Gold Gains as Credit Rating Agencies Flag an "Italian Job"

Commodities / Gold and Silver 2011 Sep 20, 2011 - 09:18 AM GMTBy: GoldCore

Gold is trading at USD 1,793.84, EUR 1,309.37, GBP 1,140.96, JPY 137,101.40, AUD 1,742.44 and CHF 1,577.91 per ounce.

Gold’s London AM fix this morning was USD 1,792, EUR 1,309.37, and GBP 1,142.27 per ounce.

Yesterday’s AM fix was USD 1,817, EUR 1,332.31, and GBP 1,155.56 per ounce.

Gold is up this morning as credit rating agency Standard and Poor's doused cold water over Italy's capacity to address their public finances. It would seem that through poor management a dysfunctional political class has done too little too late to address the worsening Italian balance sheet. As in many other countries faced with severe austerity measures, Italy's government has underpinned its austerity plan with rosy growth predictions.

The S&P report states...

The lowering of the long- and short-term sovereign credit ratings on Italy reflects our view of the Italian economy's weakening growth prospects and our view that Italy's fragile governing coalition and policy differences within parliament will likely continue to limit the government's ability to respond decisively to domestic and external macroeconomic challenges.

It then gives three reasons why they will miss their targets for growth:

.... we think that the government's projection of a €60 billion savings may not come to fruition for three primary reasons:

• First, as described below, we view Italy's economic growth prospects as weakening;

• Second, nearly two-thirds of the projected budgetary savings in the crucial 2011-2014 period rely on revenue increases in a country already carrying a high tax burden; and

• Third, market interest rates are anticipated to rise.

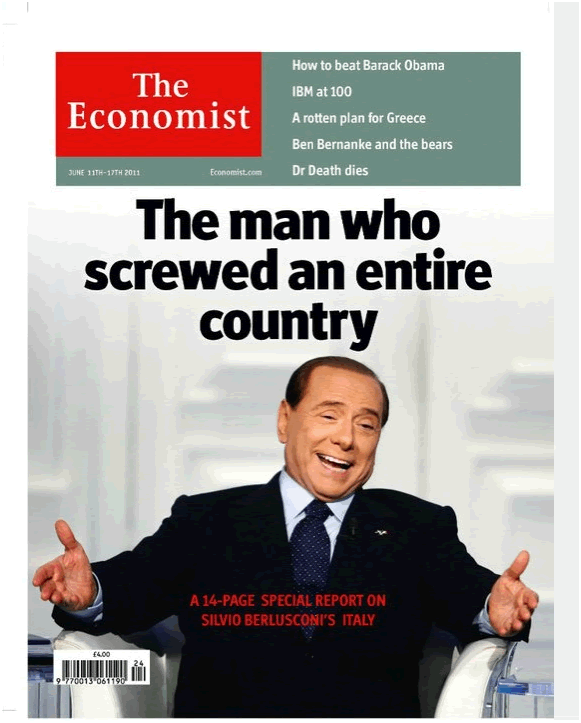

The Economist - June 11-17th 2011

Italy may be the butt of many international jokes due to the excesses of its political class but its economy is enormous and essential to the eurozone ecnomic integrity. With debt levels now at 135% of GDP (Global Finance - Public Debt by Country), it is in danger of going down the same road as Greece, (debt-to-GDP 139%). A crisis here may be too much for the eurozone to handle and may predicate a pan-European restructuring of the euro with global consequences that are potentially staggering.

From the London Bullion Market Association conference, a Bloomberg survey reports that gold could top $2,000 an ounce this year on the back of investor demand and risk aversion with a further 10% in 2012. No one knows for sure where the gold price will go but as long as governments cower from their responsibilities to balance their budgets and continue to print money instead of paying their bills, gold will likely appreciate in paper money terms.

SILVER Silver is trading at $39.45/oz, €28.83/oz and £25.14/oz.

PLATINUM GROUP METALS Platinum is trading at $1,778/oz, palladium at $713/oz and rhodium at $1,750/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.