Tick Tock, Tick Tock Goes Nasty New Cyclical Stocks Bear Market

Stock-Markets / Stocks Bear Market Sep 18, 2011 - 03:33 PM GMTBy: Adam_Brochert

I remain convinced that a nasty new cyclical bear market in common equities has begun. Now that Germany's stock market ($DAX) has dropped 35% from its May peak, there is little point in Wall Street trying to pretend that this is "just another correction/buying opportunity." The US stock markets have held up better than most, but this is about to change in my opinion. In fact, it was Germany that held up much better than the US in late 2007/early 2008, only to play catch-up later once the bear market really got rolling. Now, the crisis is centered in Europe (for now), so Germany and the US get to reverse their roles relative to the prior cyclical bear market of 2007-9.

I remain convinced that a nasty new cyclical bear market in common equities has begun. Now that Germany's stock market ($DAX) has dropped 35% from its May peak, there is little point in Wall Street trying to pretend that this is "just another correction/buying opportunity." The US stock markets have held up better than most, but this is about to change in my opinion. In fact, it was Germany that held up much better than the US in late 2007/early 2008, only to play catch-up later once the bear market really got rolling. Now, the crisis is centered in Europe (for now), so Germany and the US get to reverse their roles relative to the prior cyclical bear market of 2007-9.

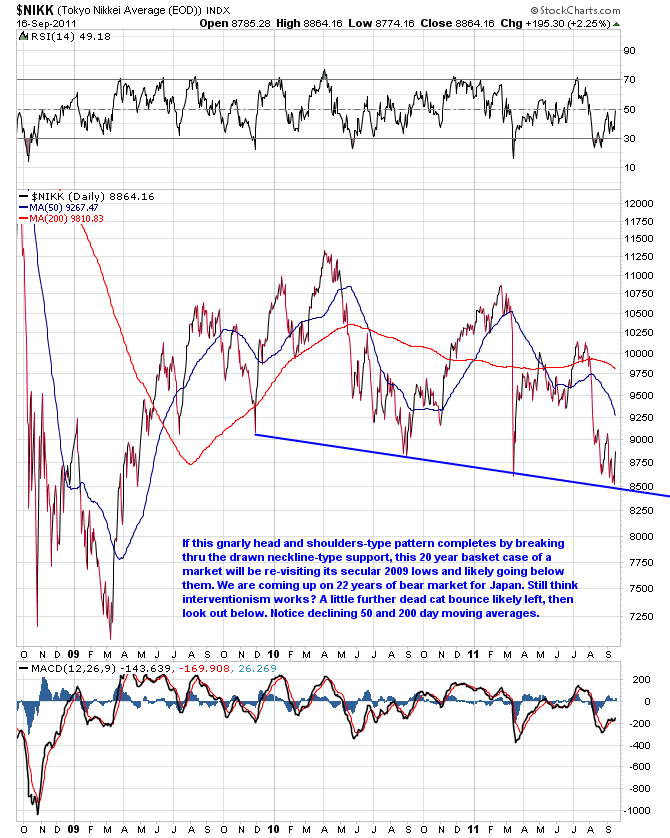

Greece continues its deflationary collapse as predicted. The Greek stock market ($ATG) is now down 84% from its late 2007 highs, versus 89% for the Dow Jones in the 1929-1932 bear market. Close enough and I don't think the decline in Greek shares is over yet. Japan's chart looks like it wants to break down yet again (3 year daily chart of the Nikkei Index thru Friday's close follows):

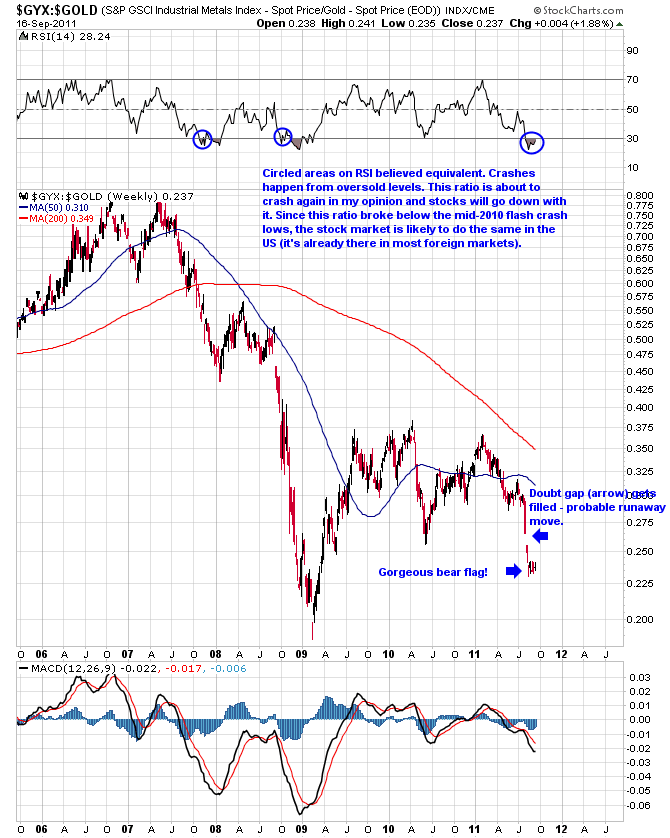

Meanwhile, one of my favorite indicators for this secular bear market, the industrial metals to Gold index, is screaming for caution. I like the $GYX industrial metals index, but the copper:Gold ratio uses the same concept and the chart looks the same. The message is simple: if Gold is rising faster than industrial metals (i.e. falling $GYX:$GOLD ratio or falling $COPPER:$GOLD ratio), the underlying economy is likely to be in trouble. Here's a 6 year weekly chart of the $GYX:$GOLD ratio thru Friday's close with my thoughts:

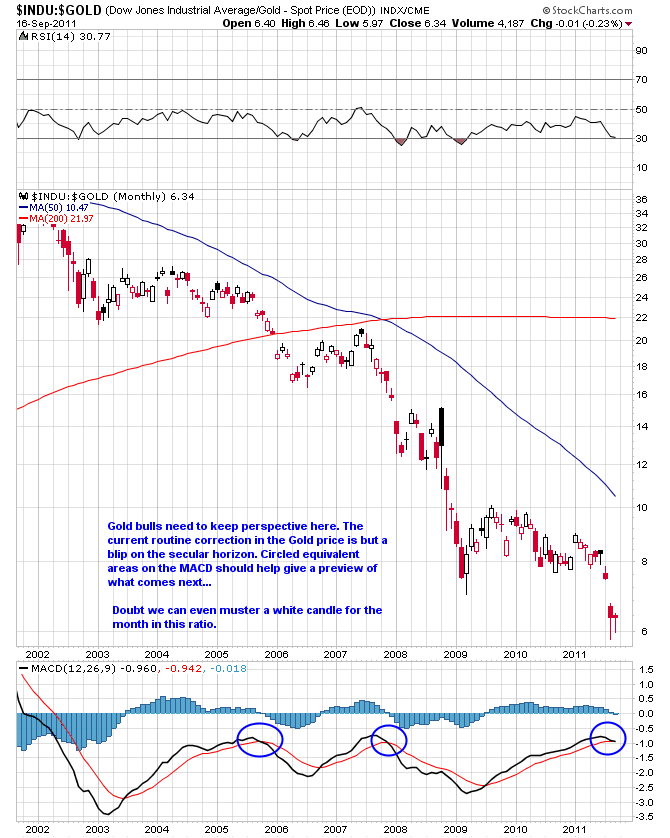

Meanwhile, the Dow to Gold ratio continues on another cyclical down move within its secular downtrend that began in 1999. To keep Gold bulls focused on the big picture of "Gold versus paper" (i.e. paper=stocks as a proxy for financial assets), here is a monthly chart of the Dow to Gold ratio ($INDU:$GOLD) over the past 10 years thru Friday's close (log scale):

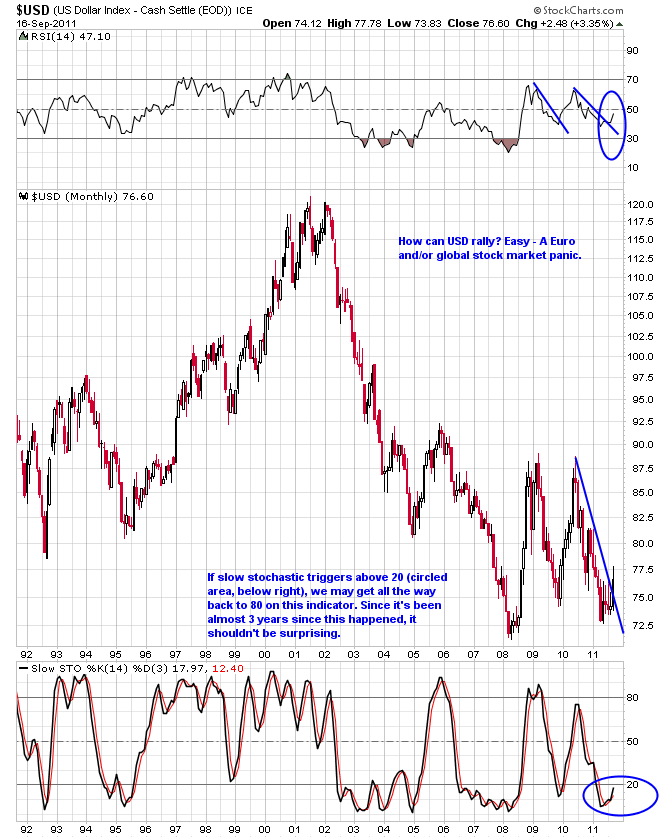

I also think ol' Uncle Buck is beginning yet another death dance rally. This separates me from the "Dollar to zero tomorrow" crowd, but doesn't temper my belief that Gold will top $2000 before the year is over. All fiat paper currency is sinking relative to Gold, just at varying rates. Here's a 20 year monthly chart of the $USD Index with my thoughts:

I think it is shaping up to be a great fall for bearish stock trading and bullish Gold trading. I wouldn't short stocks before the fedspeak meeting next week, as I think the current equity dead cat bounce can go a little further in US markets, but I also wouldn't fear that apparatchiks and central bankstaz can stop the train wreck that's coming. Unlike most Gold commentators, I am not yet bullish on Gold mining stocks and continue to favor metal over metal equities for now.

Specific trading recommendations are reserved for subscribers. Join us!

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.