Stock Market SPXU Has Broken Out

Stock-Markets / Stock Markets 2011 Sep 23, 2011 - 03:32 AM GMTBy: George_Maniere

Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. Conversely, The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500.

Several days ago I called for a break under 1140 on the S&P as a buy on SPXU. While my thesis on this trade remains intact I must admit that China stepping up to buy Italy’s bonds changed the timing of this trade. The euro, which had been sold off at the end of last week, has finally found some stabilization as we moved through last weeks New York trading session.

Indeed for the last week the S&P has shown tremendous resiliency and it looked like my prediction of a test of lows of 1050/ 1030 were just plain wrong. Well yesterday after the FOMC announced “Operation Twist” The market went into a free fall and I knew that this was the moment I had been forecasting and waiting for.

“Operation Twist” consisted of selling $400 billion in short-term Treasuries in exchange for the same amount of longer-term bonds, starting in October and ending in June 2012.

While the move does not mean the Fed will pump additional money into the economy, it is designed to lower yields on long-term bonds, while keeping short-term rates little changed.

The intent is to thereby push down interest rates on everything from mortgages to business loans, giving consumers and companies an additional incentive to borrow and spend money.

Well when all of this money was injected into the treasuries it had the effect of stimulating the dollar. As the dollar grows stronger the equity markets as well as gold and silver sell off and that is exactly what happened yesterday.

I opened a half position at $19.09 and by the premarket I knew it was going to be a good day.

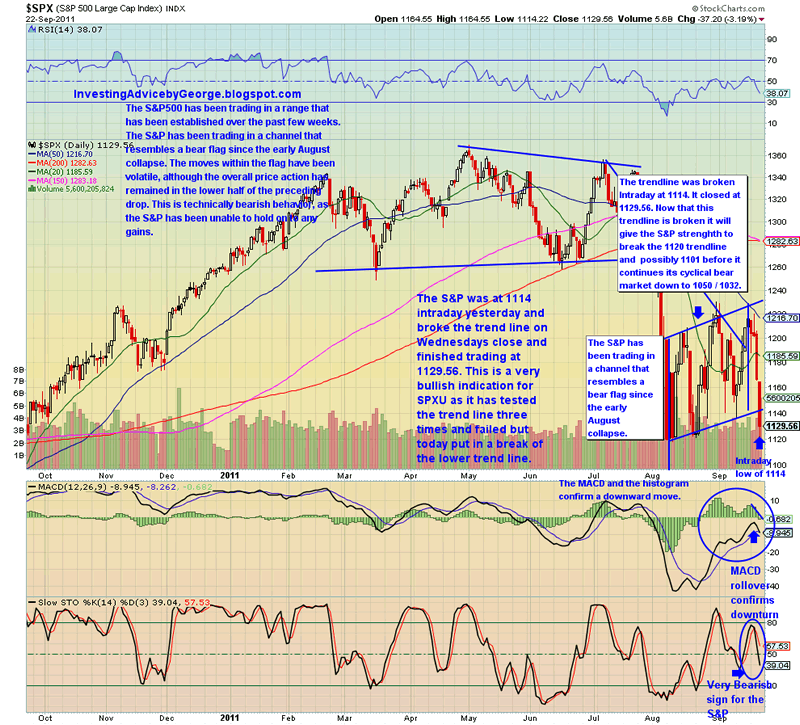

Take a look at the chart below.

As we can see by this chart, the S&P broke the trend line and had an intraday low of 1114. SPXU ran up on this. Once the S&P puts in a low of between 1050 and 1030, I will sell them and switch to UPRO because UPRO is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. That means for every point the S&P goes up UPRO goes up $3.00. I expect that once the S&P bottoms at 1050 it will quickly run up and when it does I will switch from SPXU to UPRO. A further study of the chart will show that both the MACD line and the slow stochastics have turned over and are heading down. This is a very bearish chart, which is all the better for SPXU.

In conclusion, I expect the S&P to bottom at 1030 within 3 weeks. When this happens I will switch to UPRO as I ride the S&P up to the 1200level. This is going to be a very exciting month.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.