Gold and Silver Crash Generating Big Opportunity

Commodities / Gold and Silver 2011 Sep 26, 2011 - 02:31 AM GMTBy: Chris_Vermeulen

A few weeks ago I wrote about how gold was starting to top and that everyone should expect a very sharp drop to the low $1600 area. How I came to this conclusion was though the use of inter-market analysis combining price patterns, gold futures volume, the dollar index and market sentiment. This allowed me to understand what the majority of other traders/investors were thinking and feeling. By knowing each of these market variables and crowd behavior I can accurately see into the future a few days with a high probability of success and most importantly with low downside risk.

A few weeks ago I wrote about how gold was starting to top and that everyone should expect a very sharp drop to the low $1600 area. How I came to this conclusion was though the use of inter-market analysis combining price patterns, gold futures volume, the dollar index and market sentiment. This allowed me to understand what the majority of other traders/investors were thinking and feeling. By knowing each of these market variables and crowd behavior I can accurately see into the future a few days with a high probability of success and most importantly with low downside risk.

You can view part-1 on how I properly forecasted that gold would fall sharply in August here: U.S. Dollar’s On the Verge of a Relief Rally Look Out Gold, Oil and Stocks!

At the time when I forecasted gold to reach the low $1600 area gold was still building the top pattern so I could not say how long a recovering would likely take nor did I know exactly when to re-enter a long position. But now that we have seen how gold arrived at my target price I can form a new forecast.

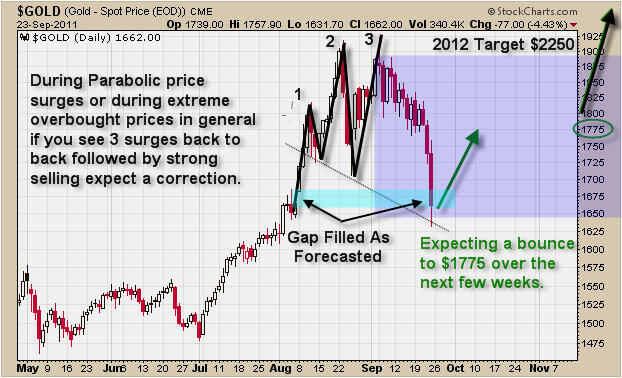

Spot Gold Price Forecast – Daily Chart:

The gold chart below clearly shows rising volatility along with my topping pattern of three surges to new highs. It was August 31st when I warned subscribers and my followers that gold was about to top and that everyone should be taking profits or at least tightening their stops to lock in gains. Only three days later gold topped and it has not stopped falling since.

On August 8th gold had a large opening gap to the upside. This means the price opened the next day much higher from where it closed the previous session. It’s important to note that gaps especially for gold almost always get filled within a couple months. Seeing this gave me a solid reason to think that gold should pullback to this level during the next big correction in price.

Also during the month of August gold had to pullbacks only to continue to make the third and final high. This told me that when the top is put in place was a very high probability that we see the price of gold drop below both of Augusts’ lows and that would trigger stop orders sending the market sharply lower.

Now that we are seeing the stops being flushed out of the market it means the majority of speculative traders have exited their positions. So speculative traders who caused the large surge in gold to take place are now out. Once all the speculative traders have exited which should take place in the coming weeks or two we can expect some type of bounce or rally. I will keep a close eye on the intraday charts for subscribers as we near a potentially major trade setup.

Where are we in this gold bull market?

Well I feel gold is more fairly priced between $1632- $1660 area. Currently gold is trading at $1660 but if things play out like I have seen in the past we just may get one more dip this week to the $1600 area before gold truly puts in a bottom. Because gold went from a new high all the way down to Friday’s panic selling washout instead of a controlled ABC correction I feel a bottom will be more of a one day event. This type of bottom carries more risk and is more difficult to time and trade. So scaling in with a small position at this level and adding on a drop to $1630 then $1600 could prove to be the safest way into a gold position.

Forward looking I see gold bottoming over the next week or two then a nice relief rally to the $1775 area. Depending on how gold arrives there will alter my next gold forecast so let’s wait and see how things unfold.

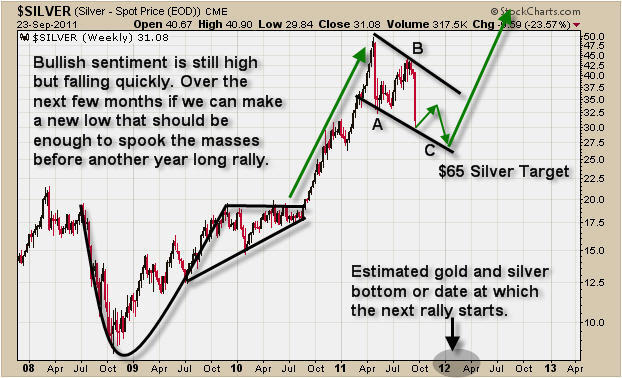

Spot Silver Price Forecast – Weekly Chart:

Silver I call the Un-Safe haven because to me it’s not a safe haven in the way everyone’s believes it be. I hear and see everyone including friends and family selling all their stocks and putting their money into silver. To me buying large amounts of silver with your retirement money is just ridiculous. I m sure my statement here will trigger an inbox of silver-perma-bulls (silver bugs) to send me hate mail but that’s fine as my assistant filters my emails so I don’t have to keep being reminded how rude some humans can be over an simple opinion…

Investments that can lose 25% in value within 2 days or lose 40% of it’s value in 5 months should not be traded nor invested in with large portions of anyone’s life savings, especially if you are over the age of 50 and have not proven to be a constantly profitable trader. No one can stomach losing that much of their nest egg.

That being said I do feel silver is in a similar situation as gold. I do feel a bottom is near. Silver has formed an ABC correction and the price and volume patterns seem to be in line with a typical bottoming pattern. After Friday’s massive selloff I feel silver may slide a little lower yet before putting in a bottom.

One thing to keep in mind with silver is that it is very thinly traded; there are a lot of speculative traders involved which push and pull the price to extreme levels on a regular basis. So if the broad stock market continues to sell off sharply then I expect silver to follow suit.

Pre-Week Precious Metals Trend Analysis Trading Conclusion:

The price action we have seen this year for both gold and silver indicate were are just warming up for something really big to happen. It could be a massive parabolic rally to ridiculous new highs in 2012 or it could be a large unwinding of the safe havens as countries sort out their issues and the big money starts moving out of metals and into currencies and stocks.

Only time will tell and that is why I analyze the market multiple times per week to stay on top of both long term and short term trends. So if you want to keep up with current trends and trades for gold, silver, oil, bonds and the stocks market check out TGAOG at: http://www.thegoldandoilguy.com/trade-money-emotions.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.