Investors Are Returning To The Undervalued Gold Mining Stocks

Commodities / Gold & Silver Stocks Aug 31, 2011 - 08:36 AM GMTBy: Jeb_Handwerger

The brouhaha over the debt ceiling has generated upward moves, particularly in gold bullion. This is a primary example of a news driven market skewing orthodox technical measurements. Now it is entirely possible that the scare headlines are generating a caffeinated move to surpass resistance areas, especially in gold. The debt farce can end precipitously and so may the risk trade. What the market giveth exogenously is what the market taketh away with the resolution of the underlying media hype. The risk off trade may boost mergers and acquisition activity in the mining sector.

The brouhaha over the debt ceiling has generated upward moves, particularly in gold bullion. This is a primary example of a news driven market skewing orthodox technical measurements. Now it is entirely possible that the scare headlines are generating a caffeinated move to surpass resistance areas, especially in gold. The debt farce can end precipitously and so may the risk trade. What the market giveth exogenously is what the market taketh away with the resolution of the underlying media hype. The risk off trade may boost mergers and acquisition activity in the mining sector.

Six weeks ago, I became aware of a major divergence between the miners and the underlying metal. This juncture represented a buying opportunity. On July 13, 2011 Barron's wrote that my firm was a solitary voice in indicating that miners would outperform gold bullion, saying "...One contrarian to that view is Jeb Handwerger, editor of Gold Stock Trades. He points to technicals that favor miners, although he remains bullish on prospects for both types of precious metals ETFs."

Subsequently, miners did bottom in mid June. In fact, we have witnessed parabolic moves in the gold sector, completely overlooking some undervalued miners such as Goldcorp (GG), Barrick (ABX), and Newmont (NEM). These are some of the fastest growing stocks in the market with increasing profits and margins.

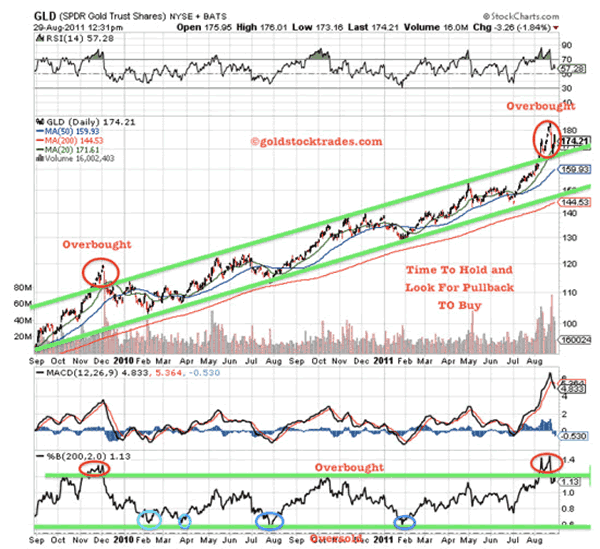

It is precisely gold's linear bull trend as opposed to a geometric blowoff which indicates the longevity of this millennial move in gold. As the metal surpasses resistance we anticipate and welcome the customary healthy pullbacks on this rising arc. The risk off trade will transfer capital from the extended gold price to the undervalued mining equities.

Meanwhile, the debt debates serve to provide fuel for these sectors as the "Washington Square Dance" was resolved by a nip and tuck procedure when major surgery is really required.

My firm senses we are on the road to additional economic stimulants by whatever guises necessary, probably in the next few weeks. They may surface under different names but the basic principle should be the de facto desirability of accumulating wealth in the ground assets of precious metals, uranium, and rare earths.

The Market Vectors Gold Miners ETF (GDX) recently advanced above its 200 day moving average and is not nearly as overbought as its underlying metal. A bullish golden cross of the 50 dma above the 200 dma is occurring now. Up to now the crises over both European and American monetary problems have marked bullion as a safe haven. It appears that the metal has become overextended relative to the miners.It's time for the miners to come to the ball.

We are seeing some major, cash loaded miners diversifying into copper and now into significantly discounted uranium miners. My firm has long been focusing on this trend. For example:

- Newmont took a stake in uranium miner Paladin.

- Barrick bought copper miner Equinox.

- Stillwater (SWC), a palladium miner, expanded into copper with the acquisition of Peregrine.

- Anglogold Ashanti (AU) acquired First Uranium Corporation (FIU.TO).

- China's Hanlong made a hostile bid for Bannerman Resources on the bargain counter at $.60 a share, representing what may be an increasingly obvious straw in the wind.

- Now this week we hear of Cameco's (CCJ) hostile bid for Hathor's Roughrider Deposit. Could this be the catalyst the sector has been looking for? Stay tuned to my daily bulletin.

Disclosure: Long GLD,SLV, GDX

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.