Gold is for wealth preservation and Silver is for bartering

Commodities / Gold and Silver 2011 Sep 02, 2011 - 07:08 AM GMTBy: George_Maniere

Gold is for wealth preservation and silver is for bartering. If we are talking about protecting wealth in the amount of several million dollars then a good spread to own in precious metals would be 80% gold and 20% silver. If we are talking about a “Mad Max” scenario where we are trying to set ourselves up for a black market bartering system then a good spread would be 75% silver and 25% gold. I will leave it to you to determine what would be an appropriate ratio for you based on the assets you are trying to protect.

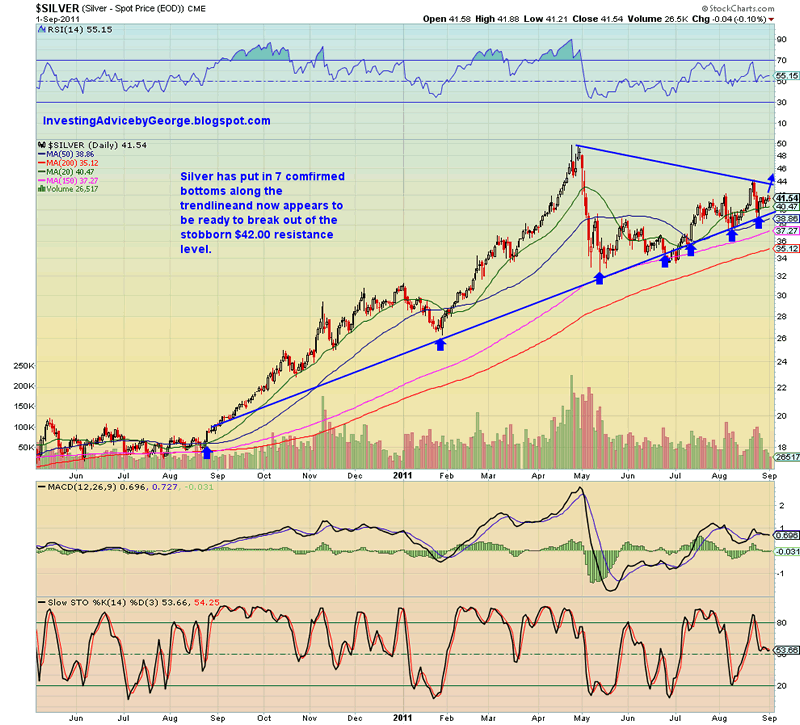

A look at the chart above will show that silver has put in seven confirmed bottoms along the trend line. The third bottom was when silver corrected violently in the first week of May after having gone parabolic in April. Since then it has put in three months of consolidation and tried to break out in mid August and ran into a firm level of resistance at $44.00. Since then it bounced on the trendline and seems ready to retest the $44.00 resistance level. Once it breaks this resistance level it will have the $50.00 level of resistance to break through.

The buying of silver ETFs like SLV, PSLV, and AGQ jumped this week showing an increase in investor confidence in the precious metal. I believe that many analysts are still cautious of silver as the people that were burned when they bought at the top in April will not soon forgive and forget. They will be looking for a chance to get out even. I believe that this will set up a strong level of resistance at $50.00 but once silver breaks this level I expect it to run to the $55.00 level by year’s end. I must say that there are some very smart people that have told me that my target price of $55.00 by year’s end is too low and once it breaks the $50.00 level it will run up to $100.00 an ounce within 6 months.

This should be proof that gold is not the only precious metal out there worth looking at as an investment. Silver has also been long used as a basis for monetary systems and is much cheaper than gold, at around $42 an ounce. Silver for the most part stayed put during this latest historical rise in the price of gold.

The reason gold is being bid up so high has to do with the world’s growing distrust of the financial system and the growing possibility of extreme or hyper inflation of the US dollar and other major currencies. This is all largely due to the Fed manipulating interest rates to zero and the continued printing of fiat money.

Meanwhile, investors have once again become very attracted to silver coins, particularly the 2011 Silver American Eagle which sold out at the mint in one day. I believe that the chart above shows silver progressing in a very bullish fashion and once it breaks the resistance level it will have a long profitable run.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.