Gold and Portfolio Asset Allocation for Today's Financial Reality

Stock-Markets / Gold and Silver 2011 Sep 02, 2011 - 12:37 PM GMTBy: Nick_Barisheff

Asset allocation is one of the most crucial aspects of building a diversified and sustainable portfolio that not only preserves and grows wealth, but also weathers the twists and turns that ever-changing market conditions can throw at it. However, while the average advisor or investor spends a great deal of time carefully analyzing and picking the right stocks or sectors, the basic and primary task of asset allocation is often overlooked.

Asset allocation is one of the most crucial aspects of building a diversified and sustainable portfolio that not only preserves and grows wealth, but also weathers the twists and turns that ever-changing market conditions can throw at it. However, while the average advisor or investor spends a great deal of time carefully analyzing and picking the right stocks or sectors, the basic and primary task of asset allocation is often overlooked.

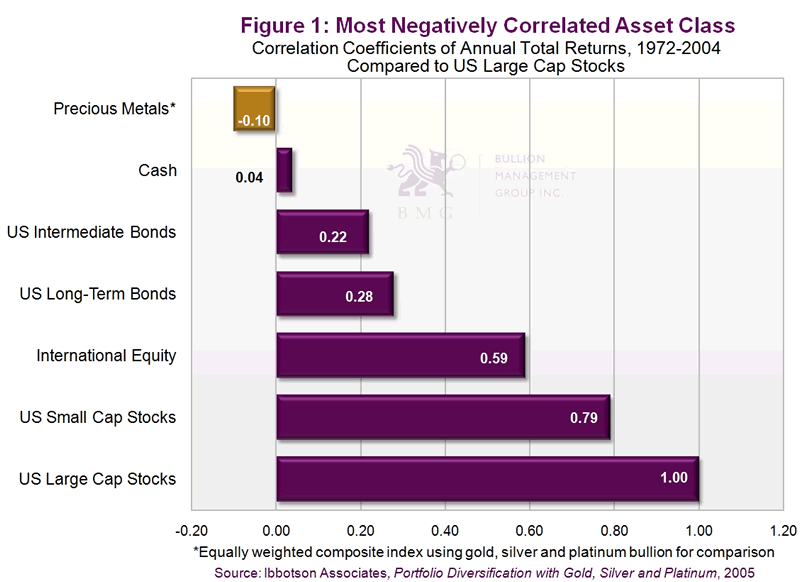

Asset allocation is usually taken for granted as being a mix of the three main asset classes: stocks, bonds and cash. Many investors believe that a broad mix of equities (financials, healthcare, utilities and telecoms), an exposure to foreign stocks, some emerging market plays, some bonds and a foundation of cash, equals diversification. However, this traditional approach is not only outdated, but also completely excludes several key asset classes such as foreign currency, real estate, collectibles, precious metals, natural resources and life settlements. Also, as Figure 1 shows, the three main asset classes are all positively correlated. A portfolio that consists entirely of positively correlated asset classes cannot achieve optimal diversification.

It is not surprising that investors usually consider only three asset classes; most financial websites still refer to portfolio diversification being achieved through an allocation to the traditional stocks, bonds and cash. The Canadian Banks Forum is an exception; it correctly defines asset allocation as a process whereby an investor diversifies his or her portfolio with different classes of assets such as stocks, bonds, cash investments, foreign currency, real estate, collectibles, precious metals, natural resources and life settlements. It notes that, because markets are constantly changing due to the unstable global economic climate, investors should examine and, if necessary, rebalance their asset allocation annually. Any portfolio that does not include these other asset classes cannot be diversified and risks ignoring important long-term trend changes that may occur in the economy.

Long-Term Trends

It is vital to consider long-term trend changes when planning asset allocation, since economic cycles are not set in stone. The trend for each individual asset class needs to be evaluated on a regular basis and adjusted accordingly. What might be an appropriate asset allocation one year could be completely ineffective 20 or 30 years later. Yet the traditional stocks, bonds and cash mix, which was popularized in the 1960s, has been used by the vast majority of advisors and investors ever since without any consideration for changes in the economic landscape. Well, a lot can change in the economy in half a century.

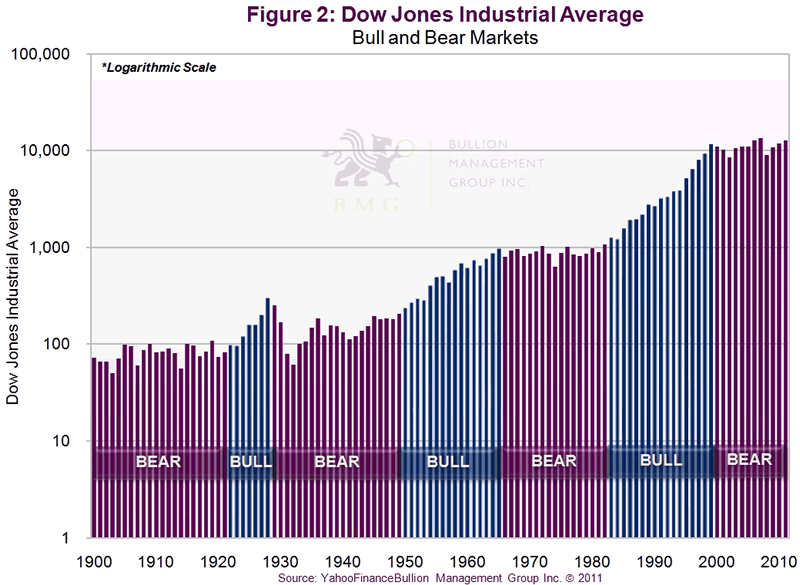

Financial markets are cyclical and history shows us that each cycle usually lasts approximately 20 years, as seen in Figure 2. Accordingly, it is critical to identify which asset classes are likely to outperform during the current cycle when deciding portfolio asset allocation.

The Dow has experienced several cyclical up and down trends throughout the last century. Identifying which trend the market is currently experiencing is of paramount importance. For example, a 60-year-old investor allocating to stocks in 1968 would have been 87 before breaking even, adjusting for inflation, in 1995.

The bond portion of a portfolio faired just as poorly during the 1970s. Bonds are decimated during periods of rising inflation, and in the 1970s inflation rose to over 13 percent. A mutual fund bond investment fared even worse during that decade; the net asset value of a bond fund drops as inflation takes hold and subsequent interest rate rises eat into the purchasing power, and then the price, of the fund.

Perhaps more crucially, a portfolio limited to stocks and bonds during the 1970s would have missed one of the greatest commodity booms ever experienced. From 1971 to 1980, gold rose by 2,300 percent, silver by 2,400 percent and platinum by 900 percent, while oil rose 900 percent.

Changing Times Require Changing Mindsets

Most investors' experience with investing is based only on the last cycle. They find it difficult to rebalance their portfolios in order to align them with changing trends, having become entrenched in one mindset. Successful investing requires correctly identifying new trends rather than simply assuming the continuation of past trends. During the past 25 years, the North American stock market has experienced one of the longest, highest-running bull markets in history, with the Dow rising 1,100 percent from 985 in 1982 to 11,723 in 2000. However, we have entered a new cycle, one that includes a long-term positive trend for gold. Savvy investors today need to adopt a gold mindset.

Just as in 1968, however, today's investors are complacent. They are convinced that equities will continue to provide superior returns during the next 20 years. Many feel the financial turmoil of 2008 is behind us, that the worst is over, and are blindly looking forward to further gains on the stock market. This mindset fails to acknowledge today's financial reality.

In fact, economic conditions today are much worse than in the 1970s. Government spending around the world has exploded and continues to do so. Fiat (paper) currency supply, along with government debt in the world's major economies, is spiraling out of control. The situation is worsening daily, and burgeoning inflation can be the only result. Crucially, the world's debt will inhibit governments from substantially raising interest rates- today's economies couldn't withstand a high interest rate environment.

These are the reasons gold has risen constantly, year after year for nine years, and will continue to do so. In truth, gold isn't just rising; fiat currency values are falling through debasement by their governments. The more dollars created, the less each one is worth. Gold protects investors against inflation, because it is a non-depreciating asset.

As we have seen, the world has changed. Equity markets are topping. From a purely analytical point of view we can see that equity valuations are high, and there is more potential risk than reward. It is time to rebalance portfolios.

The Dow:Gold Ratio

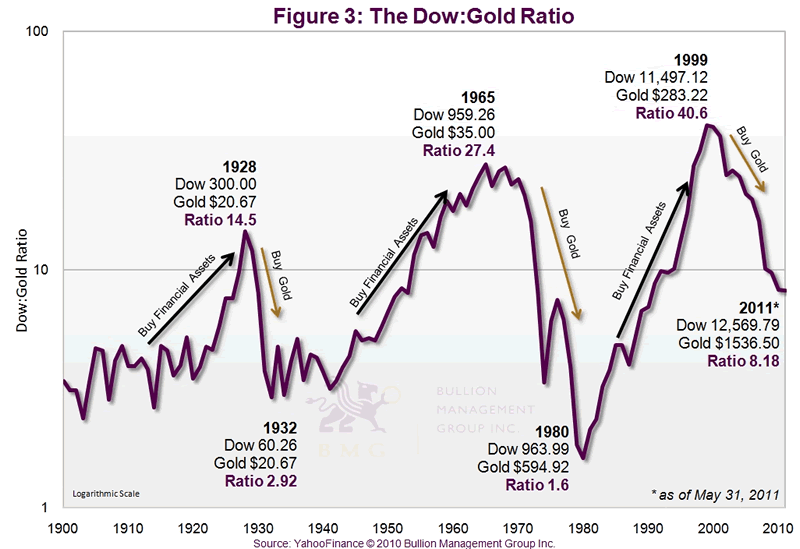

The Dow:Gold Ratio, which measures trend changes in the price of gold versus a basket of stocks as represented by the Dow, supports the idea that investors today should have an allocation to precious metals. Essentially, the Dow:Gold Ratio divides the Dow by the US-dollar gold price. Figure 3 shows that when the ratio is rising, as it did in the 1920s, 1960s and 1990s, portfolios should be overweight equities. When the Ratio is falling, as it did in the 1970s and is doing today, portfolios should be overweight precious metals. Currently the Ratio is 8.18:1 and, equally important, it is falling, meaning there is still plenty of time for investors to rebalance into gold and precious metals.

Gold is Money

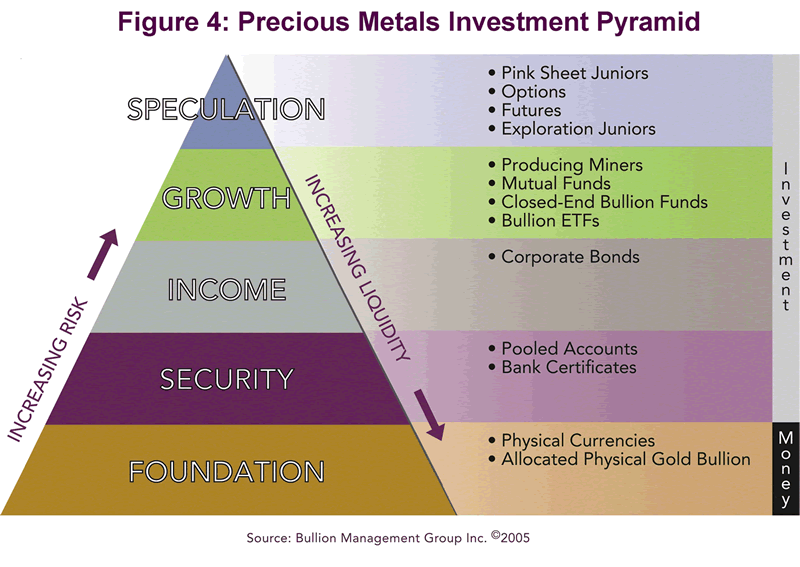

Gold is money, not a commodity as many investors and advisers incorrectly view it. Gold trades on the currency desks of the major banks and brokerage houses, not the commodity desks. It is a wealth-preserving asset, not a wealth-accumulating asset. We buy and hold gold bullion to preserve wealth. It is important to note that, while we may speculate in gold stocks, exchange-traded funds, futures and options to increase wealth, it is gold bullion ownership that best serves the purpose of wealth preservation.

Figure 4 shows the different precious metals investment vehicles based on inherent risk. The best investment strategy for long-term investors seeking low risk with secular growth potential is unencumbered physical bullion. As we can see, bullion forms the foundation of the Precious Metals Investment Pyramid, because it offers the lowest risk.

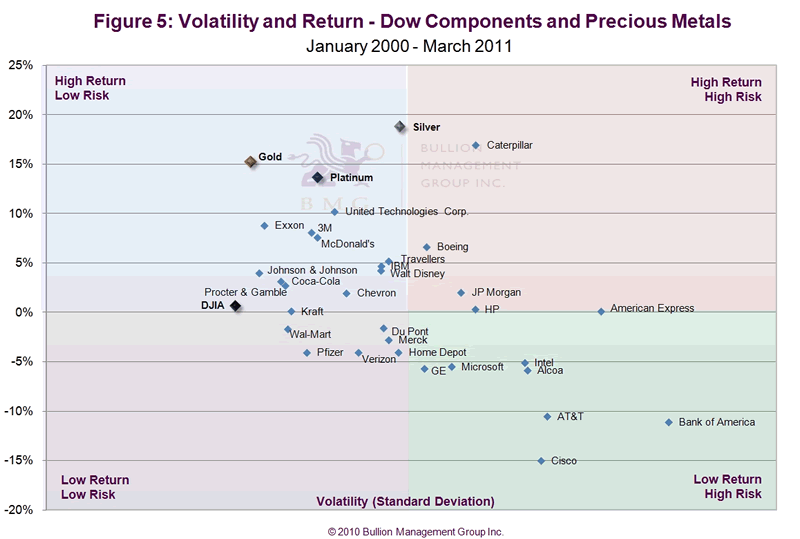

We can further illustrate this point by looking at standard deviation, the most commonly used measure of risk. It calculates the total risk or variance associated with the expected return. Simply put, it measures how volatile or widely spread an investment's returns are from its mean, over a period of time. When annual compounded returns are plotted against standard deviation, the individual Dow stocks are all more volatile than gold, and all but one of the Dow stocks have poorer performance than gold, silver and platinum over the past 11 years (Figure 5). If we use other common methods of risk/return measurements, the Sharpe Ratio and the Sortino Ratio, we get the same results. Gold is less risky and performs better.

Mid- And Long-Term Trends

There are three dominant mid-term trends that will drive the gold price for the foreseeable future and perhaps longer than the historic 20-year time frame: central bank buying, movement away from the US dollar and the effect of the changing mindset in China and many Asian countries towards gold. We have already seen how fiat currencies are losing value and being debased. In November 2010, China and Russia decided to renounce the US dollar and resort to using their own currencies for bilateral trade; this is an indication that the dollar's reign as world reserve currency is drawing to a close. In 2009, central banks became net buyers of gold for the first time in two decades. They understand the issues facing fiat currencies and are moving to protect their countries' wealth; they understand that gold is money. The Chinese are one step ahead in terms of gold. They already have adopted a gold mindset. In the first two months of 2011 the Chinese imported 200 tonnes of gold, as much as the entire previous year. This was just individual investor demand, not central bank demand, which we know is also growing.

During a speech at the Empire Club in Toronto, I spoke at length about these mid-term trends, as well as longer-term trends, which will support and propel the gold price moving forward. A transcript of that speech is available at www.bmgbullion.com/document/806.

An Appropriate Allocation

Today's typical "balanced" portfolio, consisting of 60 percent equities and 40 percent bonds, will simply lose value year after year in real terms during the coming high-inflation cycle. This is not even considering any bond defaults or equities market crashes that may occur due to the precarious financial situation many economies around the world are experiencing. Dramatic portfolio rebalancing is required to preserve and grow these portfolios.

According to a study by Ibbotson Associates, a 7 percent allocation to gold is needed in conservative portfolios and a 16-17 percent allocation is required for aggressive portfolios. Those amounts are required simply to have a balanced, diversified portfolio during stable times, or what may also be known as strategic allocation.

From a tactical allocation standpoint, Wainwright Economics looks to gold as being a leading indicator of future inflation. In a high inflation environment, which the ongoing currency creation around the world all but guarantees, their conclusion is that you need 15 percent in a bond portfolio and the same percentage in an equity portfolio just to insure your investments against further inflationary damage.

I would suggest that a properly diversified portfolio today should consist of 25 percent gold bullion, 50 percent in a basket of commodities including precious metals, oil, gas, water and agriculture, and 25 percent in short-term fixed income.

The percentage mix is debatable; what is certain, however, is that the historic three-asset-class allocation mix is outdated, out of touch with today's economic and financial reality and a recipe for loss of wealth. To protect your portfolio and preserve your wealth, a 5-20 percent allocation to precious metals is an absolute necessity.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2011 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.