General Moly - The Ulimate Coinfidence Stock

Companies / Company Chart Analysis Sep 20, 2011 - 04:02 AM GMTBy: George_Maniere

Several Days I wrote an article on a fantastic stock, General Moly (GMO). General Moly is in the home stretchof being permitted. The Record of Decision (ROD) is drawing to a conclusion and while the water rights were approved, they were appealed. When the town had a hearing on the appeal they had about two hundred chairs to make sure everyone that wanted to attend would be comfortable. Well two ranchers showed up and as it turned out their ranches are not in the vicinity that would be impacted by the mine. I can only conclude that they see money and want some.

Several Days I wrote an article on a fantastic stock, General Moly (GMO). General Moly is in the home stretchof being permitted. The Record of Decision (ROD) is drawing to a conclusion and while the water rights were approved, they were appealed. When the town had a hearing on the appeal they had about two hundred chairs to make sure everyone that wanted to attend would be comfortable. Well two ranchers showed up and as it turned out their ranches are not in the vicinity that would be impacted by the mine. I can only conclude that they see money and want some.

General Moly is a world class holding with the Mt. Hope project being their flagship project. Once permitted the General Moly will be sitting on the largest undeveloped deposit of molybdenum in the world. If you don’t know what molybdenum is, it is an ore that has the atomic number 42 in the periodic table of elements. When Molybdenum is mixed with iron ore one can create lightweight, incredibly strong stainless steel that is impervious to high degrees of temperature and pressure. This would make this steel essential for building oil rigs, nuclear reactors as well as basic infrastructure. What’s very special about molybdenum is that while China mines 97% of the world’s rare earth elements (this has subsequently changed) they are actually net importers of molybdenum.

I read everything I could find on the management of this company and was very pleased to learn that CEO Bruce Hansen had amassed an amazing team that were not looking to be acquired but instead were looking to take this company into the arena of being the suppliers of molybdenum to the world.

What did their balance sheet look like? They had received a loan from one of the largest producers of steel in the world, a South Korean company called Posco. They had also received financing from a Japanese company called Sojitz and finally they had received a bridge loan from a Chinese company called Hanlong for the amount of 50 million dollars with the promise that when permitted they would receive an additional 665 million dollar loan to fast track the project into production. Make no mistake; the South Koreans, the Japanese and the Chinese were not being benevolent. They do not want the loans paid back in dollars they want the loans paid back in molybdenum.

While General Moly has endured more than its fair share of problems, I remain firmly committed to this stock as the management team has met every obstacle with complete transparency and integrity.

Last week Hanlong mining chief executive Mr. Steven Hui Ziao, was prevented from leaving Australia after being accused of insider trading allegations. He is suspected of being guilty of insider trading activities in relation to Bannerman Resources and Sundance Resources. It should be duly noted that Mr. Hui Ziao has been terminated from the Hanlong Company.

Coincidentally, yet unrelated, General Moly (GMO) announced that Nelson Chen, Chief Operating Officer of Hanlong Mining will replace Steven Xiao, Managing Director of Hanlong Mining Investment as Hanlong (USA) Mining Investment's designee to the General Moly Board of Directors, pursuant to the Hanlong transaction announced in March 2010. Mr. Chen will serve on the Technical committee.

Mr. Chen has 11 years of audit and M&A transaction advisory experience. He was involved in a large number of financial due diligence and acquisition advisory transactions with a focus on leading engagements servicing Chinese clients. He has extensive experience in many industries including mining, manufacturing, consumer products, financial services, real estate.

CEO, Bruce Hansen said "I am pleased to welcome Nelson Chen to our Board as a Director. Nelson has been one of the key Hanlong personnel with whom we have worked with since announcing the Hanlong transaction in March 2010 and he is extremely knowledgeable of our business and our financing transaction."

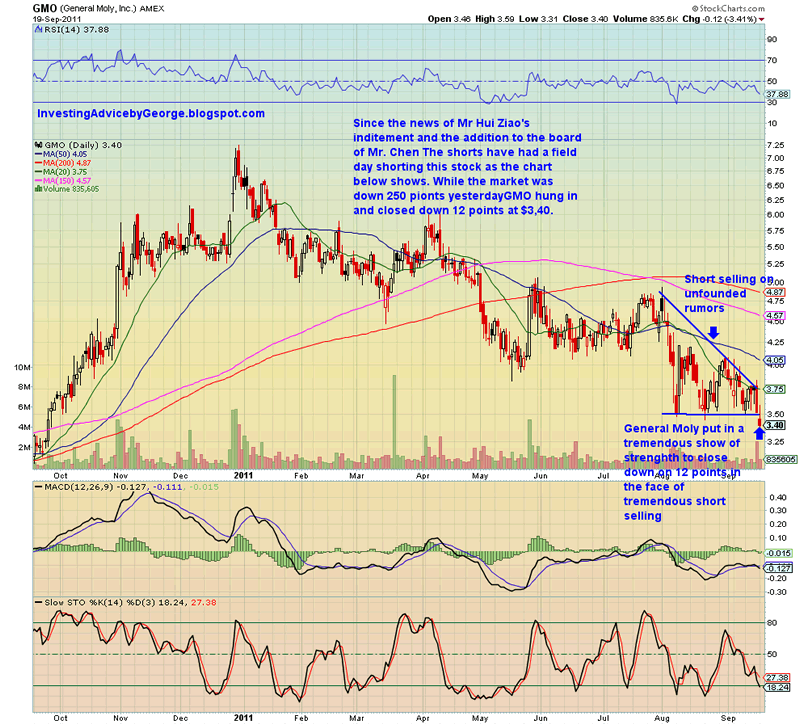

Please see the chart below.

As a look at the chart above will show, since the announcement of insider trading by Mr. Hui Ziao and the announcement of Mr. Chen to the board of General Moly these two unrelated incidents have caused the short sellers to do everything in their power to break

In conclusion, as far as I know these two gentlemen never met. Mr. Hui Ziao was dismissed as an employee of Hanlong and Mr. Chen is a prestigious representative of the Hanlong Company. The fact that General Moly has held up to the barrage of short selling for the last week is a testament to the strength and resiliency of both the management team and the massive mountain of molybdenum that General Moly represents. While I myself have a stake in the company there are many investors that have believed in this company through thick and thin and I believe after having done a careful analysis of the company General Moly is as close to being a sure thing as there can be in the world of stock market investing. I believe that General Moly is the ultimate confidence stock.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.