Stock Market Almost Ready to Fall Off a Cliff

Stock-Markets / Stock Markets 2011 Sep 11, 2011 - 03:16 PM GMTBy: Andre_Gratian

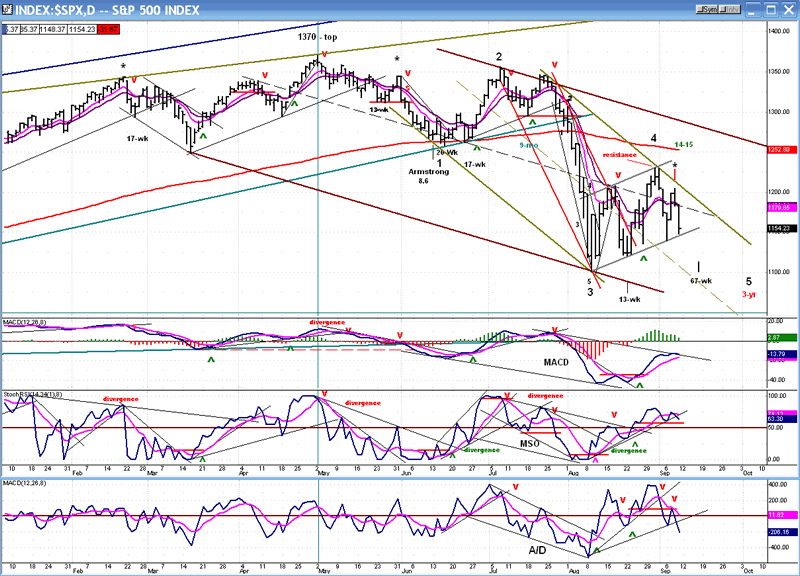

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into 2014.

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into 2014.

SPX: Intermediate trend - After last week, it is likely that the downtrend continues. It has a tentative projection to 1065.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

Last week, the SPX squandered an opportunity to extend its uptrend. Although it has not yet violated its series of higher lows since 1101 on 8/09, and has a good chance of starting next week with positive action, the odds are stacked in favor of the resumption of its long-term downtrend.

With the 3-yr cycle scheduled to make its low in early October, equity indices are facing an adverse cyclical configuration and, among other negatives, last week the dollar appears to have broken out of an intermediate downtrend. Also, TLT and the VIX are in solid long-term uptrends which may be ready to be extended.

The structure is playing out as a likely wave V for the downtrend which started at 1370. There was a question as to whether wave V had made a truncated low at 1121 but, with the recent market action, it makes more sense to place wave IV at the SPX 1230 high on 8/31, with wave V currently underway. There will be a good rally after the completion of wave V, but not before the index has made a new low -- perhaps in the vicinity of 1065 (preliminary target).

On Friday, SPX probably ended its decline from 1204 and is now ready to start a near-term bounce or, it could end on Monday instead. Either way, as we will see on the hourly chart, the short-term indicators appear ready to reverse. Should the bounce develop exceptional strength, the structural analysis would probably have to be revised.

Chart analysis

The Daily Chart displays a weak price pattern. A congestion level which angles up slightly, such as the one that the SPX has been making since 8/09, is typically a continuation pattern. Until now, the index has traded in a rising channel while the indicators were slowly losing upside momentum. In the last two days, the A/D indicator has confirmed a downtrend by breaking below a previous low at a time when the price is still in an uptrend. The result is the formation of negative divergence which signals developing weakness and does not bode well for the days ahead. It's typical for the breadth indicator to be the first to signal a reversal of the trend. It should next be followed by the MSO which is rolling over and within a hair's width of making a new low and going negative. The MACD will be the last to reverse.

The index met with resistance at the top of its green down-channel and, although it may challenge that downtrend line again next week, it would not only have to move strongly out of that channel to reverse its trend, but out of the wider brown channel as well. It has little chance of doing that in the near future. Considering the cycles which lie ahead, the path of least resistance will be on the downside and when it makes a new low, it will confirm its pattern of lower short-term highs and lows from 1370.

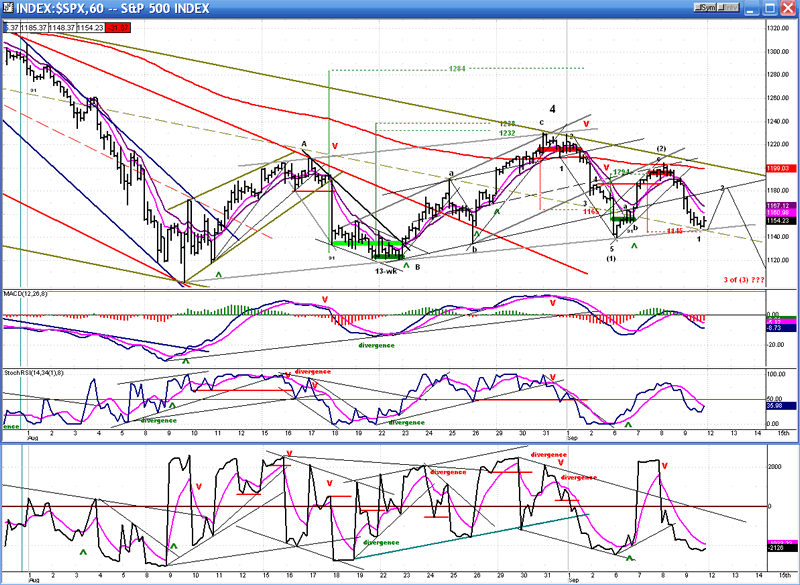

In contrast, the Hourly Chart looks poised to have an upside reversal. On Friday, the SPX came to rest on the trend line which connects the lows, starting with 1101, and may have found support on it although the P&F count called for a slightly lower target to 1145 before reversing. If the low was not made on Friday, it should be on Monday. The indicators have started to turn, and it would not take much for them to initiate an uptrend.

If we do have a near-term low in place, the P&F target is about 1185, which I have marked tentatively on the chart. That would correspond to touching a secondary trend line on the chart which could act as resistance. If this causes a reversal -- and if the EW count is correct - the next move could be a sharp decline, as third of thirds are prone to give us.

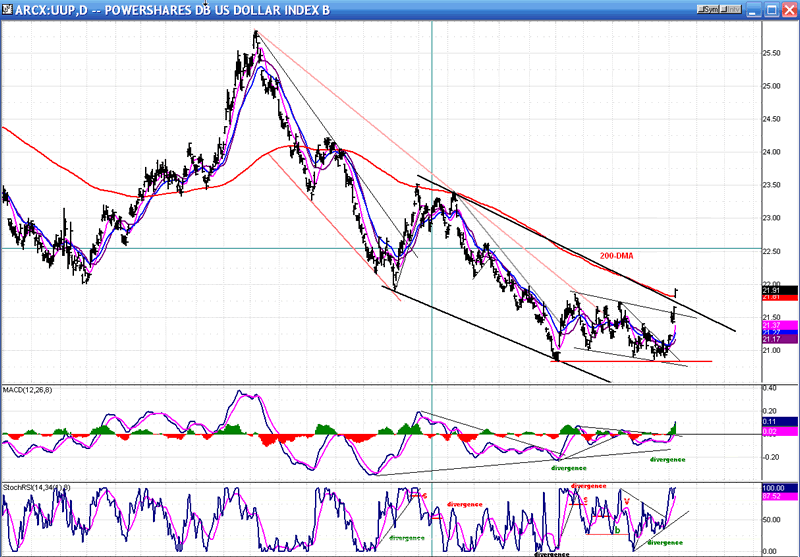

Now, let's look at other reasons why the equity indices are in trouble. We'll start with the chart of UUP, the dollar ETF, which appears to be breaking out of an intermediate downtrend. The dollar has a long-standing record of trending inversely to the equity indices. We have no reason to believe that this has changed lately. I have condensed the daily chart rather than showing the weekly one because I wanted to show you why this is a legitimate break-out.

Previously, the 200-DMA had stopped the price twice: once in August 2010 and again in January 2011. After each occurrence, the index had a steep drop to lower levels. After the second failure, UUP went into a four-month base consolidation before it tried again and this time, it did not hesitate and went right through the average as if it were not even there. "Third time is charm"!

And look at the preparation in the indicators which, of course, were directly influenced by the price action. The MACD built a long period of positive divergence and has now broken out into positive territory, reaching its highest level in about nine months. The MSO also showed some strong positive divergence before breaking out and, although it is now overbought, it could remain in that condition for some time if the upside momentum continues.

Perhaps the best guide to how far the move will go can be found in the P&F chart. If I take a normal count of its base, the UUP has a projection to about 25. Since it closed at 21.91 on Friday, that's a long way to go, topping just a little below the last high of well over a year ago. The dollar target is 89-90. This action is going to be trouble for the SPX and other equity indices for some time to come.

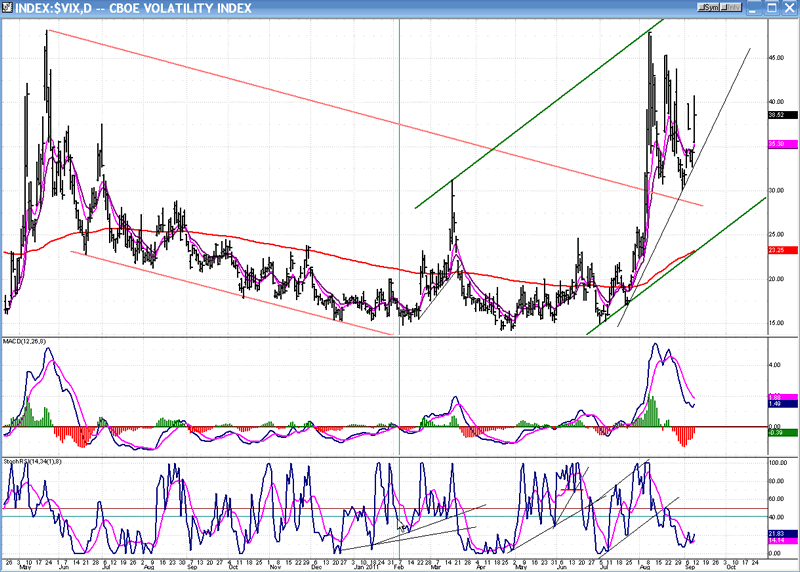

The next chart is that of the VIX, which should actually be displayed under "sentiment". This is the picture of an index which has already established an uptrend, and which does not look ready to relinquish it.

The correction which it has just experienced is the inverse pattern of the SPX. The indicators have corrected from an overbought position and are, once again, ready for a continuation move to the upside. There is nothing on that charts that indicates weakness setting in and, similarly to UUP, strength in this index is trouble for the market bulls.

The action of the two indices above is a strong warning that the downtrend that has begun in the equity indices, is not over.

Cycles

The 14-15-wk cycle looks as if it topped right on schedule and caused an immediate 56 point decline.

The 67-week cycle, if it bottoms on time, is due toward the end of next week.

The most important one of the cycles which lie ahead is the 3-yr due in early October. It is very likely to cause a new low in the SPX.

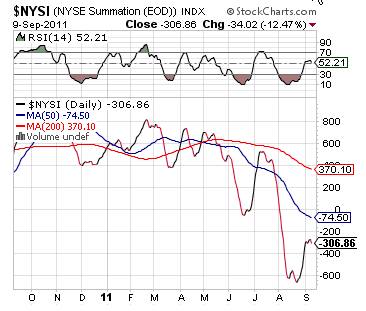

Breadth

The NYSE Summation Index (courtesy of StockCharts.com) confirms the picture which is displayed by the charts shown above. Although it rallied a little from its oversold condition, it is already beginning to roll over. This indicator is currently very weak and is forecasting weakness for the market directly ahead. We will probably need to see some positive divergence with price occur before it signals a market low.

Sentiment

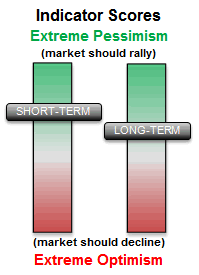

The SentimenTrader (courtesy of same) does not have too much effect on the market unless it is deeply in the green or red. The short-term indicator is on the bullish side.

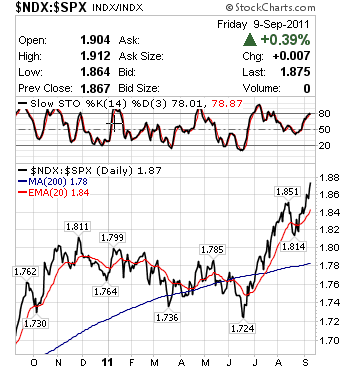

NDX:SPX The action of the following index is becoming very interesting and, under normal circumstances, should not be occurring in a weak market. I will have to resign myself that it is different this time and that we are indeed operating in "new normal" times.

Summary

There is nothing positive that one can say about the SPX, except that it appears ready to have one more near-term bounce that could start on Monday. Until the end of last week, it had an opportunity to demonstrate that it was capable of extending the rally that started at 1101. That faded promptly after the jobs report was announced last Friday.

If the analysis which I presented above is correct, the market should be almost ready to fall off a cliff and make a new low.

Looking into the future (after early October) the completion of this leg of the downtrend could be followed by a substantial counter-trend rally. Perhaps this is what the strong relative strength of the NDX to the SPX is telling us. Keep in mind, however, that it will most likely only be a bear market rally.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time frames is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth.

For a FREE 4-week trial. Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my investment and trading strategies and my unique method of intra-day communication with Market Turning Points subscribers.

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.