Will Stock Markets Crash This Week? Are Years of Reckoning Dead Ahead?

Stock-Markets / Stock Markets 2011 Sep 11, 2011 - 03:02 PM GMTBy: Joseph_Russo

Sure the market could crash this week and deservedly so, but it doesn't really matter because it's just a ride.

Sure the market could crash this week and deservedly so, but it doesn't really matter because it's just a ride.

Frankly, I could not care less whether the S&P crashes back down below 666 or if it catapults its way to new heights north of 2000. At the end of the day, it's just a ride.

You see, the Market is like a ride in an amusement park. When you choose to believe in it, or take it too seriously, you think it's real, because that's how powerful our minds are.

The ride goes up and down and round and round, and it has thrills and chills and is very brightly colored, and it's very loud, and is fun, for a while.

Many people who have been on the ride for a while inevitably begin to question, "Is this real, or is this just a ride?"

Other people know the answer to that question, and they respond "Hey, don't worry, don't be afraid, ever, because this is just a ride," and the status quo mainstream HATES THESE PEOPLE.

"Shut them up! We have a great deal invested in this ride! SHUT THEM UP! Look at my furrows of worry. Look at my big bank account, and my family. This has to be real."

No, it's just a ride.

But they always seem to hate the good guys who try and tell us that, and they let the demons of corruption and deceit run amok. You ever noticed that? Well, it doesn't matter, because ... I'm telling you, it's just a ride.

You can change your experience anytime you want. It's simply a matter of choice. Yes, it takes effort, work, commitment, and money. It's a simple choice between the greed/fear factor and having an effective plan of engagement.

The goal of greed and fear is to get you to put bigger locks on your doors, buy guns, close yourself off, and buy lock-stock-and-barrel into the latest headline manias.

The goal of adopting an effective plan of engagement instead provides plentiful opportunities, and views the Markets as one big fun-filled ride of thrills and chills. After all, it's a long ride with lots of ups and downs so we might as well enjoy and make the most of it.

Here's what you can do to change your approach and experience of engaging the Markets right now toward a better, more certain, and enjoyable ride:

Take all the money you spend on stuff you don't need each month and instead invest it in educating yourself on what it takes to put together an effective plan, or following someone you trust that already has one.

Either investment will pay for itself many times over and enable you to ride the Markets, forever ... with stable profits and peace of mind.

In case you haven't already figured it out, the above introduction was made possible by the comedian Bill Hicks, and was conceived from one of his stand-up routines prior to his untimely passing. In my view, though I do not agree with many of his views, Bill Hicks was sold short, and should have been an American icon.

INTERMISSION

The following is an unplanned commercial interruption of sorts. I'm sitting here chain smoking and nursing multiple tumblers of my favorite Emeril's (BAM) Big Easy Bold/Intense coffee, while continuously working like a dog at 2 AM following an entire Saturday filled with the same. You see, my wife is in London, one of my kids is away at college, and the other lives out of state. So it's just me and my two loyal dogs (that makes three of us) unencumbered, and left to our own devices. We're here banging away at the key board, the TV is on in background as a surrogate companion of sorts, and the three of us are chewing the rawhide, listening to round-the-clock recounts and previews of the forthcoming memorial services surrounding today's ten year anniversary of the 9/11 attacks. Without further ado, I trust you will find this spontaneous digression quite relevant to this features content, overall message, and intent.

If you have yet to see it, this latest piece of headline mania is being advertised rather heavily on cable television of late.

It's a brilliant piece of cohesive marketing, copywriting, and salesmanship, which effectively compels TV viewers to log onto a website to view a free online video that promises to protect you from the looming "End of America." You can view the essence of the fear laden commercial here on YouTube.

I must admit, it is worth watching the first 10-15 minutes of this otherwise extremely long-winded sales pitch. Beyond enjoying the artistic production value of this genius presentation, upon further research, I have concluded that all this amounts to is just another real super-slick infomercial, which leads you on a perpetual journey of sales pitches working their magic at selling you an endless inventory of vital inside information that will save your financial life. Hicks would have crucified this piece of genius, and rightly so.

After an hour or so of research, the last two threads I found below were the straws that broke the camels back in arriving at my conclusions. Here they are:

-

In my opinion, it is a good thing to use your mind instead of your emotions when approaching any type of investment. The use of scare tactics is very troubling to me. There are a few "buttons" that are utilized when attempting to motivate people to do things that may be against their better judgment...Politicians are famous for them. Fear and greed are among the most effective. The video is very effective because anyone with just a little bit of common sense realizes we are in huge trouble with our economy and it continues to get worst on a daily basis. Most thinking people feel that they should do something. Mr. Stansberry is astute enough to realize this. My last point is the actual product. Who would not want to be involved in a cure for cancer or Aids? This is another so-called button. Unfortunately, most consumers WANT to be lied to...they are not cognizant of this but it is part of human nature. Hence the statement "love is blind", which reminds me of the line in the movie A Few Good Men..."you can't handle the truth". Most people reject the truth. It destabilizes their reality. I have worked, as a financial agent, one on one with literally one million people. This is very unfortunate but denial is very prevalent...especially when it comes to romance and finances.

-

This is just an opinion, not a statement of fact, but I agree with all the above. I think Stansberry is right on the impending collapse of the dollar, but when you subscribe to his newsletter, you get a lot more invitations to subscribe to additional investment advice for more money than actual easy to find advice. I actually fell for an additional Penny Stock newsletter, so I'm out about $90. I think Stansberry has some good stuff embedded deep within his publications, but I'm an electrical contractor and make $110/hr and better, so every minute I spend listening to long winded videos I can't pause, sifting through more up sell pitches costs me about two bucks. There must be something better out there. Oh, by the way, I have found out how to make millions on the internet. Just come up with a plan to make millions on the internet, and then give it away free, only charging $9.95 S&H. Yeah, I've fallen for that too. I'm not the brightest light in the harbor, but I'm getting brighter.

Yes, I can just imagine what you're thinking right about now. Probably something like - So Einstein, just exactly what do call what you're trying to do here, it doesn't seem to be that much different than that slick infomercial to me.

Take it or leave it, it's just a ride and that's the truth. Can you handle it?

Frankly, there is some level of truth to that however, here's the critical difference. Firstly, I'm not part of a well financed corporation with unlimited marketing budgets capable of dazzling the masses into surrendering to my surgically sewn gallons of never-ending snake oil elixir. Secondly, what I am selling is a truth and fact-based common sense proven-approach in deploying trading and investment capital in the financial markets - period. Thirdly, I often work 16-hours a day, six and sometimes seven days a week to stay on top of and share my school of hard knocks experience and success with those who wish to profit from it. Finally, I'm just trying to do my best to provide whoever seeks it, a means by which to weed through the arcane business of trading and investing, and simplify this otherwise complex endeavor with clear, truthful, and transparent guidance. With that settled, let's get back to finishing up where we left off prior to this off-the-cuff quasi commercial interruption, shall we.

RESUMPTION

Learn to Profit in Both Up-trending and Down-trending Markets

Cursed with my own set of visions, it became clear to me a long time ago that in order to enjoy this particular ride, I needed to develop an effective plan to make money in both up and down markets. Once I had developed, built, and tested these strategies, I could finally agree with Bill Hicks and say with confidence, "don't worry, be happy,"- it's just a ride.

How's this Roller Coaster Been Built?

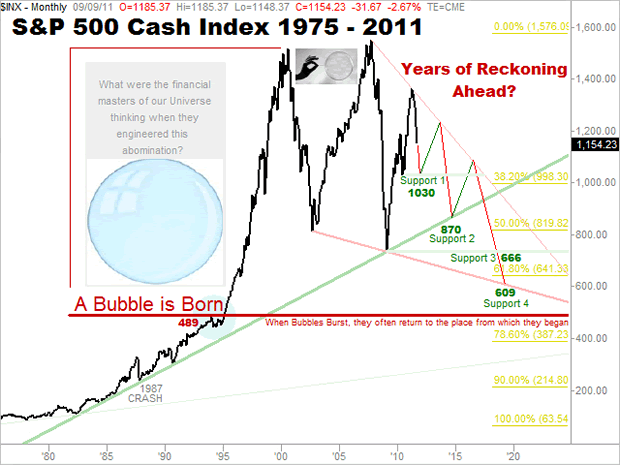

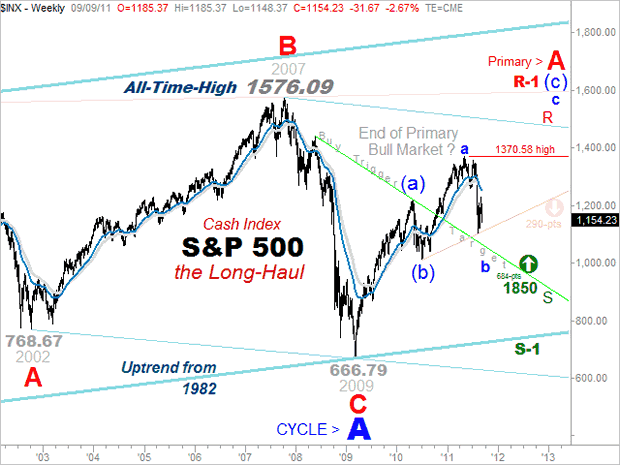

Just take a gander at this chart of the S&P from 1975, and tell me exactly what the f%#k happened from 1995-2000. Five years of moronic insanity, that's what happened!

As if the near-vertical rally from 1982 through 1995 wasn't potent enough, and despite the warning shot across the bow with the crash of '87, somehow the financial masters of our universe thought it prudent to incite a bubble so utterly freaking ridiculous that you simply can't help but laugh at the absurdity of such an anomalous abomination.

What's even more ludicrous is that this five-year golden period of insanity is the "back to normal" every other moron believes we ought to strive returning toward. Please, get over it people. Although that was a rather exhilarating episode of mass disillusionment, we simply cannot pine over it as some romantic measuring rod toward which we should obsess to get "back on track" with. It just ain't gonna happen.

Invisible Roller Coasters

What's most facinating about financial markets is that not only do they resemble roller coaster rides, but if you can conceptually imagine it for a moment, they are far more like "invisible roller coasters" whose structure of twists and turns take on a visibly tangible shape only after we have traversed them.

How's that for the thrill of the unknown. You strap yourself into the seat of one of the biggest most powerful rides within our realm of reality, and you have no idea where it will take you nor how, and no clue as to whether or not you will get to your final destination in one piece.

Having said that and believing it, and despite any of my personal views or instincts, I simply do not know with any level of reliable certainty which way, how far, how fast, or how stable the balance of our ensuing ride will be. It is an invisable and dynamic work in progress that we all must somehow be adequately prepared for.

Sounds impossible to navigate doesn't it? Well, it's not. It's really quite simple and it goes something like this.

Since we do not know the forward path and structure that markets will take, we must look to the paths and structures they have already formed. Narrowing down what makes price tick as it were, enables us to acquire the most reliable clues as to the paths and direction that will most likely unfold before our eyes over the near and long-term future. Anything beyond the mathematical calculations that quantify a historical edge, which can be measured within this realm, is nothing but sheer folly - fundamentals included Cra-merica. Touché Jimmy, so too is there always a bear market somewhere.

Speaking of Cra-mer', it is not my intention to single him out or anything, but a respected and controversial rough-around-the-edges acquaintance of mine just completed a short exposé on the maniac of Mad Money. Much of it is outrageously funny, some of it is rather illuminating, but mostly it's just downright spot-on and entertaining. If you can stand a bit of bad language and grammar, you can watch it here on YouTube.

Back to the main topic, think of a sound plan of engagement as a mathematically quantified excersise in continually observing boundaries and markers that sound off various alarm-levels or all-clear signals from which to position yourself in the best light of participatory bias so as to enjoy the thrill-ride, and not get killed in the process.

Even with the best laid plans, seat belts and crash helmets are mandatory requirements for boarding this thrilling and at times dangerously unforgiving coaster ride. By that I'm alluding to having reverence for one's acquired capital, and gaining a solid command of money management to the extent that will empower you to mitigate risk and as Cramer likes to say, keep you "in the game".

Unfortunatley, the old "don't risk anything you can't afford to lose" adage no longer applies. You see, the masters of our financial universe are intentionally forcing us to take risks we perhaps might not otherwise take if there were any reasonable alternatives.

They're telling us you gotta be on the ride or you'll be left behind, and yes, we're listening because it's proven to have been the truth. What they're not telling us is how to effectively prepare for the journey, and just what to expect along the way. Why, because the majority of those ruling the universe haven't a clue.

We suspect its easier and more profitable for them to just serve us up as billion-dollar marketing lists of ignoramuses, and steer us into to the corrupt hands of financial institutions so that their partners in crime can generate fees-galore with no promise or guarantee of fiduciary duty, balanced guidance, or accountability for performance.

Timing Is Everything

When investing or trading in any financial instrument, one adage that shall forever endure is that timing is indeed everything. Interestingly, no matter how profitable or effective, the exact same truth applies to adopting a strategy, discipline, or planned methodology of engaging the markets.

Similar to the probable serendipity associated with the moment in time at which you invested in your first stock or mutual, so too is your fate tied to the moment in time at which you commit to embrace a proven strategy of engagement.

For instance, if you were real lucky, you would have decided to give my NAVIGATORS short-term E-mini trading strategy a try last week. Had you decided to do so four months ago, you'd be like Cramer, who is still trying to clown and snowball his way back to breakeven.

Or maybe you might have instead decided to commit to trading Dollar Futures a couple of weeks ago. If you did, my NAVIGATOR would appear to be a panacea of profits - or a traders' paradise if you will. Had you decided to embark upon that journey at the start of August however, you'd have no doubt spilled some blood by month's end.

CONCLUSION

Integrity, Knowledge, Tenacity, and Patience Are Everything

There are no Holy Grails folks. Despite the fact that a given strategy may have produced incredible absolute returns over numerous market cycles, even the most profitable top-tier investment/trading methodologies undergo periods of drawdown. So in that sense, Cramer has it right when he says you gotta lose money to make money.

Just like a stock or mutual fund, the timing of one's psychological investment toward committing to a strategic market discipline also carries risk. With that said, I thought it prudent in closing to come up with a new adage, which I've placed at the head of this paragraph.

So, roll up your sleeves, do-the-math, do the homework, draw your own conclusions, mentally prepare to risk spilling plenty of blood throughout the course of an ongoing battle ride, and then get to work or you might just miss the ride of a lifetime.

Until next time,

Elliott Wave Technology provides a suite of Winning Solutions designed to assist those who wish to trade better and invest smarter based upon the practice and deployment of proven trading strategies in concert with expert and unbiased chart analysis.

Until next time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.