Bank of England Worried as Interbank Interest Rates Fail to Fall

Interest-Rates / UK Interest Rates Dec 10, 2007 - 12:38 AM GMTBy: Nadeem_Walayat

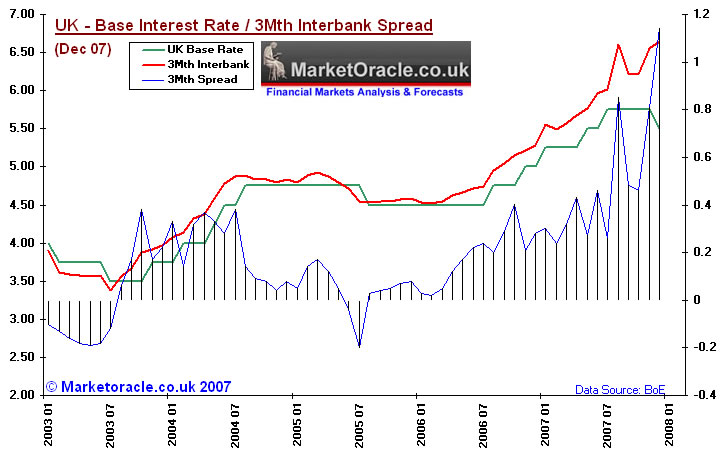

The Bank of England responded last week with a panic interest rate cut to 5.5% on the latest signs of the UK housing market entering a bear market with the release of Halifax November House price data showing a sharp fall in house prices of 1.1%, and the liquidity squeeze that had raised the interbank rate substantially above the base rate.

The Bank of England responded last week with a panic interest rate cut to 5.5% on the latest signs of the UK housing market entering a bear market with the release of Halifax November House price data showing a sharp fall in house prices of 1.1%, and the liquidity squeeze that had raised the interbank rate substantially above the base rate.

The Interbank spread analysis revealed that the current situation has not occurred in 17 years, i.e. where a cut in base rates at a interest rate juncture has actually resulted in a widening in the interbank / base rate spread to a new extreme high. Usually interbank spreads are at the widest at the mid-point of a rate raising cycle. Whereas during the start of a rate cutting cycle interbank rates tend to trade at a discount to the base rate.

Interest rate cuts having been anticipated by the Market Oracle as of 18th September 07 towards a target of 5% by September 08, with the first rate cut expected to occur in January 2008, as forecast -

a. The UK housing market would enter a 2 year slump (22nd August 07)

b. That inflation would decline sharply during 2008 (26th Nov 07)

However, the fact that the interbank rate has FAILED to react to the base rate cut implies that the credit crunch liquidity squeeze is deepening, which implies that the impact of the interest rate cuts is far less than had the money markets reacted in line with previous actions. This greatly increases the probability that the Bank of England will make far deeper cuts in interest rates during 2008 as the real rate of interest being borne by the economy is somewhere in between the base rate and the interbank rate i.e. as of last weeks cut we can estimate that the impact rate of interest rate is at 6.07%. Which is still above the estimated impact rate of interest rate in July 07 following the rate rise to 5.75%, estimated at 5.88%.

If in a worse case scenario, the freeze in the interbank money markets remains during 2008, then even a deep cut in UK base rates to 4.50% would still barely result in a real impact interest rate to the economy of much different than 5.50%.

Unfortunately both the UK and US housing bear markets will persist during 2008 and it is highly unlikely the credit markets will be able to unfreeze whilst illiquid debt is still trying to be valued against falling asset prices. This increases the risks of further Northern Rocks out there teetering on the brink of credit crunch oblivion the consequences of which will only further tighten lending between financial institutions and to the general public as well as impact on the coporate sector that will result with an increase in profit warnings during the 1st quarter of 2008.

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.