Silver and Silver Stocks Forming Bullish Cup and Handle Pattern

Commodities / Gold and Silver 2011 Sep 06, 2011 - 06:45 AM GMTBy: Jordan_Roy_Byrne

A cup and handle pattern is a bullish continuation pattern that represents a period of consolidation followed by an eventual breakout, which is the continuation of the previous trend. Typically these patterns last months and not weeks or days. Cup and handle patterns also entail precise price targets. To find the price target, one measures the distance from the top to the bottom of the cup and then adds the distance to the top of the cup. In some cases analysts can use a logarithmic scale though its best to use a arithmetic scale.

A cup and handle pattern is a bullish continuation pattern that represents a period of consolidation followed by an eventual breakout, which is the continuation of the previous trend. Typically these patterns last months and not weeks or days. Cup and handle patterns also entail precise price targets. To find the price target, one measures the distance from the top to the bottom of the cup and then adds the distance to the top of the cup. In some cases analysts can use a logarithmic scale though its best to use a arithmetic scale.

I find that cup and handle patterns tend to form after very strong moves that reach a significant overbought status. An overbought market needs time to correct and the cup and handle pattern is more of a consolidation than a correction. There is an initial correction and then the market gradually forms a bottom and slowly works its way back to the previous high.

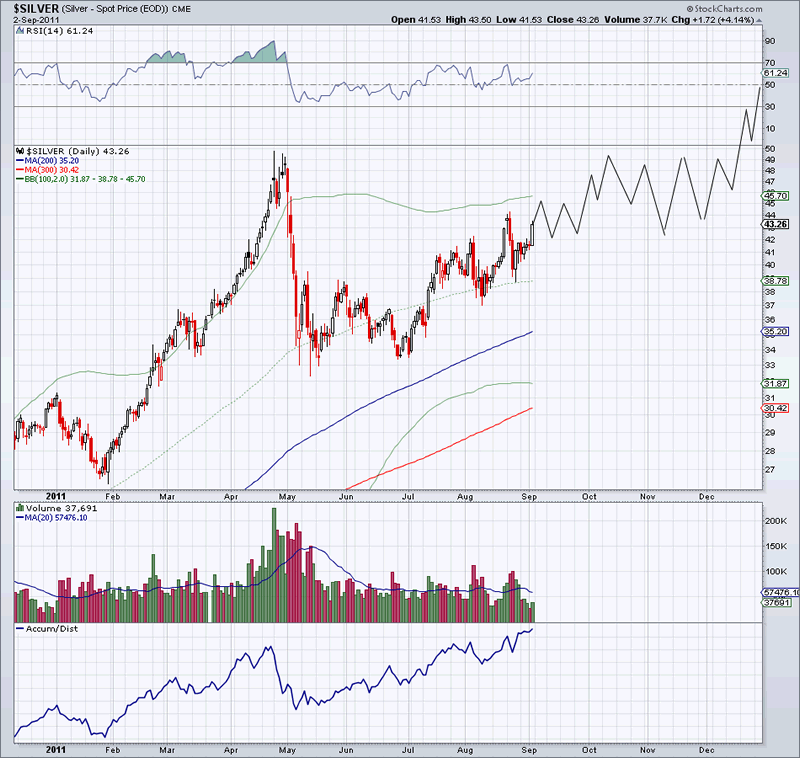

We show Silver below. Silver had a very strong move up to nearly $50. It corrected to the $30s immediately and then spent three months ranging from $33 to $41. After confirming its the bottom, Silver has quietly worked its way beyond resistance at $40-$41. Given the new uptrend and the strength in Gold, its quite reasonable to assume Silver returns to $49. Should Silver form a cup and handle pattern, then once it surpasses $50, we can project a strong target of $65.

Naturally, the silver stocks have formed a similar pattern. Below is a chart of our junior silver index. Note that the average market cap within the index is $600 Million. We created this index two years ago when these companies were juniors. Since then a handful have graduated from junior status. Anyway we can see that the index has a high of 310 and recent low of 215. This means a potential cup and handle pattern projects to 405.

Sure, the gold equities are breaking out as we touched on last week but don’t forget Silver and the silver equities. In ourpremiumservice we’ve focused on the leading and best performing gold equities while maintaining positions in the strongest silver stocks. Those equities are nearing their previous highs and forthcoming consolidation (handle) would serve as an excellent buying opportunity prior to an explosive breakout.

If you’d be interested in professional guidance then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.