S&P 500 Relative to Europe is Raising Red Flags for Bulls

Stock-Markets / Stock Markets 2011 Sep 14, 2011 - 01:26 AM GMTBy: Chris_Ciovacco

The S&P 500 has been regarded as a relative “safe haven” given:

The S&P 500 has been regarded as a relative “safe haven” given:

- The high probability of a default by Greece.

- Concerns debt markets will focus on Italy next.

- Weakening economic data in Europe.

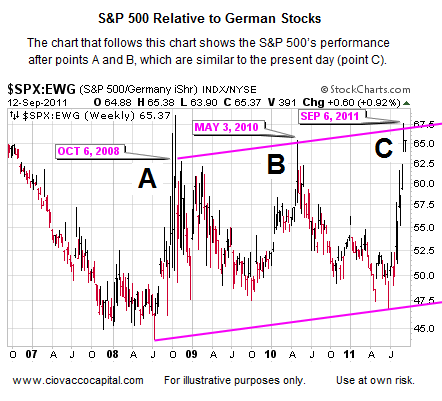

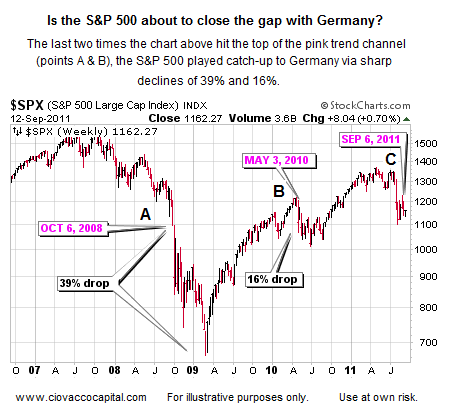

On the morning of September 13, German stocks rallied strongly, but the S&P 500 seemed a bit more hesitant. If under-performance of the S&P 500 relative to German stocks continues for a time, it may be an ominous sign for U.S. stocks and safe haven sectors, such as consumer staples (XLP). Recently, the S&P 500’s performance relative to German stocks reached the top of the pink trend channel shown below (see point C).

Compare points A and B in the charts above and below.

The charts of the U.S. and Germany align well with our concerns relative to a possible deflationary signal given by the U.S. Dollar Index last week. As mentioned in our recent look at the U.S. dollar, we continue to watch the relative performance of inflation-friendly assets:

- Silver (SLV)

- Agriculture (DBA)

- Copper (JJC)

- Australian Dollar (FXA)

and deflation-friendly assets:

- Short S&P 500 (SH)

- U.S. dollar (UUP)

- Long-Term Treasuries (TLT)

- Intermediate-Term Treasuries (IEF)

If the inflation assets hold up well vs. the deflation assets, it gives hope to the bulls. If inflation assets, such as the Australian dollar, become increasingly weak vs. deflation assets, such as the U.S. dollar, it is another bearish signal, in an increasingly long-list of negative developments, for the economic/market bulls.

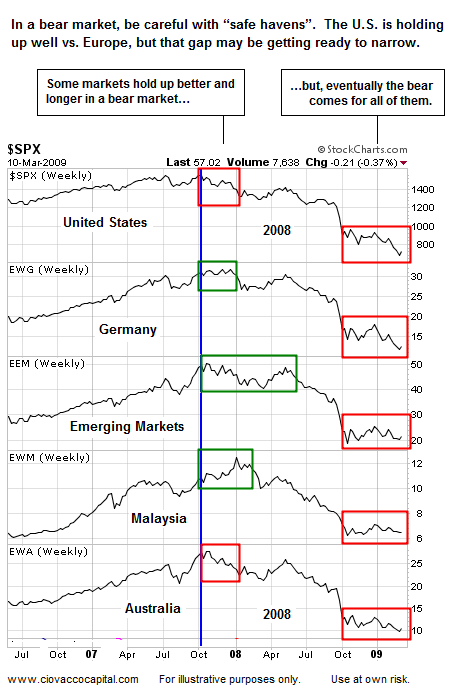

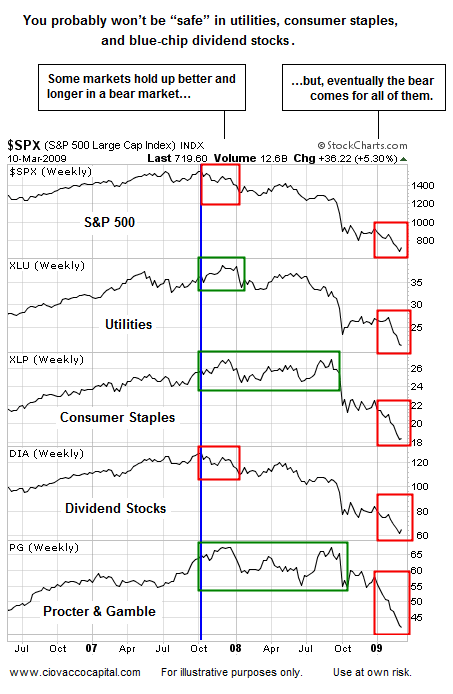

The market’s current risk-reward profile and present debt market conditions do not bode well for the S&P 500 maintaining safe haven status. As shown in the charts of the 2008 bear market below, safe haven markets tend to be a temporary phenomenon in the context of a bear market.

Investors who have been told “you will be fine” in defensive sectors or “tried and true” stocks may want to brush up on their bear market history.

The current state of the S&P 500 is fragile at best. Last week, the CCM Bull Market Sustainability Index (BMSI) dropped into a range that typically means the bears have overtaken the bulls in terms of probable outcomes – said another way, the odds are against the S&P 500 overtaking the spring 2011 highs relative to the S&P making new lows in the months ahead.

The excerpt below from Bloomberg should throw some cold water on the face of the “now is the time to buy” crowd:

We’re getting close to a full-blown banking crisis in Europe,” El-Erian, Pimco’s chief executive officer and co-chief investment officer, said in a radio interview on “Bloomberg Surveillance” with Tom Keene and Ken Prewitt. “We are in a synchronized global slowdown. There’s very little confidence in economic policy making both in Europe and the U.S.”

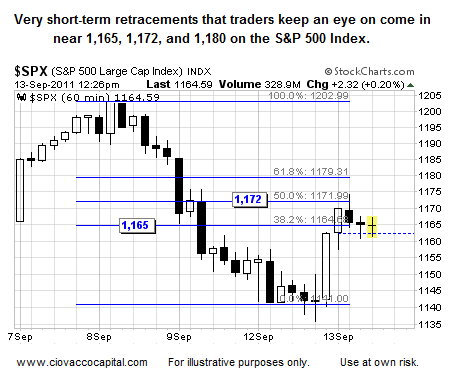

In terms of our deflationary stance, we may add to our shorts (SH) and/or small position in the dollar (UUP) if we see reversals near the levels shown above. We would feel more comfortable relative to the probable next leg down in stocks if the S&P 500 closes below 1,140 (1,146 is also a good step). On the upside (above 1,172), the several pockets of potential resistance sit between 1,174 and 1,195, with 1,180 being a very reasonable level to revisit.

A Bloomberg article may have captured the ongoing concerns in Europe, despite a relatively-decent bond auction in Italy and talk of the Chinese stepping in to solve all the world’s problems:

“This auction (Italian bonds) will do little to improve the deteriorating sentiment,” Michael Leister, a fixed-income strategist at WestLB AG in London, wrote in a note to investors. “Neither will this morning’s reports on possible Chinese support, as the market has heard these stories before with regards to Greece, Portugal and Ireland, with no follow up. The only institution with both the ability and flexibility to act is the ECB.”

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.