Global Currency Wars Sees Swiss Franc Devalue 8.5% Against Gold This Week

Commodities / Gold and Silver 2011 Sep 09, 2011 - 07:22 AM GMTBy: GoldCore

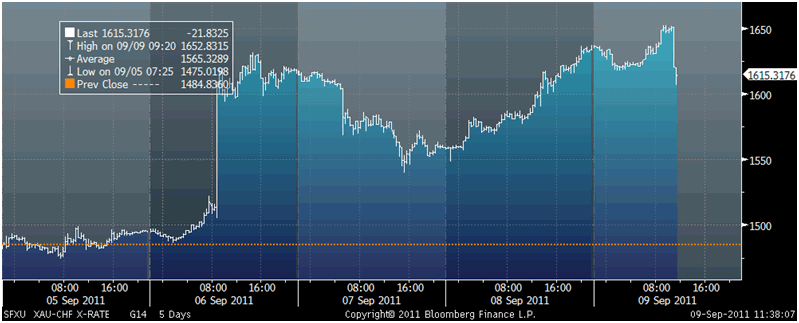

Gold is trading at USD 1,836.60, EUR 1,330.90 , GBP 1,153.90, JPY 142,750 per ounce and reached a new record nominal high in Swiss francs at CHF 1,652.83. Gold was higher in all currencies prior to sharp selling was seen in the hour after the London AM fix.

Gold is trading at USD 1,836.60, EUR 1,330.90 , GBP 1,153.90, JPY 142,750 per ounce and reached a new record nominal high in Swiss francs at CHF 1,652.83. Gold was higher in all currencies prior to sharp selling was seen in the hour after the London AM fix.

Gold’s London AM fix this morning was USD 1,879.50, EUR 1,359.39, GBP 1,177.12 per ounce. Yesterday’s AM fix was USD 1,827.00, EUR 1,298.88, GBP 1,146.68 per ounce.

Gold in Swiss Francs – 5 Day (Tick)

The speeches from Trichet, Bernanke and Obama were as expected and did not materially impact markets – but did belatedly confirm the extremely challenging macro environment.

Trichet’s angry outburst may lead to concerns about the long term health of euro. The outburst came after a question from a German reporter who asked what Trichet’s message was for German people who say their country should revert to the Deutsche mark.

Risk aversion has seen equity markets in the U.S., Asia and Europe fall again and peripheral European bond yields are edging up again, as are European CDS.

Some headlines have suggested that gold is lower due to Obama’s jobs speech. This is highly unlikely as most traders were not convinced by it and gold’s sell off again has the hallmarks of official intervention. There is also chatter regarding margin calls.

It was a momentous week for markets and the ramifications of the German constitutional court decision and the Swiss National Bank currency intervention have yet to be realized.

The German constitutional court decision has effectively ruled out Eurobonds which has massive ramifications for the European monetary union and the euro. While promoters of Eurobonds suggest that Eurobonds may still be possible – most objective analysts believe they are now highly unlikely.

The SNB decision to peg the Swiss franc to the beleaguered euro, thereby effectively devaluing the franc, stunned currency and wider financial markets.

It is one of the most significant currency interventions in modern history and led to violent volatility the like of which have never been seen in foreign exchange markets.

Incredibly and not widely reported the Swiss franc fell more than 7% against the euro, dollar and gold in just 15 minutes (putting gold’s relatively minor recent price fall into context).

Such volatility in currency markets was not seen during 9/11, the Lehman’s collapse or for any other major macroeconomic or geopolitical event in modern history.

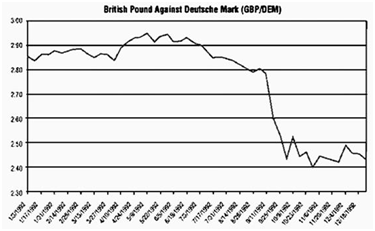

The collapse of the Swiss franc in minutes greatly surpassed the collapse of sterling seen on “Black Wednesday” in 1992, when the British pound fell by 2.7% against the German mark on one day.

British Pound Against Deutsche Mark (GBP/DEM) in 1992 including Black Wednesday

The SNB have now threatened to buy "unlimited quantities" of foreign currencies to force down its value – thereby debasing the currency.

This has resulted in the Swiss franc falling by nearly 10% against gold for the week – from CHF 1,484 per ounce to CHF 1,620 per ounce.

The ‘hard’ currency that is the Swiss franc became not so hard – as we have been long warning it would – thereby leaving gold as the true ‘hard currency’.

The Swiss intervention reignites the global currency wars and competitive currency devaluations of fiat currencies look set to intensify in the coming months.

There are already market jitters that Japan may again seek to weaken the yen. Japan's finance minister is set to tell the Group of Seven meeting that Japan will intervene in the currency markets if there are what he termed any “excessively speculative” movements pushing the yen higher.

Continuing ultra loose monetary policies with near zero percent interest rates globally, quantitative easing and money printing and now massive currency creation and interventions is currency debasement on a scale never before seen in history.

In time, it will likely come to be seen as monetary and economic madness of the highest order.

Some economists have justified the currency debasement and global currency wars by comparing it with and the debasement of the gold and silver coin of the realm by kings and Emperors of yore (through coin clipping).

However, the scale of debasement being done today (through money printing and electronic creation) would make Roman Emperors and even Henry VIII the ‘Great Debaser’ look virtuous in comparison.

Competitive currency devaluations and currency debasement throughout history have led to inflation and the impoverishment of the mass of the people.

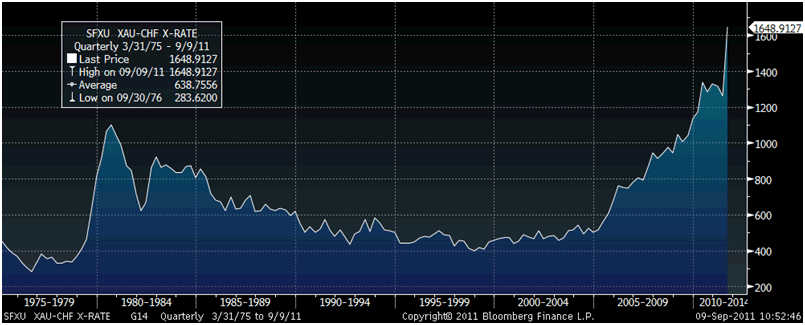

Gold in Swiss Francs in Nominal Terms – 40 Years (Quarterly)

The Swiss franc’s 10% plummet against gold this week clearly shows how cash is far from ‘king’ and no fiat currency in the world, in any bank in the world can be considered a “safe haven”.

Gold is again becoming the sovereign of sovereigns and reasserting itself as the safe haven money and asset par excellence.

If the Swiss franc, long considered the safest fiat currency in the world, can devalue 10% in a week, then it can happen and likely will happen to other currencies as well.

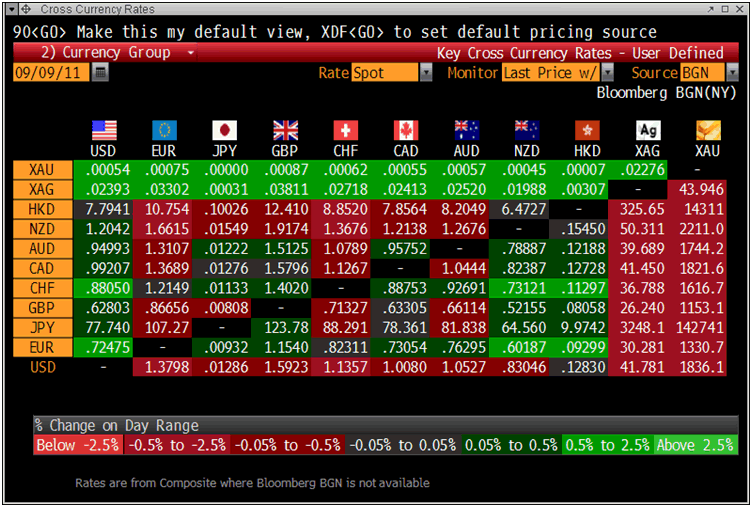

Cross Currency Table

Global diversification and allocations to gold and silver remain the prudent course of action.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $41.45/oz, €30.02/oz and £25.99/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,829.00/oz, palladium at $745/oz and rhodium at $1,775/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.