Triple Top Forming in U.S. Stock Market, Robert Prechter Explains

Stock-Markets / Stocks Bear Market Sep 16, 2011 - 12:24 PM GMTBy: EWI

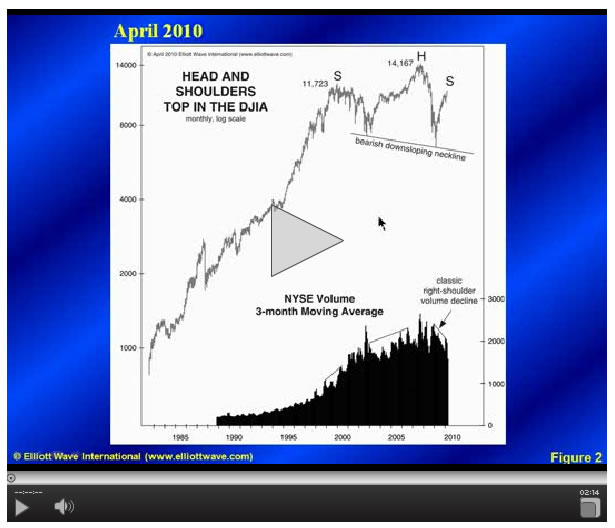

This excerpt from the special video issue of the August Elliott Wave Theorist brings you Bob Prechter’s analysis of the triple top that has been forming in the U.S. stock market over the past 12 years. Watch as Bob himself explains what this pattern means for you and the markets.

This excerpt from the special video issue of the August Elliott Wave Theorist brings you Bob Prechter’s analysis of the triple top that has been forming in the U.S. stock market over the past 12 years. Watch as Bob himself explains what this pattern means for you and the markets.

You can get even more analysis – including an 84-year study of stock values – that will help you gain perspective about the recent market moves with Elliott Wave International’s FREE report, “Reality Check: Studying the Past to Bring Clarity to the Future.”

You’ll get a glimpse into the in-depth analysis Robert Prechter presents each month in his Elliott Wave Theorist with 3 excerpts from his most recent issues.

Don’t let extreme market volatility leave you confused and scared. Prepare yourself for today’s critical market juncture with your FREE report from Robert Prechter.

Read Bob Prechter's FREE report "Reality Check: Studying the Past to Bring Clarity to the Future."

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.