Stock Market Intermediate Support Is Holding

Stock-Markets / Stock Markets 2011 Sep 18, 2011 - 04:05 PM GMTBy: Andre_Gratian

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into 2014 after this bull market has run its course.

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into 2014 after this bull market has run its course.

SPX: Intermediate trend - The market strength which was experienced last week attests to the seemingly impregnable support which exists in the low 1100's. With the market volatility being what it is, the market profile may change again, but it has become doubtful that the bottoming 3-yr cycle will cause the index to make a new low.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

After making a new high at 1370, the SPX lost its upward momentum and subsequently broke the important 1260 support level. This caused many market analysts to assume that the stock market had started a new bear market decline. I had pointed out previously that, in order to confirm a bear market trend, the index would have to trade below its July 2010 low of 1011. It does not look as if this is going to happen anytime soon. Now, my question is becoming: can the SPX even trade below its August 2011 low of 1101 by the time that the 3-yr cycle makes its low in early October?

A little over two weeks ago, a decline started from 1230 which looked as if it would continue until October and make a new low in the process. With the positive action of the past week, this scenario has come under serious scrutiny. Although a decline should eventually materialize into (about) the second week in October, It is no longer clear that the bottoming cycle will create enough weakness to challenge the 1101 level. In fact, the market is showing enough technical strength to suggest that, after a near-term correction, it might even make a new high before succumbing to the 3-yr cycle downward pressure. I will show you why when we analyze the SPX daily chart.

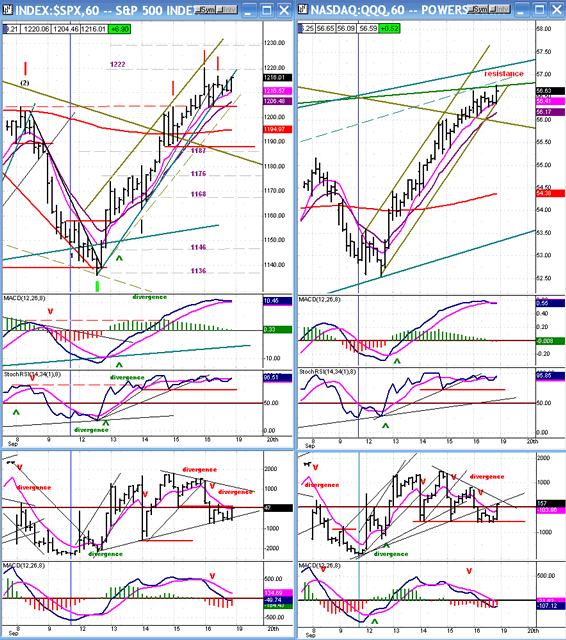

By Friday's close, the hourly momentum indicators were overbought and the A/D was showing negative divergence in both indices. However, neither index had given a short-term sell signal. The Point & Figure chart looked as if it might be making a distribution top, but this will only be confirmed if prices drop below 1205. If we have a good opening on Monday, SPX could even run up to 1222 - 1228 before beginning a short-term correction.

With these parameters established, let's start to look at some charts.

Chart analysis

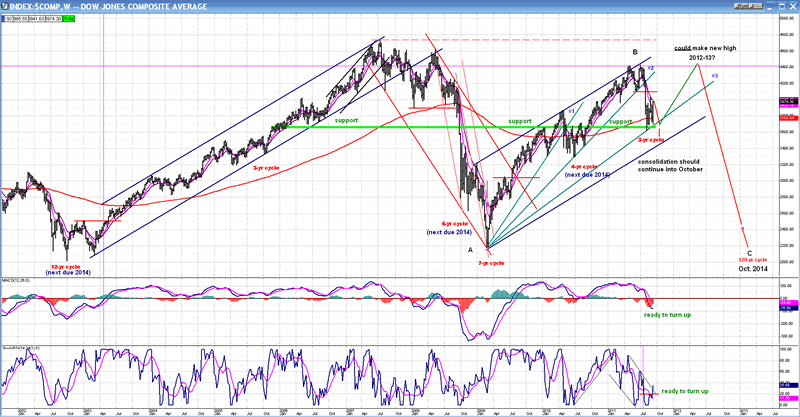

Few indices are capable of giving us as good a long-term perspective as does the Dow Jones Composite Index. The following is its Weekly Chart, going back to the 2002 low. On it, I have delineated the trend channels, shown the bottoming dates of the major cycles, and indicated the reason why the stock market is having such a tough time making further downside progress. There is long-standing support which goes back to 2006 and which corresponds to the low 1100's in the SPX.

The last two major trends -- the bull market from 1202 and the bear market from 1207 - are obvious (as things always are with 20/20 hind sight), and need not be discussed. We'll focus on the current trend from March 2009. I have drawn a line across the tops, as I did with the bull market which started in 2002, and a parallel to that line from the 2009 bottom. This has created a wide up-channel which is still containing prices and, by that criterion alone, we have to admit that we are still in an uptrend until the bottom channel line is broken.

Before we go any further, notice how the width of the up and down channels has steadily increased since 2002. This is due to increased market volatility which is creating wider and wider trading ranges. This may continue until we get to the bottom of the next bear market in 2014.

Now we have two criteria which tell us that we are still in an uptrend: we continue to trade within the confines of the up-channel, and we have not broken below the July 2010 low. So let's expound on what we are likely to do from this point on?

The 3-yr cycle bottoming in early October should bring about one more decline into that time frame. But afterwards, the 3-yr cycle should exert upward pressure for several months, and it will be assisted by the 4-yr cycle which has been rising for one year and, ostensibly, has one more year to go up. The upward pressure of the two cycles combined could push prices up well into 2012. If that's the case, the indices may have plenty of time to make a new high or, at worst, make a double-top.

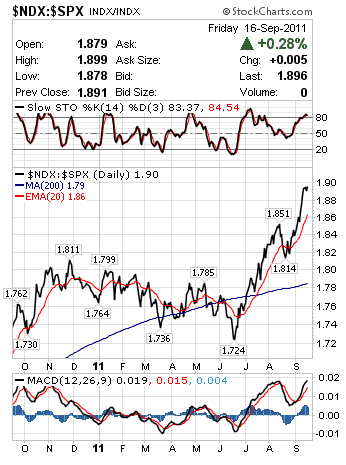

Before going on with our analysis of the DJ Composite Index, let's highlight another factor. On numerous occasions, I have remarked that an NDX so strong relative to the SPX did not square with the beginning of a bear market. Lately, I have vacillated between a new bear and a continuing bull, even accepting the possibility that the "new-norm" could account for this historical aberration, but the new life which the bulls displayed over the past week is causing me to re-consider the market's technical position- once again.

Getting back to the above chart, there is no question in my mind that another bear market lies ahead of us. Each major cycle low on the chart has the notation under it: "next due in 2014". Time-wise, the above chart has a relatively short-term span, but if we were to go back to 1974, the low of the 40-yr cycle would also have this notation, as well as the low of the 30-yr cycle in 1984. This is because 2014 is scheduled to be the low of the 120-yr cycle, as well as the low of its various components which consist of all the cycles shown on the chart and those listed above. This is why I fully expect another significant decline into 2014. But has it already started; or is there a new high in the making, first?

We know that we are likely to get another upward push from the 4-yr and 3-yr cycles. Graphically, this is indicated by the oscillators at the bottom of the chart. Both are getting ready to turn up, so another rally (after the 3-yr low) is virtually certain. What will it consist of? A double-top? A new high? We should be able to get some idea after October by the size of the base which has been built by the SPX. Perhaps some indices will make new highs, and some won't. One that should is the QQQ, because of its strong relative strength, and because it has a potential P&F projection to 64-67.

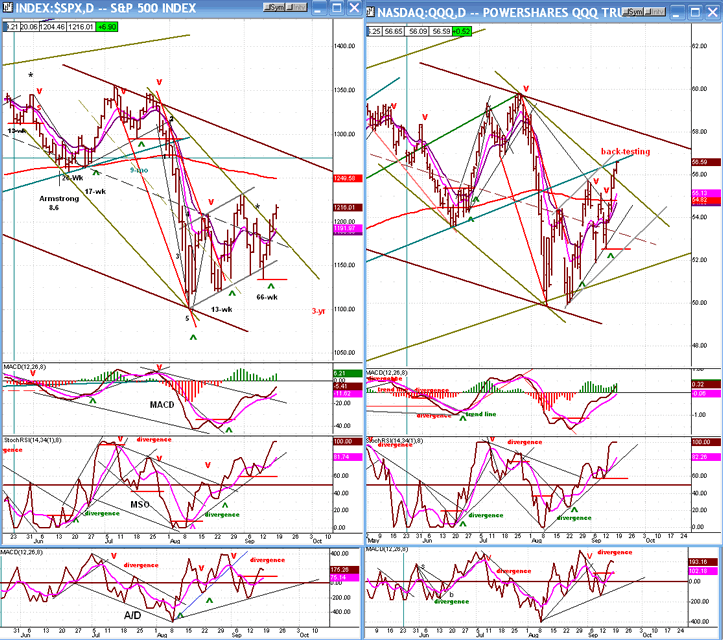

Let's now look at the Daily SPX Chart side by side with that of the QQQ. It's obvious that the QQQ is stronger. It had a shallower correction and a better rally than the SPX. The QQQ has also already moved well above its 200-DMA. They are both currently trying to get out of their green channels, but will most likely have to do some additional consolidation before challenging the brown channel.

Overcoming that one would signal the continuation of the long-term uptrend.

The QQQ is currently back-testing its former intermediate uptrend line, which should provide some resistance. Since it had a near-term target of 56.50 which was met on Friday and, as you will see, its hourly indicators are on the verge of giving a sell signal, it's likely that it is ready for a consolidation. Because the QQQ has been the leader, if it corrects, there should be a correction in the SPX as well.

Now take a look at the daily momentum indicators (MSO). They are both at 100% and can go no higher. This is suggestive of a strong market, and although they are probably ready to pull-back, it's possible that this will be followed by another recovery high where negative divergence should develop in the indicators. Only after reaching that point will they come down to satisfy the 3-yr cycle low in what could be a violent near-term move.

The SPX/QQQ Hourly Charts will complete the picture. Both indices show negative divergence in their A/D indicator. The MSOs are only overbought, but if it the MACD's cross, it will probably start a near-term reversal. The QQQ has reached the underneath of its intermediate trend line, which normally provides strong resistance.

The SPX has already broken its uptrend line. The QQQ pushed away from it in the last hour, Friday.

The SPX has backed-off once from its 1222 pivot point, and the QQQ has reached its near-term projection of 56.50. All these conditions suggest that an end to the rally from 9/12 has probably arrived. Friday's last-hour push may have been caused by the customary Friday last-hour rally, as well as the last vestige of options expiration.

For the SPX, a pull-back to 1187 would satisfy both a P&F target and a .382 Fibonacci retracement of the uptrend.

Cycles

There is only one very important cycle left directly ahead, and that is the 3-yr cycle which is scheduled for the end of the first week in October. It could bring a sharp, quick decline to the averages before attempting to send them on to a new recovery high.

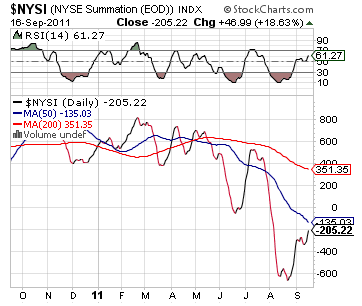

Breadth

The NYSE Summation Index (courtesy of StockCharts.com) is looking a little more healthy and is trying to re-establish an uptrend. However, it is still far from looking bullish. Let's see what it does over the next 3 weeks.

Sentiment

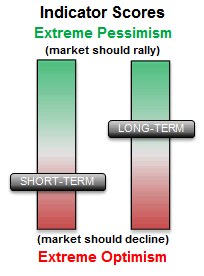

The SentimenTrader (courtesy of same) does not have much effect on the market unless its long-term indicator is deeply in the green or red. The short-term indicator is on the bearish side.

NDX:SPX

This ratio should continue to give the bulls hope and comfort. This kind of display is NOT bearish.

The VIX is still in an uptrend and it could try to move higher as the market corrects into early October. But if we are to resume the uptrend which started in 2009, it should not make a new high, and it should give a sell signal after the October low.

Summary

There is nothing positive that one can say about the SPX, except that it appears ready to have one more near-term bounce that could start on Monday. Until the end of last week, it had an opportunity to demonstrate that it was capable of extending the rally that started at 1101. That faded promptly after the jobs report was announced last Friday.

That's what I wrote last week, but what a difference a week makes! I had expected the decline to continue into the 3-yr low, but in this volatile environment, sentiment can turn on a dime and, practically overnight, the bears became bulls!

The fact that the decline was interrupted by a burst of strength and that the NDX:SPX ratio continues to improve may have changed the market profile for the next few months. Long-term weakness will be confirmed if the 3-yr cycle brings about a new low. If it is not able to do that, it will impart a bullish cast on the market which can take at least some of the indices, such as the QQQ, to a new high before the trend which started in March 2009 comes to an end.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time frames is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth.

For a FREE 4-week trial. Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my investment and trading strategies and my unique method of intra-day communication with Market Turning Points subscribers.

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.