Details to Note Prior to Fed Announcement on September 21

Interest-Rates / US Interest Rates Sep 21, 2011 - 01:32 AM GMTBy: Asha_Bangalore

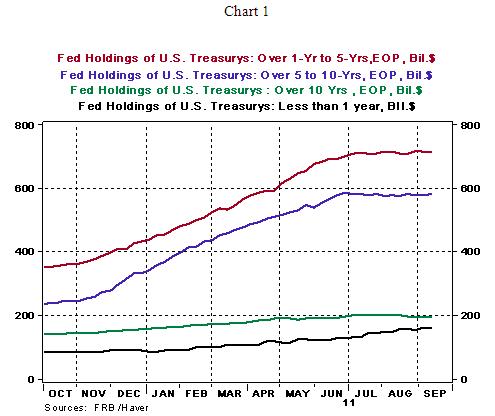

It is widely anticipated that the Fed will announce new monetary policy support following the 2-day FOMC meeting on September 21, 2011. The Fed is expected to put in place “Operation Twist” to bring down rates at the long-end by purchasing long term U.S. Treasury securities to replace U.S. Treasury securities of short maturities in its portfolio. A large percentage of the Fed’s holdings are of 1-5 years maturity (see Chart 1).

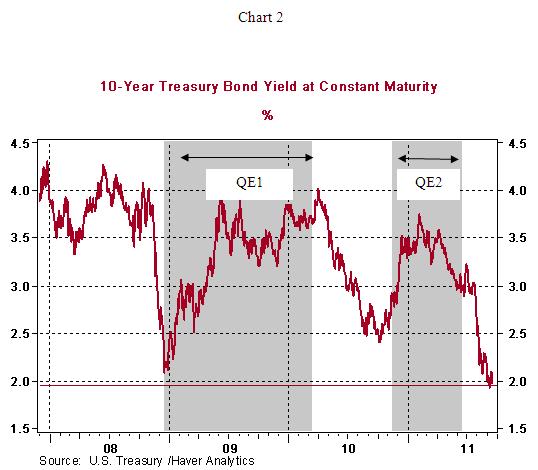

The 10-year Treasury note is trading at 1.95% as of this writing. It is noteworthy that the 10-year Treasury note yield has been declining since the peak on February 7, 2011 (3.68%). The completion of QE1 (quantitative easing) and QE2 both resulted in lower ten-year yields. Fed’s guidance about expectations regarding its policy actions will be insightful. The likely limited benefit of Operation Twist is the subject of the U.S. Economic Outlook of September 9, 2011.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.