U.S. Mint Gold Eagle Coin Sales Research (1987-2011) Casts Doubt on “Gold Bubble” Assertion

Commodities / Gold and Silver 2011 Sep 08, 2011 - 08:44 AM GMTBy: GoldCore

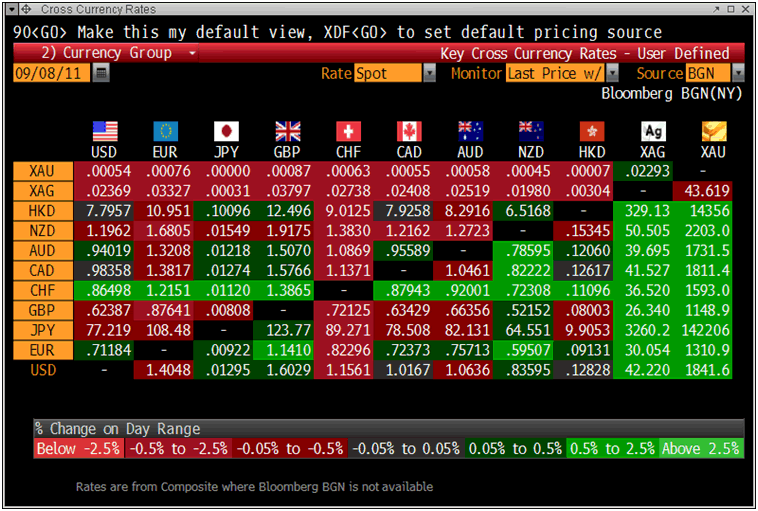

Gold is trading at USD 1,841.60, EUR 1,310.90, GBP 1,148.90, CHF 1,593.10 and JPY 142,290 per ounce and is thus trading at levels seen at this time yesterday.

Gold is trading at USD 1,841.60, EUR 1,310.90, GBP 1,148.90, CHF 1,593.10 and JPY 142,290 per ounce and is thus trading at levels seen at this time yesterday.

Gold’s London AM fix this morning was USD 1,827.00, EUR 1,298.88, and GBP 1,146.68 per ounce. Gold fixed lower in all currencies from yesterday’s AM fix - USD 1,844.00, EUR 1,311.99, GBP 1,153.44 per ounce.

Cross Currency Table

New research from Dr Constantin Gurdgiev, Head of Research with St Columbanus AG, member of the investment committee of GoldCore and the adjunct lecturer in finance in Trinity College, Dublin, questions the widely held belief that retail investors are “piling into” gold in a speculative frenzy.

This assertion has been heard for many months now. It is one of a few simplistic assertions that are used by those who have been claiming that gold is a bubble – including by respected economists such as Paul Krugman.

In July, Krugman suggested somewhat simplistically that gold prices have risen to record nominal highs due to retail gold dealers in the US engaging in a “marketing scam” trying to aggressively sell gold coins by preying on people’s fears about inflation.

The very real and significant global gold demand, especially from Chinese and Asian store of wealth buyers and from central banks internationally who are set to be net buyers again in 2011, was completely ignored by Krugman.

Many have echoed Krugman’s assertion that retail demand for gold coins due to aggressive marketing campaigns by unscrupulous bullion dealers was leading to higher gold prices and creating a gold bubble.

The ‘gold bubble’ meme has been widely accepted and propagated by much of the non specialist financial press.

Constantin Gurdgiev’s article published in The Globe and Mail today looks at the facts and questions this widely held assertion and assumption.

The article, ‘If you’re looking for bubbles, don’t look at gold coins’, can be read here.

“The U.S. Mint data on sales of gold coins suggests that we are not in the last days of the ‘bubble’,” finds Gurdgiev.

Buyers of gold bullion coins such as the U.S. Mint’s gold eagles are store of value buyers and sometimes collectors, Gurdgiev points out.

They are not speculative buyers trying to time the market and make a short term financial gain or speculative profit.

Buyers of gold bullion coins and bars are not speculators as speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum. Most buyers of gold coins are motivated not by a return on capital but by a return of capital and by wealth preservation.

This is particularly the case in today’s extremely uncertain world where some blue chip stocks, including bank stocks, have collapsed to become worthless and where a safe haven currency such as the Swiss franc can be devalued against gold and other currencies by more than 7% in a matter of minutes.

Concern, risk aversion and sometimes fear is leading to store of wealth demand. Demand today is not driven by greed, “irrational exuberance” or a mass mania to get rich by jumping on the latest bandwagon.

Gurdgiev points out that “gold coins are traditionally held by retail investors as portable units to store wealth. Due to this, plus demand from collectors, gold coins are less liquid and represent more of a pure ‘store of value’ than a speculative instrument.”

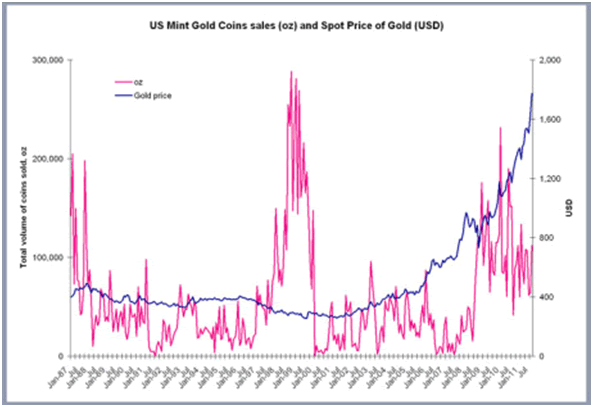

US Mint Gold Coin Sales and Nominal Gold Price (1986-2011)

The data shows that there has not been a dramatic increase in demand for the U.S. Mint’s Gold Eagles with annual demand in 2011 set to be some 1,275,000 oz which is below the levels since back in 1986-1987, in 1998-1999 and more recently in 2009 when demand was 1,435,000 oz.

Gurdgiev points out that even if there was record demand for gold eagles today surpassing the levels seen in 1986-1987, in 1998-1999, and again in 2009, it would not necessarily be a contrarian signal that gold was a bubble about to burst.

“Classical bubbles arise when speculative motives (bets on continued accelerating price appreciation) exceed fundamentals-driven motives for holding gold. In later stages of the “bubble”, we should, therefore, expect demand for gold coins to fall compared to the demand for financially instrumented gold.”

This is something we have long pointed out. Demand for gold bullion coins and bars is not a good contrarian indicator of retail demand and the typical mass mania greedy buying that accompanies most market tops and most bubbles.

A far better indicator of this is the Commitment of Traders (COT) data from the COMEX and data from the global gold market and the increasingly important gold spot and futures markets in Dubai (DMCC) and especially Shanghai (SGE).

(COT data from the COMEX, as we pointed out last week, is far from the record levels seen in recent years and sentiment remains lukewarm today.)

The myriad of more liquid gold ETFs which cater for the less risk averse stock trading and investing public may also be a good benchmark of retail exuberance for gold.

Gurdgiev's excellent article concludes that the data and evidence from the U.S. Mint regarding the “behaviourally anchored, longer-term demand for gold coins as wealth preservation tool for smaller retail investors” does not “appear to support the view of a dramatic over-buying of gold by the fabled speculatively crazed retail investors that some media commentators are seeing nowadays.”

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $42.20/oz, €30.05/oz and £26.35/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,839.50/oz, palladium at $757/oz and rhodium at $1,800/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.