF trades with additional leverage in New York.

The week of Nov 21 may be one of particular interest to US investors in precious metals. The cross currents may make it even more volatile than this August with its 'Night of the Long Knives.' Or perhaps the banking metals bears have their eyes to the future and are pre-emptively striking now.

If this theory is correct, at some point this market operation will fail, and the price reaction, not to speak of the political scandal, may be memorable. It is not clear to me that we will see it coming on the charts, but one can hope. Personally I think China and Russia will use this as a bargaining tool if they are not doing so already. What's the old line about selling them the rope? Brought to the brink for the sake of a relatively few bankers' bonuses.

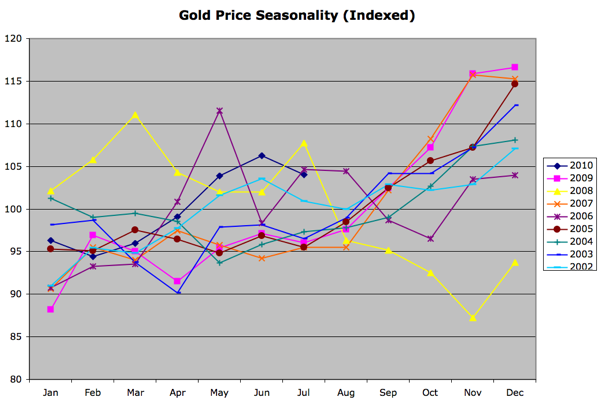

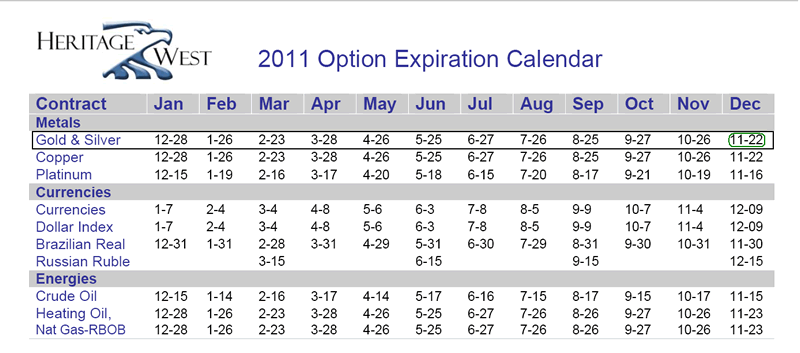

There is a an option expiration for December 2011 contracts that week, on November 22. December is a big delivery month, so fireworks are always expected. And we are entering a seasonally strong period for the precious metals.

The US 'Super-Committee' to resolve the debt crisis will be facing a November 23 deadline to vote on a plan which they will present to the Congress and the President on Dec 2. This will avoid triggering 'automatic cuts' to take place in 2013.

November will be the real kick off month for the US presidential elections.

On November 22 the US will release its first estimate of 4Q GDP.

On November 23 the Fed will release its latest FOMC Minutes.

The November Jobs Report will be released the following Friday on December 2.

And of course, November 24 begins a four day holiday weekend for Thanksgiving, including the famous 'Black Friday' for US retailers.

Super-Committee Timeline

Oct. 14: House and Senate committees must submit recommendations to the committee by this date.

Nov. 23: Deadline for the committee to vote on a plan with $1.5 trillion in deficit reduction.

Dec. 2: Deadline for the committee to submit report and legislative language to the president and Congress.

Dec. 23: Deadline for both houses to vote on the committee bill.

Jan. 15, 2012: Date that the “trigger” leading to $1.2 trillion of future spending cuts goes into effect, if the committee’s legislation has not been enacted.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.