China's Biggest Bubble Warning Ever

Economics / China Economy Sep 14, 2011 - 10:37 AM GMTBy: Justice_Litle

When the Japan bubble peaked in the late 1980s, there were major warning signs. The same is happening in China too...

When the Japan bubble peaked in the late 1980s, there were major warning signs. The same is happening in China too...

It's the biggest and clearest sign yet: China is a giant bubble waiting to burst.

With Europe in the spotlight, few are thinking about China these days. And when China does come up, it is typecast as the wealthy uncle with deep pockets -- the one player rich enough to help keep Europe afloat. (We saw that earlier this week, on hopes that China would buy Italian debt.)

China itself, though, is in the grip of a dangerous bubble, complete with "ghost cities," infrastructure overload, Ponzi finance schemes and the potential for trillions in bad bank loans.

China's finances are very opaque -- and deliberately hidden from the public. It is hard to see from the outside in. This can make it hard to determine just how far things have gone in the bubble department.

But there are clues, just as there were with Japan's monster bubble in the late 1980s.

If you'll remember: For a window of time, Japan was going to dominate America and take over the world. The Japanese way of doing business was considered superior, unstoppable even, in comparison to the weaker Western way.

At one point -- the peak of the frenzy -- the ground under Japan's imperial palace in Tokyo was deemed more valuable than all the real estate in California. Anecdotes like that one, amid other tales of mind-blowing excess, marked a multidecade top.

So what is the comparable China bubble sign?

Take a look at the building below

What is it?

One could be forgiven for thinking the Palace of Versailles... or British Parliament... or some grand old Austrian estate dating back to the Habsburg Empire.

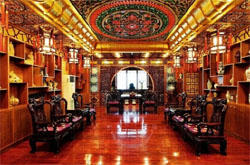

The source will be revealed in a moment. But first, below see two shots of the building's interior -- which is, if anything, more elaborate than the outside...

OK, enough of the suspense.

So what is this place? Some powerful new government ministry? A cultural center? A seven-star hotel to rival the Burj Al Arab in Dubai?

No. It's a Chinese pharmaceutical plant. As in, a factory that makes pills...

The images come from ChinaSmack, a website that translates and reports popular Chinese news and trends. Via Chinese television anchor Li Xiaoming -- as translated by ChinaSmack -- we get the following:

Initial reaction, Harbin Pharmaceuticals Six is a state-owned enterprise... It is said that state-owned enterprises are the people's enterprises, so the people should know how the enterprises' money is used. This "palace," would the people be delighted to see it?

It does look like a beautiful place to work:

The trouble with this sort of thing is, one rarely gets "a little bit of excess." Wasteful spending tends first to come in trickles, then in floods -- especially when funded by gushers of cheap capital.

And with a plain-Jane pharmaceuticals outfit -- a pill factory no less -- pushing such limits, one can only wonder what the other SOEs have done with their cash.

China's "command and control" approach to keeping up employment and maintaining the boom involved staggering sums of lending from the state-controlled banks.

When determined bureaucrats push loans out the door on a quota -- to the tune of trillions no less -- the development of "palaces" (or other boondoggles) is not such a stretch.

It would be a stretch, however, to think China can get through its self-created real estate and finance bubbles unscathed.

As with invincible Japan in the 1980s and crack-up Japan post-1990, there is the initial perception and the aftermath. We may shake our heads over many more tales like Harbin's after the smoke clears.

Publisher's Note: China's growth was a lie, a global scam to rip off the world. The whole thing is about to collapse around them -- and it's going to take your retirement with it. Unless you act immediately. Get the details on this China bubble.

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source :http://www.taipanpublishinggroup.com/tpg/taipan-daily/taipan-daily-091411.html

By Justice Litle

http://www.taipanpublishinggroup.com/

Justice Litle is the Editorial Director of Taipan Publishing Group, Editor of Justice Litle’s Macro Trader and Managing Editor to the free investing and trading e-letter Taipan Daily. Justice began his career by pursuing a Ph.D. in literature and philosophy at Oxford University in England, and continued his education at Pulacki University in Olomouc, Czech Republic, and Macquarie University in Sydney, Australia.

Aside from his career in the financial industry, Justice enjoys playing chess and poker; he enjoys scuba diving, snowboarding, hiking and traveling. The Cliffs of Moher in Ireland and Fox Glacier in New Zealand are two of his favorite places in the world, especially for hiking. What he loves most about traveling is the scenery and the friendly locals.

Copyright © 2011, Taipan Publishing Group

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.