Stock Market Downward Pressure Increases in Sepember

Stock-Markets / Stock Markets 2011 Sep 12, 2011 - 03:10 AM GMTBy: Donald_W_Dony

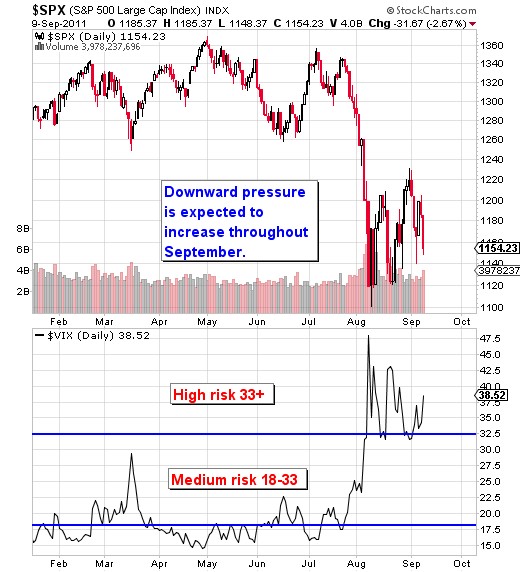

As the S&P 500 approaches the expected low in late September, downward pressure is increasing and volatility continues to expand.

The VIX, which moves in the opposite direction to the S&P 500, has risen from a medium risk level of 24 in early August into the high risk band of over 33. At the same time, the stock index dropped from 1290 to 1120 (Chart 1).

Models indicate that the S&P 500 should develop a low near 1050-1060 at the end of this month and the VIX is expected to remain in the high risk level.

Longer term, equities are now entering their seventh week of the bear market (Chart 2). With a significant low at the end of this month and another trough in early January, the bear market is expected to continue into at least Q1.

Bottom line: Downward pressure can be expected throughout September with high levels of volatility. There is a bounce anticipated in October, however, that rise should be limited.

Investment approach: It is unknown how long this bear market will continue or how deep. The expectation is that the S&P 500 will reach the target level of 1050-1060 in late September, that is another 8% lower than at Friday's (September 9th) close.

Investors may wish to remain on the sidelines until evidence suggests a final low has developed. A better assessment of the bear market bottom may come in early January.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2011 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.