Global Imperatives of a Chinese Exporter

Economics / China Economy Sep 17, 2011 - 11:31 AM GMT Here are the two simple "equations" that all of the incessant rumor-inspired momentum chasers, equity bulls, peripheral EU bond bulls and relentless predictors of an imminent global Asia-backed bailout would do well to memorize:

Here are the two simple "equations" that all of the incessant rumor-inspired momentum chasers, equity bulls, peripheral EU bond bulls and relentless predictors of an imminent global Asia-backed bailout would do well to memorize:

1) Export Economy = Relatively Weak Currency

2) Chinese Economy = Export Economy

After the Parliament of AAA-rated Austria rejected any near-term possibility of expanding the "European Financial Stabilization Facility", which requires unanimous consent of contributing members, the continued existence of Greece and the current EMU structure as an "ongoing operation" has come to rely solely on the good will of China.

Global equity markets are hanging by the skin of their knuckles on rumors that the Chinese are committed to assisting the EMU through its sovereign debt crisis and buying the toxic bonds of its debtor nations en masse. What these markets are soon to realize is that the Chinese government not only has its own domestic financial troubles to deal with, but is also not filled with brain-dead individuals who fail to understand the basics of global trade.

A truly significant bond purchase program by the Chinese would require them to re-allocate precious reserves into large EU member economies, such as Italy and Spain. These are economies that even other EU member states and their populations are both unable and unwilling to bail out.

Such a drastic action by the Chinese at this stage of the game would be the equivalent of an extremely "sophisticated" investor voluntary agreeing to be the last greatest fool in a speculative financial ponzi scheme that makes the U.S. sub-prime housing bubble look tame in comparison. Li Daokui, member of the Chinese central bank’s monetary policy committee, has a few choice words to say on this point, as quoted by Ambrose Evans-Pritchard for the Telegraph:

China States Price For Italian Rescue

Professor Li said China must stop investing its hard-earned wealth in western debt and switch its incremental holdings into "physical assets", including the equities of major western companies.

"China is the most patient investor in the world. Imagine if our $3.2 trillion in foreign reserves had been controlled by George Soros: financial markets would be in much greater chaos," he said.

But such irrational investments are made all of the time in our twisted system of "free-market" incentives, right? Wrong. That argument may carry some weight on the way up before the ponzi has begun its process of implosion, but the Eurozone sovereign debt ponzi is well past that mark.

The Irish, Greek and Portuguese economies came under public financing pressure well over a year ago, and it has already been a few months since the "contagion" infected Italy and Spain. The Chinese have lost significant value on their purchases of Portuguese bonds and the volatile bond yields of Spain and Italy aren’t looking very appetizing for the once-bitten investor.

Evans-Pritchard:

However, the relentless climb in Spanish and Italian yields over the summer indicates clear limits to Chinese buying. China's central bank has already suffered a large paper loss on Portuguese debt bought with much fanfare before that country needed a rescue. Italy's finance minister Giulio Tremonti said it is hard to persuade Asian investors to buy Italian debt when the European Central Bank hesitates to do so.

Now, some may still argue that it’s not 100% ridiculous to believe the Chinese have managed to convince themselves that an extremely risky intervention is needed to preserve the EMU and stabilize global financial markets, on which they heavily rely. Well, at least not until we factor in the fundamental equations of global trade in our current system that were presented above.

The only other reason the Chinese would be willing to go "all in" on the EMU is because it wants to preserve the economic health of its major export markets. There is little doubt that the Chinese economy does not have nearly enough internal consumer or investment demand to sustain moderate levels of economic growth, and therefore is utterly dependent on its export industries maintaining or increasing their market share in an era of rapidly contracting consumer economies.

So the only question is, how is this goal best accomplished from the perspective of the Chinese? By bailing out the entire Euro "periphery", or by letting nature take its course as some of the weak debtor nations are gradually pushed out of the Union by righteous members running a surplus and incredulous financial markets? The following graphs present the ECB's data on export/import value of the EU:

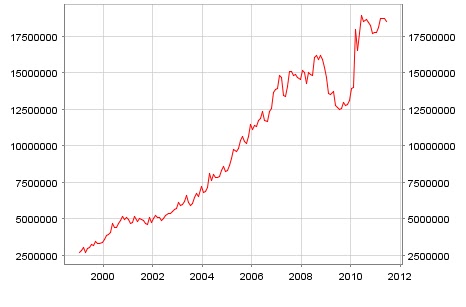

Value (1000s of Euros) of EU Imports from China ECB Data

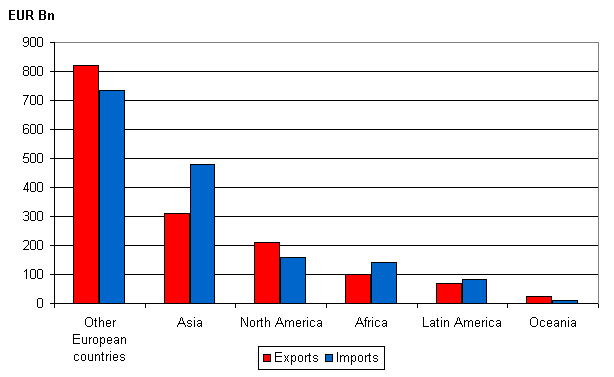

Value of 2008 EU Exports/Imports ECB Data

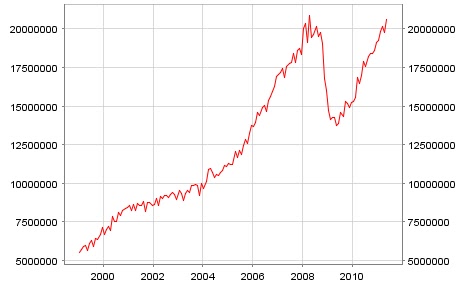

Value (1000s of Euros) of EMU (17) Exports to Other EU Members ECB Data

While many analysts view this import/export relationship as a reflection of a healthy dynamic which encourages mutual aid, it is actually one that engenders aggressive, cutthroat competition. In this global system, and especially now, one does not gain market share by generously helping out the competition. The major competition, in this context, is Germany, France, the Netherlands and Switzerland.

We recently witnessed this dynamic when the Swiss became so concerned with an appreciating Swiss Franc and its consequences for a struggling export industry that its central bank decided it was willing to defy decades of history and undertake an unprecedented maneuver of pegging its currency to the Euro.

Essentially, it decided that suppressing the value of its currency, even in the short-term, was worth destroying its balance sheet and ruining its credibility as a central banking institution by promising unlimited currency intervention. From their perspective, this currency suppression provides a desperately needed boost to its export industry by lowering the price of exports and stabilizing the private CHF-denominated finances of Eastern European countries. What do the Chinese think of this bold move?

Although there was no clear public reaction by Chinese officials, we can be sure that they were not thrilled by the SNB stealing a patented move out of their playbook. The Chinese Yuan is pegged to a fixed exchange rate against the U.S. Dollar, and the U.S. Dollar (USD) floats against the Swiss Franc (CHF) and Euro. With the CHF now pegged to the Euro, the Chinese lose any export benefits gleaned from appreciation of the CHF as a safe haven relative to the Euro and USD.

That has only added insult to a much deeper injury, as they have also had to deal with a Euro currency which has repeatedly come under downward pressure for the past year. This pressure obviously benefits the non-euro European export market share of German, French, Italian, Spanish and Dutch industries, as well as their extra-European market share.

And, as if all of that wasn’t enough, the EU exporters have benefitted greatly at the expense of China by failing to recognize it as a "market economy" under the definitions of the World Trade Organization. This failure of recognition has been used as an economically, politically and legally leveraged asset for Western exporters, since it effectively increases the exposure of Chinese industries to threatened or actual legal actions brought to the WTO and sanctions for violating "anti-dumping regulations".

These are regulations prohibiting WTO members from "dumping" their goods on other countries by "unfairly" lowering prices through government subsidies to private industry (usually via below market-rate loans) or other state-sponsored measures (i.e. "artificial" currency devaluation). Never mind that Western "market economies" engage in this activity all of the time.

Evans-Pritchard:

Market status under the WTO has become the Holy Grail for China, both because it makes the country less vulnerable to 'anti-dumping' sanctions from the EU and because it marks the country's final coming of age in the global economy.

Beijing is bitter that the EU recognises the market status of Russia despite open violations of WTO rules by the Kremlin, claiming that the "double standard" is a disguised form of protectionism.

Under its WTO accession accord in 2001, China remains a "non-market economy" for 15 years unless other members agree to fast-track the process. There could still be problems even after 2016 if major powers take a tough line.

The very mention of this "request" as a part of the numerous conditions to a Chinese bailout is essentially a big, fat NO to any such possibility. There is a reason why China has been the number one target of AD lawsuits, and that reason only becomes stronger in an environment of global economic contraction and universally struggling exporters.

The WTO has been one of the fundamental mechanisms through which developed countries manage trade flows to their favor under the guise of promoting economic efficiencies through "free trade". Now, major exporters must do everything they can to retain their share of a dwindling pie, and the WTO is still one of the most coercive means for the West to do so. An example of this dynamic from Wikipedia:

The consequences of not being granted market economy status have a big impact on the investigation. For example, if China is accused of dumping widgets, the basic approach is to consider the price of widgets in China against the price of Chinese widgets in Europe. But China does not have market economy status, so Chinese domestic prices cannot be used as the reference.

Instead, the DG Trade must decide upon an analogue market: a market which does have market economy status, and which is similar enough to China. Brazil and Mexico have been used, but the USA is a popular analogue market. In this case, the price of widgets in the USA is regarded as the substitute for the price of widgets in China.

This process of choosing an analogue market is subject to the influence of the complainant, which has led to some criticism that it is an inherent bias in the process.

Chinese elites know that any firm commitment they make to purchasing bonds of EU debtor nations will not stabilize their public finances long-term, and, in addition, will not even make the Euro appreciate considerably against the USD or other established reserve currencies. They also know that Northern Europe will never agree to "fast-track" the WTO process, because, at this precarious time for exporters, that may cost them even more than the price tag on preventing EMU collapse.

China’s bailout would merely serve to preserve the present situation, in which the Euro officially survives, but as a freak of nature that may be devalued at any time with nothing more than an unpleasant rumor, and major exporting nations continue to pursue considerable monetary interventions which the Chinese simply cannot afford to match due to their already under-stated rate of domestic inflation. From their perspective, the only "legitimate" option is to let the EMU splinter.

Regardless of whether the Euro is retained by core member countries of the EU or, in a more extreme situation, the core countries withdraw and re-instate their own national currencies, Chinese export market share is bound to increase relative to some of their largest and, therefore, most troublesome competitors. There is no doubt that the Chinese are worried about the financial contagion effects from a peripheral default, such as the increasingly imminent default of Greece, but so is everyone else in the world and there is very little anyone can do about it.

At this point, it is merely a foregone conclusion and countries (and central banks) must try to prepare their best for it, by insulating their own financial systems to any extent possible. Chinese Premier Wen Jiabao implied as much in a few words to the World Economic Forum, which the markets seemed to have completely missed. The Telegraph's Ambrose Evans-Pritchard once again:

China wants to break the ultimate taboo and buy into Western companies such as Apple, Boeing and Intel

Chinese premier Wen Jiabao was soothingly polite in his speech to the World Economic Forum in Dalian, insisting that his country will play its part to "prevent the further spread of the sovereign debt crisis".

The language toughened a few notches when asked later how far China's Communist Party is really willing to go. The message was clipped and severe. Beijing will not sign a blank cheque for European states that have failed to carry out deep reform. "Countries must first put their own houses in order," he said.

But that’s the entire problem; they can’t put their own houses in order, and everyone, including Premier Jiabao, knows it. Besides, the Chinese are much more concerned with the health of the USD and Treasury markets than those of the EMU periphery, and capital flight from a splintered EMU will significantly boost those markets.

For all of China's talk about becoming a powerhouse consumer economy, domestic companies moving abroad, investing in foreign companies, or its currency contending for the role of global reserve, we must remember that it is still by and large an export economy according to the dictates of the global market system of trade.

The Chinese are under no illusion that anything has changed in the last few years for their economic model, and that means they must remain "competitive" until the bittersweet end. In this system, you don't stay competitive by bailing out the competition.

Ashvin Pandurangi, third year law student at George Mason University

Website: http://theautomaticearth.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2011 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.