Most Likely A Prudent Time To Cover S&P 500 Shorts

Stock-Markets / Stock Markets 2011 Sep 27, 2011 - 12:27 PM GMTBy: Chris_Ciovacco

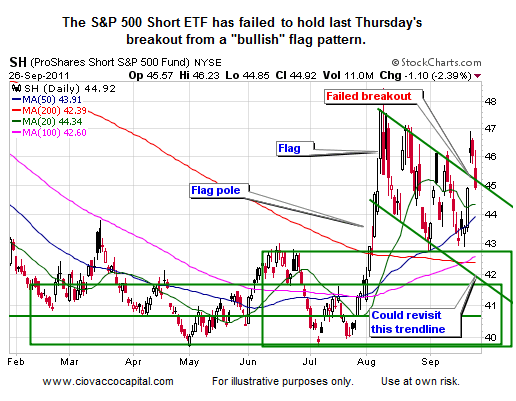

There is a sound axiom in the markets – “When the market does not do what you expect it to do, it is time to pay attention.” In terms of timing an entry point, our rationale for adding to our S&P 500 short positions (SH, RYURX) was based primarily on last Thursday’s breakout from a bullish flag pattern (see below). Yesterday’s sharp rally from 2:00 p.m. to 4:00 p.m. after the CNBC announcement pushed SH back into the flag below, meaning the breakout was in jeopardy of failing. This morning’s futures indicate we will get confirmation of the failed breakout at the open. Consequently, we will most likely exit our SH position within the first hour of trading today.

As of yesterday’s close our loss on SH was only 1.25%. The high-end of our allocations to SH represents 37% of an account/household. This means the loss on SH, relative to an account’s balance is only 0.46%. The short-term risk-reward of SH has deteriorated in the last two trading sessions. The reason we added to our positions last week (breakout above) is no longer in place.

Do we believe stocks have put in the final low? No. However, it is not uncommon for a bear market rally to revisit the 50-day, 100-day, or 200-day moving average. A move back to the 200-day on the S&P 500 would represent a gain of 10.15% relative to Monday’s close. We are not willing to let a loss run on the short side of the market. We would much rather be wrong based on our current loss of 1.25% on SH than a loss of 11.4% (1.25% + 10.15%) if the S&P 500 rallies back to its 200-day moving average. One thing we learned in the last bear market - If your short position is not profitable, cut the losses very quickly since bear markets can rally in a strong and rapid manner.

We are happy to consider SH again if a more attractive risk-reward entry point surfaces in the coming days and weeks. Part of managing risk properly is being able to admit when the odds have shifted against your position. This morning we asked ourselves these questions:

- Would I buy SH today based on the current short-term outlook? “No”

- Has the risk-reward profile of SH changed since last Thursday? “Yes”

Comments in this morning’s Wall Street Journal (WSJ) highlight the concerns that remain longer-term relative to the European bailouts.

There are still plenty of headwinds that could trip up markets, said Kathleen Brooks of Forex.com. “A €2 trillion to €3 trillion plan to stem the sovereign-debt crisis and save the euro zone is fantastic in theory, but in reality it might never see the light of day,” she said. “The markets have ignored comments from Finland that it would not support any extension to the EFSF—this is significant since it is one of only six euro-zone members with a triple-A credit rating.”

Also, Spanish Finance Minister Elena Salgado said a plan to expand the EFSF to as much as €2 trillion isn’t on the table, while Slovak parliamentary speaker Richard Sulik said Greece should be refused further aid. The remarks showed a deal on expanding the bailout facility is far from certain.

Meanwhile, the Spanish Treasury sold €3.23 billion of three- and six-month treasury bills at auction Tuesday, getting away roughly the amount of paper it was aiming to but at an average yield of 1.692%, more than the 1.357% yield seen at the last auction.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.