In a Year of Massive Change, Gold's Status Remains Unchanged

Commodities / Gold and Silver 2011 Sep 12, 2011 - 03:14 AM GMTBy: Clif_Droke

The year 2011 has been a tumultuous one for market participants and non-participants alike. In just the last few months we've witnessed record extremes in the weather in the U.S., revolutions in the mid East region and exceptionally high levels of volatility in global financial markets.

The year 2011 has been a tumultuous one for market participants and non-participants alike. In just the last few months we've witnessed record extremes in the weather in the U.S., revolutions in the mid East region and exceptionally high levels of volatility in global financial markets.

Just how popular has gold been this year? There are a couple of indications just how extraordinary the public's desire for precious metals has been this year. To start with, the leading Exchange Traded Fund (ETF) that tracks gold bullion has surpassed its stock market counterpart. According to Businessweek, the SPDR Gold Trust (GLD) saw its market valuge rise to $76.7 billion on Aug. 19, when the gold price topped $1,881 an ounce for the first time. By contrast, the SPDR S&P 500 ETF Trust, which tracks the Standard & Poor's 500-stock index and was the industry's biggest ETF since 1993, stood at $74.4 billion.

Gold's reign as the safe haven du jour has been virtually unchallenged since the fourth quarter of 2008. Despite suffering a period of liquidation during the credit crash of August-September 2008, gold has since bounced back and has been on a roll ever since. Since the collapse of Lehman Brothers in September 2008, the gold ETF has more than doubled in price while the SPDR S&P 500 ETF is down by almost 5 percent.

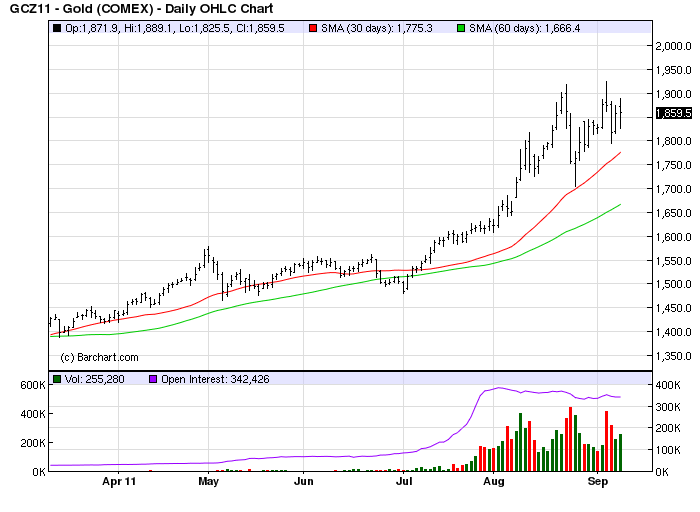

In recent months gold has solidified its role as the preferred safe haven for investors by virtue of its strong performance during the recent worries that European countries will struggle to repay their debts, as well as the recent downgrade of the USA's government debt. Gold is up 25 percent in 2011 and is on track for its 11th consecutive year of gains, a fact which hasn't escaped the public's notice and has only contributed to its popularity.

As long-time readers of this commentary are aware, the SPDR Gold Trust (GLD) is our favorite tracking vehicle for the gold price. It was created by the World Gold Council in 2004 and is the world's largest gold tracking ETF. The fund is backed by gold bars deposited in a London vault, though there is at least some degree of leverage in the fund which hasn't been quantified by the fund's managers.

The SPDR Gold Trust does a good job of tracking the gold price by and large, however, and is the preferred gold tracking ETF for many of the top investors and fund managers. As Businessweek reports, hedge fund billionaire John Paulson is the largest holder in the SPDR Gold Trust as of June 30, with 31.5 million shares, or 7.4 percent of outstanding stock.

So with the gold price hovering near an all-time high and with gold retailers unable to keep the metal on the shelves, shouldn't we be concerned that the yellow metal has entered bubble territory? While that concern may be valid for the near term outlook, the longer term reality is that gold should continue to feed off the fear and volatility associated with the deflationary leg of the 60-year cycle scheduled to bottom in late 2014.

Gold typically outperforms at the two extreme ends of the long-term cycle: during hyper inflation and during hyper deflation. Gold's strong performance during hyper inflation is easy to understand; its outstanding performance during hyper deflation is less understood by investors. This is because gold is a barometer of extreme fear as much as it is of currency devaluation. Investors typically shun paper assets during both extremes of the long-term cycle, but especially during periods of deflation. The long-term real estate bear market is the biggest symptom of the deflationary undercurrent that is currently plaguing the economy.

Real estate was the long-term investment vehicle of choice for millions before the real estate collapse and credit crisis. Now that the Great American Dream has been shattered, those same investors who formerly viewed real estate as the sure road to financial safety have turned their collective attention to gold. As investors flee debt and debt-related instruments, gold stands virtually undisputed as a relatively safe asset to own and preserve capital during the long-term real estate decline.

A testament to gold's safe haven status is the recent fears concerning the U.S. and the euro zone. Investors flocked to gold in the months of July and August when these fears were at their height. With the debt outlook still hanging in the balance, gold continues to hover around all-time highs.

The most pertinent observation for the intermediate-term outlook concerns the 6-year cycle, which is scheduled to peak in approximately three weeks. Although the 6-year cycle is primarily an equity market cycle it also has a residual impact on the gold price. With the long-term economic cycles, including the 60-year and 120-year Kress cycles - in their final "hard down" declining phase through late 2014, gold should benefit from the economic bear market expected to worsen between now and the 120-year cycle bottom in 2014.

According to Samuel J. Kress, the formulator of the Kress cycle series, the 6-year cycle peaked in terms of price in May, although the time peak is schedule for the end of September/beginning of October with a 0+ probability for the S&P 500 to exceed the 1,363 price peak at the forthcoming time peak. Nevertheless, when the 6-year time cycle peak is in just a few short weeks, there will be no long-term yearly cycles of any consequence in the ascending phase until late 2014. As Mr. Kress recently affirmed, "...the potentially tumultuous historic bear market is underway, and to last until late September 2014 when the 120-Year cycle, and all its component cycles, are scheduled to bottom." Mr. Kress refers to this as the "Revolutionary Low."

One of the components of the 120-year cycle that is scheduled to bottom in late September/early October 2014 is the 30-year cycle. Ever since the 30-year cycle peaked (the last of the long-term bull market cycles within the 120-year series), gold has been in a secular bull market. This bull market is expected to continue until at least the scheduled bottom in 2014 since gold feeds off the extreme fear, uncertainty and overall downward force on debt-based assets which is generated by the acceleration of the 120-year cycle decline. Accordingly, the next correction in the gold price can be used by long-term investors to position for the next up-leg in gold as we head closer to the fateful year 2014.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn't matter when so many pundits dispense conflicting advice in the financial media. This amounts to "analysis into paralysis" and results in the typical investor being unable to "pull the trigger" on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, "Gold & Gold Stock Trading Simplified," I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It's the same system that I use each day in the Gold & Silver Stock Report - the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won't find a more straight forward and easy-to-follow system that actually works than the one explained in "Gold & Gold Stock Trading Simplified."

The technical trading system revealed in "Gold & Gold Stock Trading Simplified" by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You'll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in "Gold & Gold Stock Trading Simplified" are the product of several year's worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today's fast moving and volatile market environment. You won't find a more timely and useful book than this for capturing profits in today's gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.