Stock Market Traders Don’t Care About Long-Term Problems, But You Should

Stock-Markets / Stock Markets 2011 Sep 01, 2011 - 03:10 PM GMTBy: Chris_Vermeulen

Professional stock market traders manage risk very closely. In fact, stop loss levels tend to be set almost directly below entry points, meaning they are comfortable owning a position for a few minutes or a few days. If the trade does not work, they get out. Traders look at risk-reward ratios on much shorter time frames than investors. A good trading opportunity is not necessarily a good opportunity for investment.

Professional stock market traders manage risk very closely. In fact, stop loss levels tend to be set almost directly below entry points, meaning they are comfortable owning a position for a few minutes or a few days. If the trade does not work, they get out. Traders look at risk-reward ratios on much shorter time frames than investors. A good trading opportunity is not necessarily a good opportunity for investment.

We believe the current rally is being driven by traders, which is fine. Traders who “played” the current rally will be more than happy to sell at the first sign of trouble, which could come from this week’s ISM report, Friday’s employment report, or from across the pond. Given the points that follow, do you really believe the current rally in stocks is sustainable?

1.The problems in Europe are very serious and have not been addressed in a meaningful way.

2.The debt debate in the United States will come back into the news cycle soon.

3.The U.S. economy is stalling and the economic numbers have not shown signs of improving.

4.Estimates for corporate profits may need to come down significantly in the next few months.

5.Rather than helping stimulate growth, China is trying to tame inflation via tighter monetary conditions.

6.Global stimulus spending helped fuel economic activity in Brazil, Russia, India, and China – there will be no repeat performance to assist the global economy this time. The United States will be cutting spending, not increasing it.

7.Housing prices in the U.S. could fall another 10-25%, according to Robert Shiller, the economist who co-founded the S&P/Case-Shiller index of U.S. home prices. Imagine the impact on banks and financial markets – scary.

8.Investors have lost faith in global policymakers.

9.More importantly, investors have lost faith in the Fed’s ability to ride to the rescue. If they launch another round of money printing (QE3), it will have a much more muted impact on asset prices; it may even have a negative impact using the “are things this bad?” rationale.

10.Numerous long-term bearish signals have materialized in recent weeks. Countertrend rallies are common and help keep wary investors in weak markets.

We believe the psyche of investors is on the verge of reaching a tipping point, which could cause a very rapid decline in asset prices. It is next to impossible to know if and when they will reach for the sell button in unison, but the risk for such an event is elevated and must be considered in all portfolio management decisions. Stocks dropped 34% in twelve trading sessions in 1987. High volatility occurred before that drop, indicating an increased willingness to run for the exits. If you have not noticed, the markets have been volatile recently. An “Oh, my God” type event is difficult to predict, but the conditions are in place to make for an interesting next few months.

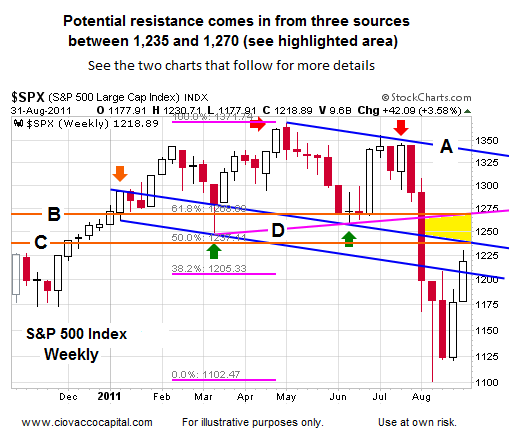

While the chart below is busy, the basic takeaway is simple; the S&P 500 faces hurdles between 1,219 and 1,270. Let’s assume traders take the market back to 1,270 – that represents a 4% gain from the August 31 close of 1,219. If stocks go on to make a lower low later this year, the next logical retracement level comes in at 1,020, which is a 16% drop from the August 31 market close. The blue lines, marked A, are parallel trendlines from recent highs. Points B and C show logical retracement levels monitored by traders. Point D is the neckline from the topping pattern known as a head-and-shoulders formation. As we mentioned on August 12, a rally back to the neckline is not uncommon.

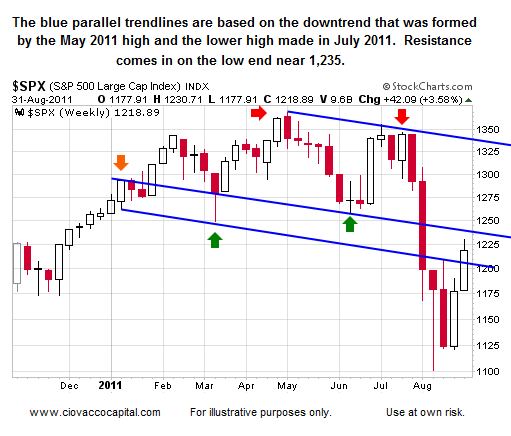

Unless something improves somewhere in a better than expected manner, we are inclined to use the current trader-induced rally to review bear-market friendly assets, such as bonds (TIP, PCY, TLT, IEF) and stock market hedges (SH). We are also keeping an eye on Fed-Friendly agriculture (DBA). We need to see a better entry point for bonds and agriculture. Stock market hedges are looking more attractive the higher the current rally goes. The chart of the S&P 500 below shows the blue trendlines labeled A in the chart above, allowing for a less cluttered review.

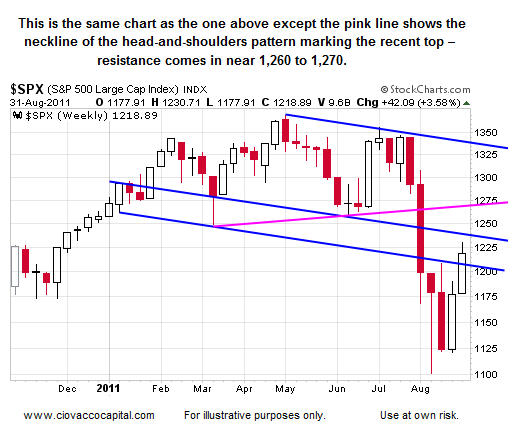

Gold (GLD) and silver (SLV) are very crowded trades at this point, which elevate the odds of significant downside in the short-to-intermediate term. We would prefer to re-enter those markets after some corrective or sideways price action. Agriculture may be a good precious metals alternative, but a pullback might be needed first. The chart of the S&P 500 below adds back another form of resistance.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.