Gold Consolidates Gains while Gold Equities Outperform

Commodities / Gold & Silver Stocks Sep 09, 2011 - 02:25 AM GMTBy: Jordan_Roy_Byrne

In only two months Gold surged from $1500 to $1900/oz. Over the past few weeks Gold has remained range bound from $1750-$1900. The longer Gold holds this range then the more optimistic we can be. That $400 move was not a parabolic blowoff top but the initiation of an acceleration. This consolidation is likely to develop into a bullish flag. While Gold consolidates, the gold equities have taken the leadership role. The large caps have broken out from a 10-month consolidation to a new all time high. The junior golds are not far behind.

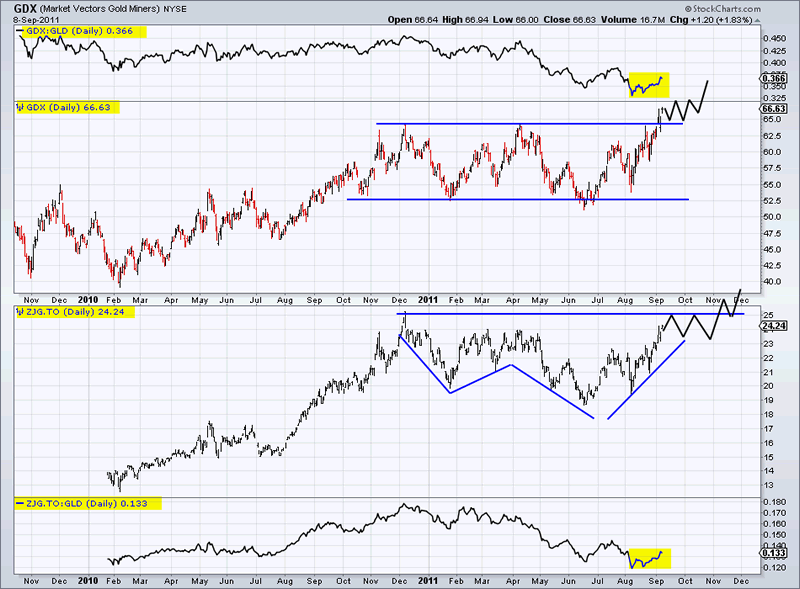

In the chart below we show GDX (large-caps), ZJG (junior golds) and both against Gold. As we can see, GDX has made an obvious breakout while ZJG is not far behind. Consolidation in ZJG will produce the handle on a bullish cup and handle pattern. The breakout target is $31. Relative to Gold, both markets bottomed in August and are trending higher.

z

z

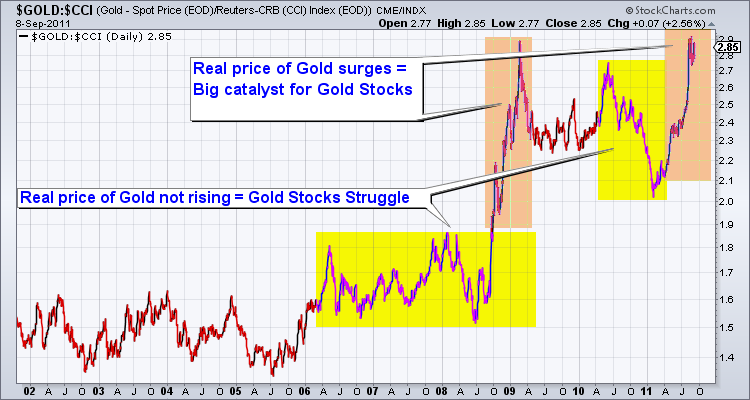

Why are the equities performing well now? For one, the S&P 500 has held up after finding good support at 1100. However, strength in the real price of Gold is more important. Charting Gold against Commodities provides a look at the real price of Gold which is a leading indicator for performance in the Gold equities. As you can see, Gold relative to Commodities has reached its 2009 spike high. Gold is outperforming because not only is it rising but other Commodities such as Oil and Copper are not rising.

The gold stocks are not only rising because they are in a technical sweet spot but they are rising due to strengthening fundamentals. Gold and Silver have been rising yet input costs such as Oil remain stable. This explains why the large miners have begun to outperform. It is a positive for the entire sector as it catches the attention of the big money and gives the miners a stronger currency for potential acquisitions. That is of course where the juniors come into play.

Meanwhile, there is little competition for the gold equities. The S&P 500 is basically in a range and fodder for day traders. Commodity equities and emerging market equities, while in structural bull markets, figure to underperform for months until the next round of artificial stimulus hits the economy. It is why you need to seriously consider a heavy position in gold and silver equities. In our premiums service, we work to uncover the best and strongest performing equities as well as those juniors with multi-bagger potentialIf you’d be interested in professional guidance then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.