Stocks, Silver, Gold and Bonds, Recession / Depression Until 2016?

Stock-Markets / Financial Markets 2011 Sep 25, 2011 - 03:24 AM GMTBy: Willem_Weytjens

Let’s start with an update of an article I wrote on July 20th 2011. If the pattern isn’t broken soon, this could mean we are about to see 2008 all over again, and silver could drop another 50% from here:

Let’s start with an update of an article I wrote on July 20th 2011. If the pattern isn’t broken soon, this could mean we are about to see 2008 all over again, and silver could drop another 50% from here:

Chart courtesy Prorealtime.com

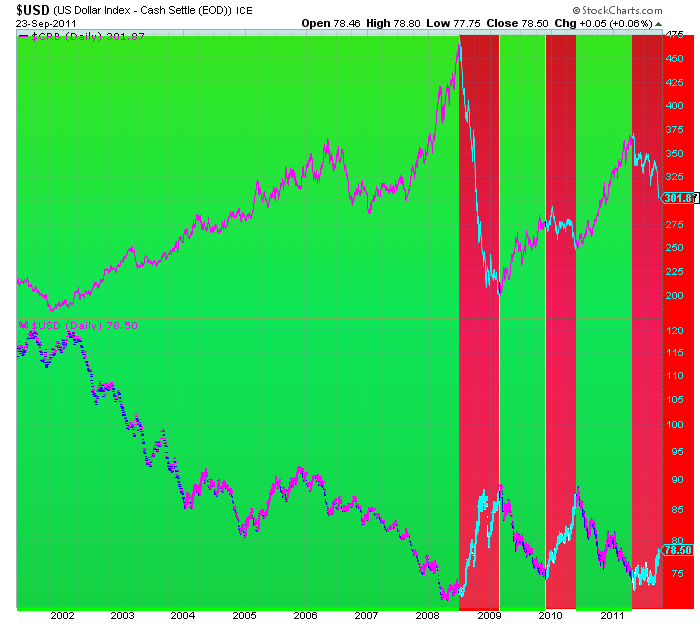

The following chart is an updated version of one I also posted a while ago. It shows that when the dollar drops, commodities rally (green zones), and that when the dollar rallies, commodities drop (red zones). Currently we are in a red zone.

Chart courtesy Stockcharts.com

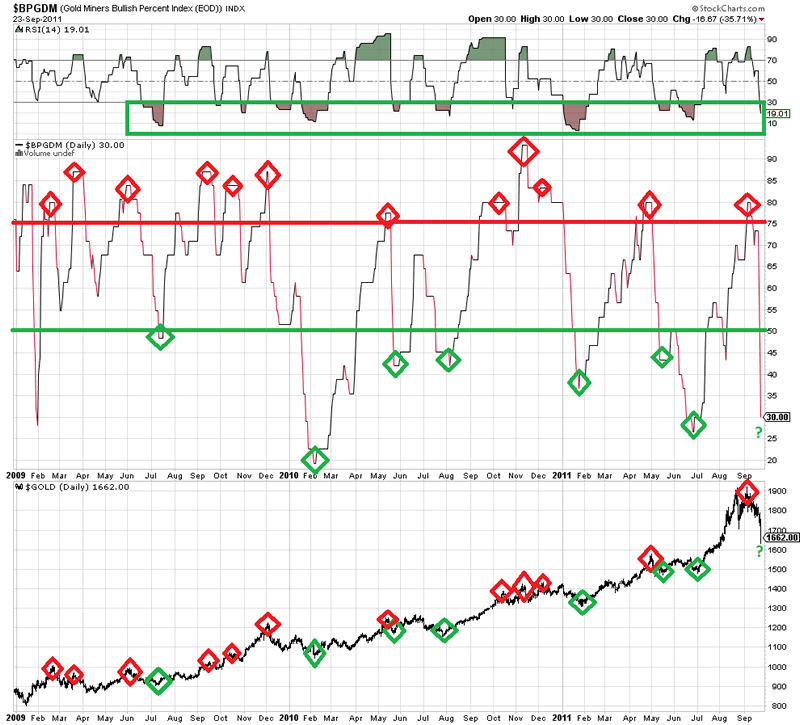

The following chart shows us the Gold Miners Bullish Percentage Index. As we can see, when the BPGDM Index fell below 50 and the RSI reached oversold levels, Gold was usually at or very close to a bottom (see green Diamonds on the chart).

When the BPGDM index was above 70, gold often topped (see red Diamonds). Right now, the RSI is getting into oversold territory and the BPGDM index is at 30, meaning we might be at or very close to a bottom.

Chart courtesy Stockcharts.com

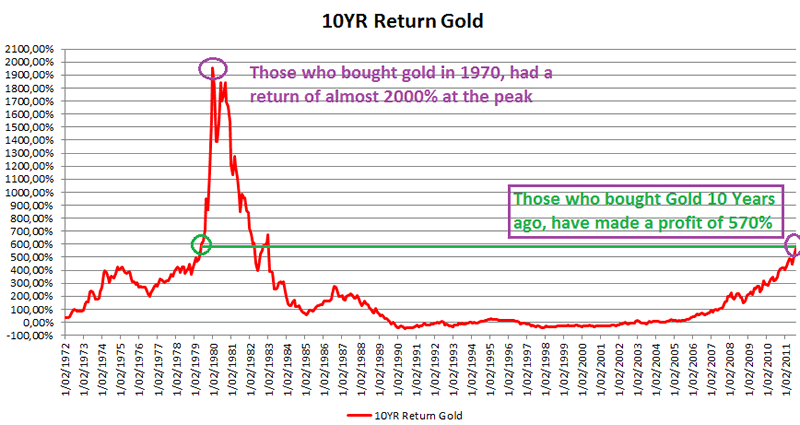

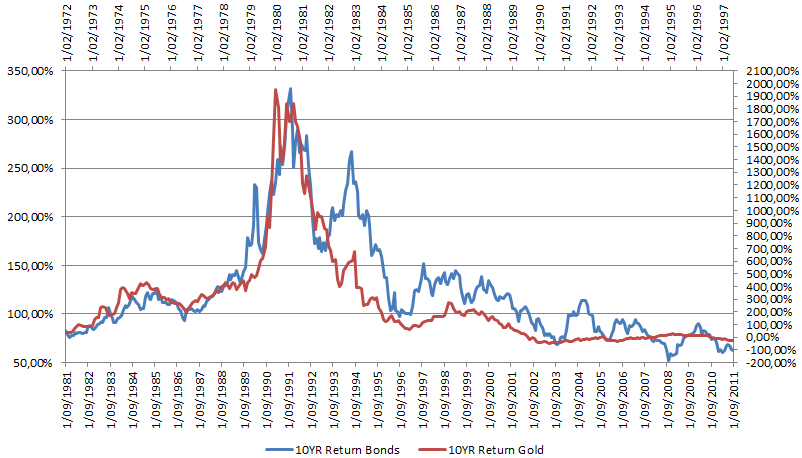

When we look at the 10Year Return for gold, we can see that those who bought gold 10 years ago, are now looking back at a return of 570%. That’s a nice profit, but look at 1980. Those who bought gold in 1970 had made almost 2,000% by 1980. Compared to 1980, we are nowhere near a top in gold.

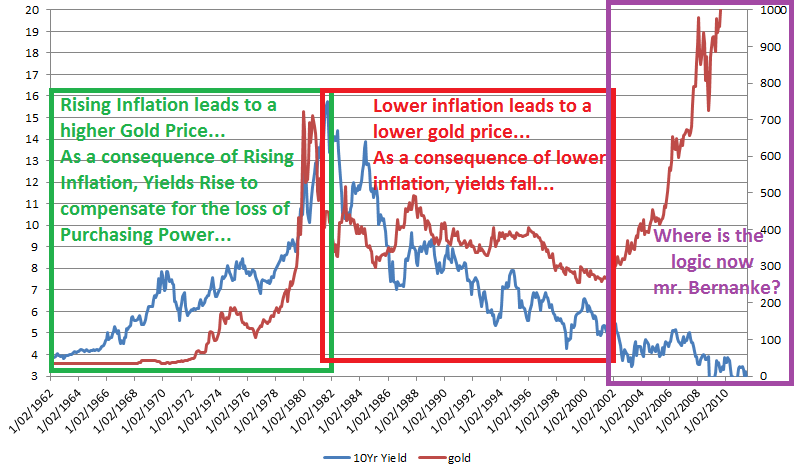

When we look at bond yields, we can see that from the early 60′s to the early 80′s, bonds yields rose as inflation was rising. Higher inflation caused gold to rise.

From the early 80′s on, yields fell as a consequence of lower inflation. Gold also fell. That made sense.

However, from the early 2000′s, gold has been on the rise, but yields kept falling, as reported inflation was low. Who or What is wrong: mr. Bernanke and his statistics, or Gold? When I look at the real cost of living, I tend to agree with Gold or statistics of Shadowstats.com instead of mr. Bernanke, who – as Marc Faber and Jim Rogers say – has never been right about anything.

Besides the 10Year Return of Gold, I also calculated the 10Year Return of Bond Holders. I noticed a similar pattern in 10Year Returns of Bonds and 10Year Returns of Gold, be it over a different period of time. The 10Year Return of Bonds is now in the same position as gold was in late 1998, right before the bull market started. If history is about to repeat, Bond Yields will start a bull market, meaning Bond Prices (which are inversely correlated with Bond Yields) will start a bear market pretty soon. Is the final pillar (which mr. Sinclair has been talking about for 10 years now) about to break?

Chart: Own calculations

Please have a look at the following chart which plots the weekly price of Gold right now compared to the gold Price in the late ’70s:

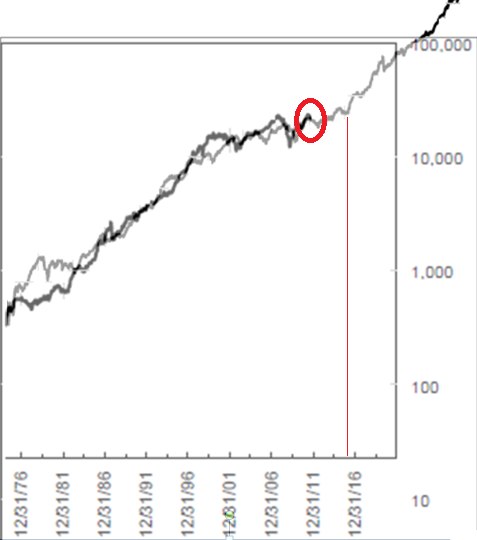

Perhaps the stock markets are telling us we are in a similar position as in 1979 rather than in 2008:

The Total Return Index is also showing a similar pattern, which could mean we won’t make new highs until late 2016 (and thus remain in Recession/Depression mode until then)

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.