FOMC Engages in Operation Twist, Another Unconventional Step

Interest-Rates / US Interest Rates Sep 22, 2011 - 02:30 AM GMTBy: Asha_Bangalore

The Fed left the federal funds rate unchanged, as expected, at 0.0-0.25%. The much awaited action called “Operation Twist” was part of the policy announcement. It was not an unanimous vote, three Fed Presidents -- Richard Fisher of Dallas, Narayana Kocherlakota of Minneapolis and Charles Plosser of Philadelphia – who are concerned about inflation dissented. These three Fed officials opposed the FOMC's August 9, 2011, decision that included an assurance of holding short-term interest rates near zero until mid-2013.

As per today’s announcement, the Fed will purchase $400 billion of Treasury securities with maturities of 6-30 years and finance this operation with sales of an equal amount of Treasuries with three years or less left on them. Operation Twist will not increase the current size of the Fed’s balance sheet. It is unlike the $600 billion program (known as QE2) which increased the size of the balance sheet to around $2.8 trillion and ended in June 2011. The objective of Operation Twist is to lift economic activity, that has slowed in the first-half of the year, by bringing about lower interest rates for home mortgages and business investment outlays. The FOMC included a surprise package – it will now reinvest early payment of mortgage securities back in debt issued by Fannie Mae and Freddie Mac.

The Fed continues to believe that “there are significant downside risks to the economic outlook, including strains in global financial markets.” The reference to global financial markets is new in the September statement and reflects the ongoing debt crisis in Euroland. The Fed anticipates a deceleration of inflation in the months ahead and continues to maintain that longer-term inflation expectations are stable.

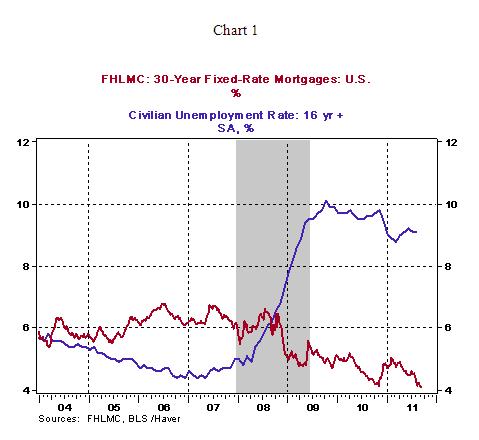

In the Fed’s opinion, the rearrangement of it current portfolio “should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative.” However, if the unemployment rate fails to register a significant improvement, households who were not able to obtain a mortgage at already historically low rates (see Chart 1) are unlikely to pass strict underwriting standards that are in place now. The likely limited benefit of Operation Twist is the subject of the U.S. Economic Outlook of September 9, 2011. If this forecast is accurate and economic growth remains lackluster, Chairman Bernanke would most likely embark on QE3 in the early part of 2012.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.