Stock Market Forecasting Fed Disappointment

Stock-Markets / Stock Markets 2011 Sep 21, 2011 - 04:26 AM GMTBy: Chris_Ciovacco

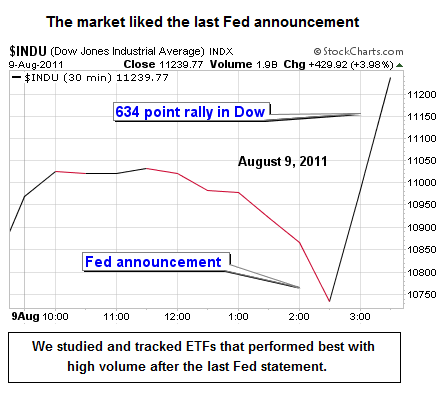

As shown in the chart below, the Dow was having a rough day on August 9 as it waited for the Fed’s statement to be released. After digesting the pledge to keep interest rates low “at least through mid-2013”, stocks spent the rest of the day rallying.

As shown in the chart below, the Dow was having a rough day on August 9 as it waited for the Fed’s statement to be released. After digesting the pledge to keep interest rates low “at least through mid-2013”, stocks spent the rest of the day rallying.

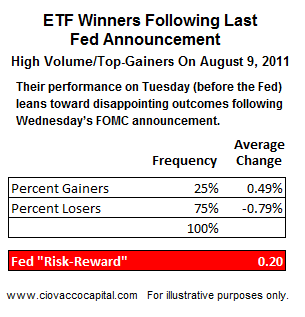

Since top performing ETFs that experience gains on above average volume can turn out to be attractive investments during the subsequent rally, we screened ETFs after the close on August 9 looking for:

- The day’s top performers in terms of percentage gain.

- ETFs that trade at least 500,000 shares per day.

- ETFs that had daily volume on August 9 above their 3-month average volume (conviction).

The screen above helps us keep track of where institutions, pension funds, hedge funds, etc. are seeing potential for gains. You would think that if the market was anticipating a similar bullish reaction to this Wednesday’s Fed announcement, the top ETFs from August 9 would have (a) made money on Tuesday (9/20), and (b) seen a lot of buying interest as measured by trading volume. There were fifty-three ETFs that met the criteria above after the close on August 9. On Tuesday of this week, only 25% of the fifty-three ETFs made money, posting an average gain of 0.49%. The lack of interest in Fed-friendly assets was highlighted by the 75% of the fifty-three ETFs that lost ground on Tuesday, posting an average loss of 0.79% (see table below).

Using the figures above, a back of the envelope “Fed Risk-Reward Announcement Forecast” yields a weak ratio of 0.20. A ratio of 1.00 would “forecast” 50-50 odds of a favorable reaction to the Fed. Tuesday’s ETF activity leans toward a disappointing reaction to Wednesday’s Fed announcement. Obviously, the most important thing to watch is price and volume action (conviction of buyers) from 2:15 to 4:00 p.m. on Wednesday. However, given the Fed has telegraphed its menu of possible policy options, the market does not seem to be anticipating a strong rally to follow the Fed announcement; if it did, it stands to reason the buying interest in Fed-friendly ETFs would have been more convincing on Tuesday.

Is the market anticipating a somewhat surprising announcement of QE3? Based on the performance of QE2-winning ETFs on Tuesday, the answer appears to be a definitive “no”. We have been tracking QE2 winners for a few weeks looking for signs of life. More details on recent performance of QE2 ETFs can be found here.

Concerns we have mentioned in recent weeks, including tepid interest in Emerging Markets and Greece / weak technicals, also align well with the possibility of a disappointing reaction to the Fed’s statement. Another scenario calls for a sharp rally to roughly 1,260 on the S&P 500, followed by a sharp reversal. The bullish scenario where debt problems in Europe are resolved and stocks sprint higher into year-end remains a possibility, but not a highly probable outcome. Our large cash position allows for a flexible stance heading into the Fed meeting. If the S&P 500 (SPY) breaks below last Monday’s low of 1,136, we would consider adding to our deflationary/bearish stance, which includes bonds (TLT), the dollar (UUP), gold mining stocks (GDX), and a short (SH).

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.