China Market Action Question Stock Rally’s Staying Power

Stock-Markets / Stock Markets 2011 Sep 17, 2011 - 12:04 PM GMTBy: Chris_Ciovacco

Regardless of what happens in Europe, stocks are not the place to be if a recession is around the corner. The odds of a recession are increasing. A bearish economic outlook is supported in Friday’s Wall Street Journal:

Regardless of what happens in Europe, stocks are not the place to be if a recession is around the corner. The odds of a recession are increasing. A bearish economic outlook is supported in Friday’s Wall Street Journal:

“It feels like a recessionary environment. What they call it later on I can’t tell you,” says Bart van Ark, chief economist of the Conference Board, who put the odds of recession at 45%. Since 1988, every time the Conference Board’s estimate of the probability of recession topped 40%, a downturn followed shortly thereafter.

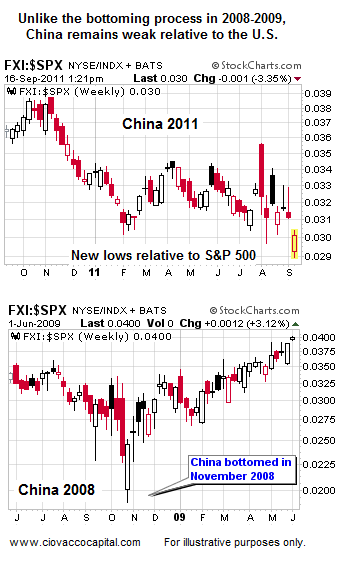

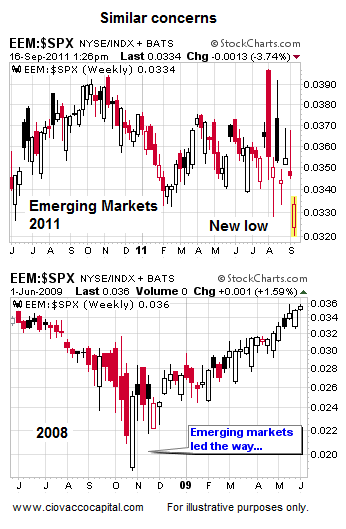

We remain skeptical of the current advance in stocks, primarily due to the weak participation and conviction behind moves in economically sensitive sectors, such as energy and commodity-related stocks. The current advance looks narrow (again) with the S&P 500 Index and NASDAQ QQQ’s being used as the main exposure vehicles. The sectors, asset classes, and portions of the globe that lead the markets higher off the November 2008/March 2009 lows are not providing a lot of confidence the current advance is sustainable. China and emerging markets, shown below, were leaders off the 2008/2009 lows. Following the bottom in 1998, emerging markets also led the way to higher highs. Emerging markets and China continue to lag the S&P 500, which is not what we want to see.

The bulls still have a good grasp on the short-term trend. It was only five days ago the market was on the edge of taking out important levels on the downside. Sharp moves like what we have seen since the intraday reversal on Monday are typical in bear markets. It remains well within bear market reason for the S&P 500 to revisit the 1,260 level, as we mentioned on August 10.

How the market behaves between 1,230 and 1,260 will go a long way in helping sort out the debate between the bulls and the bears. If the S&P 500 barrels through these levels in impressive fashion, it would obviously be a win for the bulls. The most likely outcome for the S&P 500 is a reversal between current levels and roughly 1,260. If a reversal does occur, the manner in which the market comes down will be very important. If we see a pullback on weaker volume and see bullish divergences appear on charts (especially weekly charts), then it may represent a good entry point for bullish positions. If the reversal is swift, backed by volume, and negative market breadth, then the bearish case will remain firmly intact. The important thing is to keep an open mind and make decisions based on facts rather than fear of missing something. Our current high position in cash allows us to adapt if conditions improve.

We still have all of the following to contend with:

- The problems in Europe are very serious and have not been addressed in a meaningful way. This week’s developments are more in a series of “kick the can”/short-term Band-Aids. Very little has been done to address concerns about Italy – a much, much bigger problem, in terms of size, than Greece.

- The debt debate in the United States will come back into the news cycle soon.

- The U.S. economy is stalling and the economic numbers have not shown signs of improving. The four-week moving average of jobless claims is above 400K and rising (not a good sign).

- U.S. stocks market performance relative to Germany remains near the top of a trend channel that has preceded stock market weakness in the past (more detail).

- Estimates for corporate profits may need to come down significantly in the next few months. Profits were still in decent shape in the fall of 2007 and spring of 2000. Financial markets tend to lead earnings and the economy.

- Monthly charts of European stocks have long-term sell signals in place similar to those in late 2007/early 2008

- Rather than helping stimulate growth, China is trying to tame inflation via tighter monetary conditions. China was a leader off the November 2008 lows in stocks – today it is a laggard.

- Global stimulus spending helped fuel economic activity around the globe since 2009 – there will be no repeat performance. The United States will be cutting spending, not increasing it. Europeans are cutting back as well.

- Housing prices in the U.S. could fall another 10-25%, according to Robert Shiller, the economist who co-founded the S&P/Case-Shiller index of U.S. home prices.

- Investors have lost faith in global policymakers.

- More importantly, investors have lost faith in the Fed’s ability to ride to the rescue. If they launch another round of money printing (QE3), it will have a much more muted impact on asset prices; it may even have a negative impact using the “are things this bad?” rationale. ‘Operation Twist’ is probably coming our way next week; it will not add new money to the financial system, which is significantly different than QE.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.