Changing Markets Risk Perception Across Multiple Asset Classes

Stock-Markets / Financial Markets 2011 Sep 25, 2011 - 04:13 AM GMTBy: Tony_Pallotta

This week saw a lot of technical damage across multiple asset classes as demonstrated by the charts below. The biggest shift though appears to be that of perceived risk. In the past bad news was good news as it would bring further accommodative monetary policy such as QE1 and QE2. Market participants always believed the Bernanke put was alive and well and equity values would be defended. In other words the perception of risk was less severe.

This week saw a lot of technical damage across multiple asset classes as demonstrated by the charts below. The biggest shift though appears to be that of perceived risk. In the past bad news was good news as it would bring further accommodative monetary policy such as QE1 and QE2. Market participants always believed the Bernanke put was alive and well and equity values would be defended. In other words the perception of risk was less severe.

The Fed is not done with "free market intervention" though and like a child in the toy aisle will go down kicking and screaming trying to get what they want. The recent emergency action such as globally coordinated swap lines are such proof as are the eventual TALF programs where US and EU banks can access Fed capital in exchange for any "collateral" they can find.

Like the famous line from Rocky IV "You see? You see? He's not a machine, he's a man, he's a man" the Fed showed its ability to print at will is constrained though, it too is not a machine. Whether it is political pressure, rising inflation, dissention among members or the simple reality that QE1 and QE2 actually harmed the economy market participants are realizing perhaps the Bernanke Put has a massive theta burn, an expiration date. The next Fed meeting is not until November 1 and beyond any emergency programs equities are now on their own. The training wheels are off.

The market's reaction to this shift in risk perception was made clear this week as demonstrated by the multiple charts below.

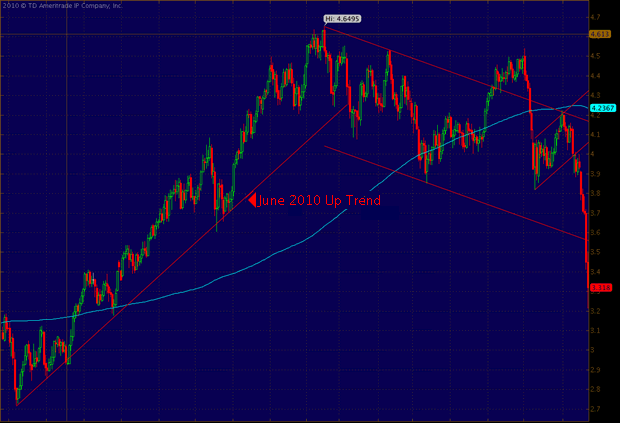

Copper: There is no better place to start than the leader and that is the role copper plays in the equity market as a signal of both risk aversion and global economic health. Not only did the bear flag fail so did the multi-month trend. A retest of this trend line in the 3.55 area is highly probable but the selling appears far from over (see COT data below).

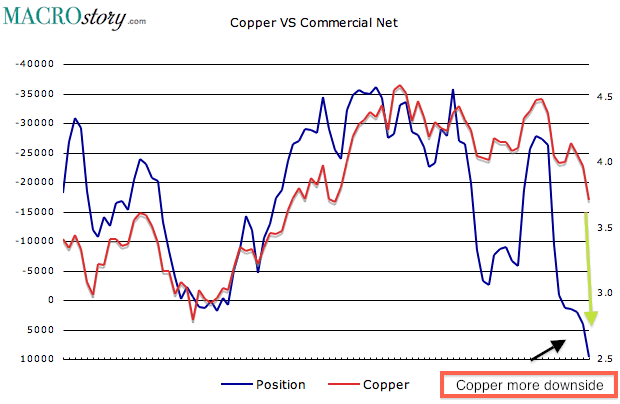

Commercial Net Copper Position: The weekly COT report (Commitment Of Trader's) is extremely insightful in understanding where copper is headed next. It foretold of this most recent move lower in copper and once again is signaling further weakness ahead.

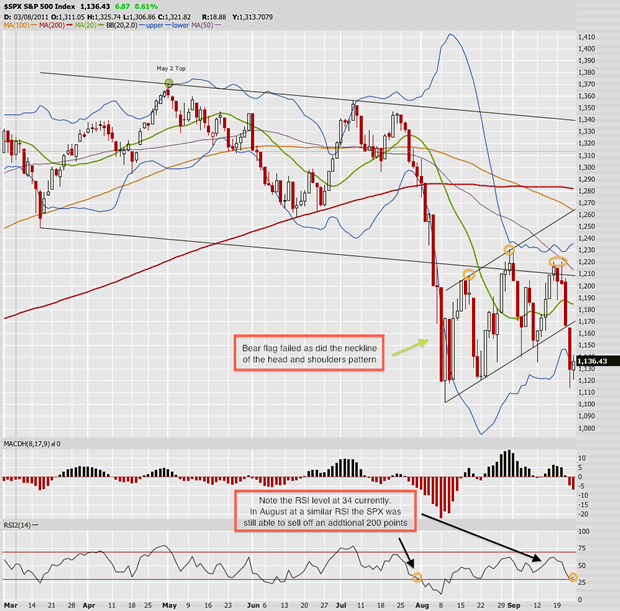

SPX: The bear flag has broken with a downside target of 1015 as well as the head and shoulders with a target of 1042. Additional support comes in at the 2010 lows of 1010-1040 which very well will serve as a bounce as shorts cover and longs initiate new positions.

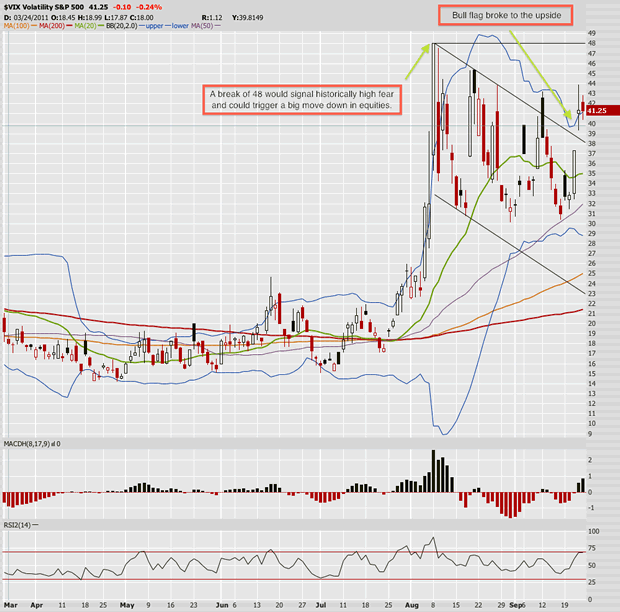

VIX: The bull flag failed and the next target is 48. If this breaks it will signal a level rarely see beyond 2008 and 2001 when fear was prevalent based on economic and geopolitical risks. Current market risk and the bull flag failure favors 48 not holding which should lead to further equity selling pressure and confirmation for shorts on the sidelines to initiate new positions.

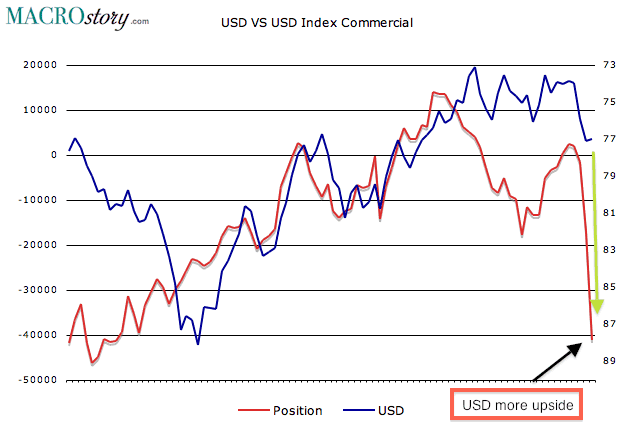

US Dollar (DXY): Rather surprising to see the USD breaking above key resistance. The chart below is a five-year weekly that shows a break to new highs, three weeks closing above the 200MA and close above resistance. 87 is now a possible target which would put further selling pressure on equities.

Commercial Net USD Position: Similar to that of copper commercial net positions are anticipating a big move higher in the USD which supports the technical view as well. This data supports the 87 target in the DXY as discussed above.

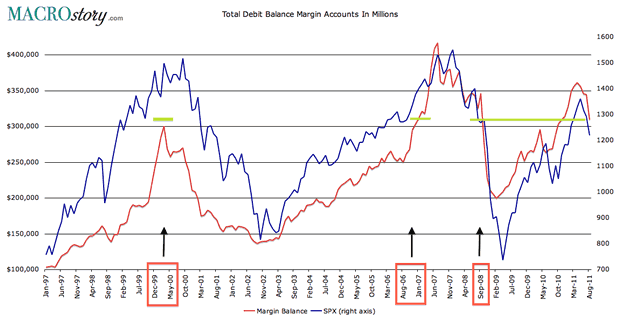

Margin Debt: Although margin debt is coming down it is still historically high and at levels that preceded major selloffs such as September 2008. In fact margin debt is now higher than that of the dot com boom.

As long as stocks like AAPL continue to set all time highs I believe there is no real fear in the equity markets and thus no forced equity liquidations yet. AAPL may be the best company out there but there is little to no short interest to support selloffs and with everyone all in on the long side and leveraged once selling begins it will be fierce. Remember AAPL is the ATM and when people need to raise cash to meet margin calls they are forced to sell their most liquid positions.

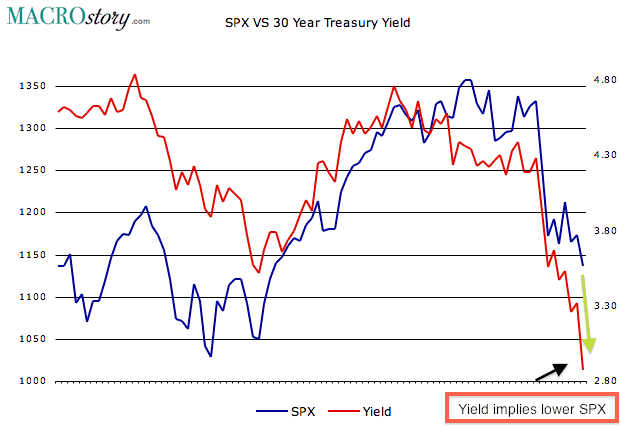

30 Year Yield: The 30 year yield continues to signal further equity selling pressure to come.

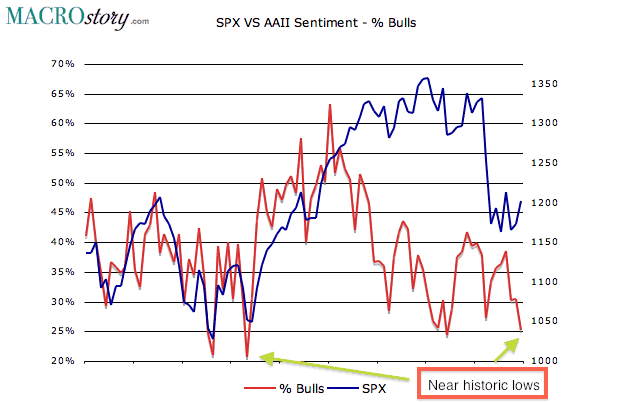

Investor Sentiment: The one warning sign facing the short term bearish argument is the rather large shift towards bearish sentiment. There is still room to move more bearish but it should serve as a warning to those looking to add or open short positions. Markets don't have to reverse simply due to historically low bullish readings and it is quite possible the next data set shows a shift away from such high bearish readings.

Bottom line this market is very dangerous right now. As witnessed in August when the SPX appeared "oversold" it still managed to sell off another 200 points and take out support levels as if they never existed. The most recent short covering rally has taken away buying pressure and flushed out weak shorts. With leverage still at multi year highs it appears selling pressure remains the bigger risk to equities.

Most important though is the diminished threat of the Bernanke put which is analogous to a pick up game between a group of guys on the weekend. The "bears" begin to show an ability to outscore the "bulls" only to see Michael Jordan (the most famous Bull) come in from the sidelines and reverse everything. Perhaps Michael Jordan is sidelined for a while finally or at least limited in his ability to score at will.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Paul Prichard

02 Oct 11, 09:11 |

Oxymoron

“The non-Federal non-Reserve is not done with “free market intervention”.” ? Such an oxymoron. |