Gold New Record High in Euros on Greek Debt Default and Eurozone Contagion Risk

Commodities / Gold and Silver 2011 Sep 12, 2011 - 08:06 AM GMTBy: GoldCore

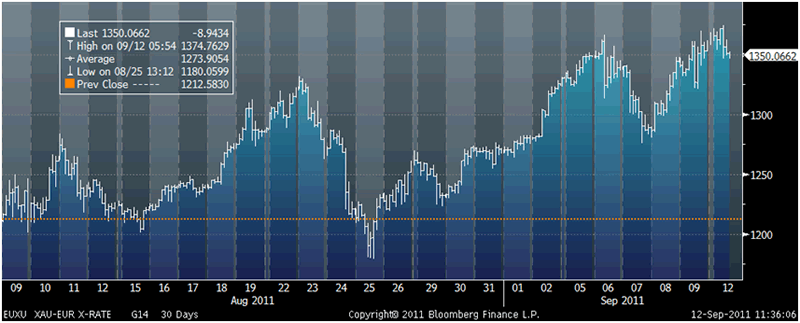

Gold is marginally lower in most currencies and is trading at USD 1,836.60, EUR 1,350.90, GBP 1,158.90, JPY 141,320, AUD 1,779 and CHF 1,626 per ounce. Gold reached a new record nominal highs in Australian dollars, Swiss francs and euros this morning.

Gold is marginally lower in most currencies and is trading at USD 1,836.60, EUR 1,350.90, GBP 1,158.90, JPY 141,320, AUD 1,779 and CHF 1,626 per ounce. Gold reached a new record nominal highs in Australian dollars, Swiss francs and euros this morning.

Gold’s London AM fix this morning was USD 1,843.00, EUR 1,354.94, and GBP 1,164.10 per ounce. Friday’s AM fix was USD 1,879.50, EUR 1,359.39, and GBP 1,177.12 per ounce.

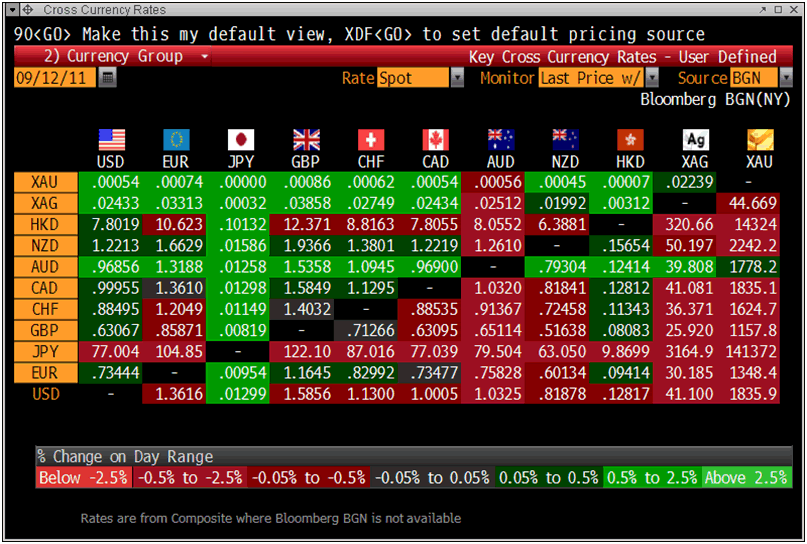

Cross Currency Table

There has been a sharp increase in risk aversion with the euro and stocks internationally falling sharply due to concerns about the coming Greek default and the real risk of contagion in the Eurozone.

The euro got off to a rocky start in Asia, falling to fresh six-month lows against the dollar and a 10 year low on the yen as downside momentum picked up after several key technical levels gave way recently.

Gold could see weakness today due to dollar strength and the possibility of margin calls for leveraged players on the COMEX.

However, bargain hunting bullion buyers are present at these price levels and gold is likely to be supported above $1,800/oz.

While dollar strength would normally result in gold weakness it is very possible that both the dollar and gold could rise together in the short term. This would result in gold making sharper gains in pounds, Swiss francs, euros and other fiat currencies.

France’s largest banks by market value, BNP Paribas SA, Societe Generale SA and Credit Agricole SA, may have their credit ratings cut by Moody’s Investors Service as soon as this week because of their Greek holdings.

Officials in Merkel’s government are debating how to shore up German banks in the event that Greece defaults. Merkel is due to hold talks on the debt crisis with European Commission President Jose Manuel Barroso today.

The risk of contagion in the Eurozone sovereign, banking and entire financial system is very real and will result in continuing safe haven demand.

Gold in Euros – 30 Day (Tick)

Gold is being supported by broad based global gold demand. Demand dropped in the second quarter of this year compared with the second quarter of 2010, but is expected to strengthen by the end of 2011, driven by robust store of wealth jewellery buying in India and China and recovery in global investment demand, the World Gold Council said over the weekend.

The real risk of a U.S. and wider global recession is prompting investors to buy gold as safe haven while Asian consumers continue to buy jewellery and increasingly gold bars as a store of value and inflation hedge.

SILVER

Gold’s unloved little brother silver continues to receive little or no media coverage which continues to be bullish from a contrarian perspective.

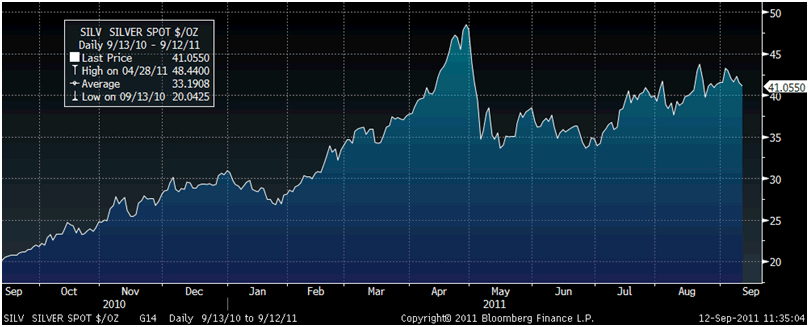

Silver Bullion in USD – 1 Year (Daily)

Silver has been quietly consolidating for the last two months between $37/oz and $44/oz. A close above $44.25/oz could see silver quickly challenge the recent and 1980 record high at the $50/oz level.

Longer term the real high (CPI inflation adjusted) of $130/oz remains a realistic price target.

Silver at just under $42 per ounce continues to be more attractive to many investors relative to gold at about $1,850.

At 44:1 the gold silver ratio continues to favour silver with many silver buyers conscious of the long term historical gold to silver ratio of 15 to1.

Silver is also more attractive to many jewellery manufacturers and jewellers whose margins on gold jewelry are being badly squeezed.

Jewellery makers at an international trade fair in London have said that silver is seeing greater use in jewellery as rising gold prices put off cash strapped consumers.

High prices have practically squeezed gold out of the low and medium-priced segments of western jewellery markets, with other metals replacing gold for small gifts worth 100-300 euros, industry officials said.

David Lamb, managing director for jewellery at the World Gold Council (WGC) said that "at the current prices of gold, that level of jewellery in gold has really disappeared."

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $40.85/oz, €29.99/oz and £25.76/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,806.00/oz, palladium at $721/oz and rhodium at $1,750/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.