AT&T Offers an Attractive Alternative to Low CD Rates

Companies / Dividends Aug 29, 2011 - 12:43 PM GMTBy: EconMatters

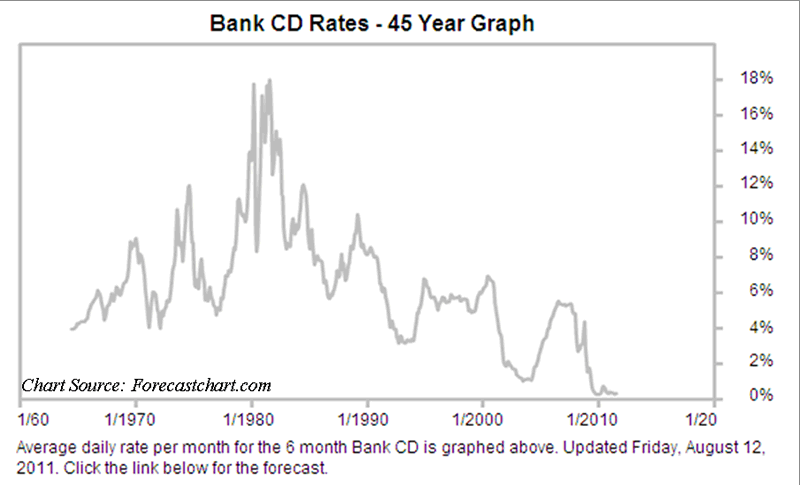

With the Fed promising to keep rates low for an extended amount of time, at least for the next two years based upon their latest analysis of the economy, interest rates on CDs is a negative return when you factor in inflation. For example, Chase offers a 6 month CD for an annual percentage yield of 0.20%, a 12 month CD that pays 0.25%, and a two year CD for 0.40% in the southwest part of the country, rates may differ slightly by region of the country.

With the Fed promising to keep rates low for an extended amount of time, at least for the next two years based upon their latest analysis of the economy, interest rates on CDs is a negative return when you factor in inflation. For example, Chase offers a 6 month CD for an annual percentage yield of 0.20%, a 12 month CD that pays 0.25%, and a two year CD for 0.40% in the southwest part of the country, rates may differ slightly by region of the country.

An investor can find higher paying CDs with institutions that are courting capital but not by much, and beware of any CD`s yielding far above market rates as this is a giant red flag, and not worth the risk.

Keeping Up With The Cost of Inflation

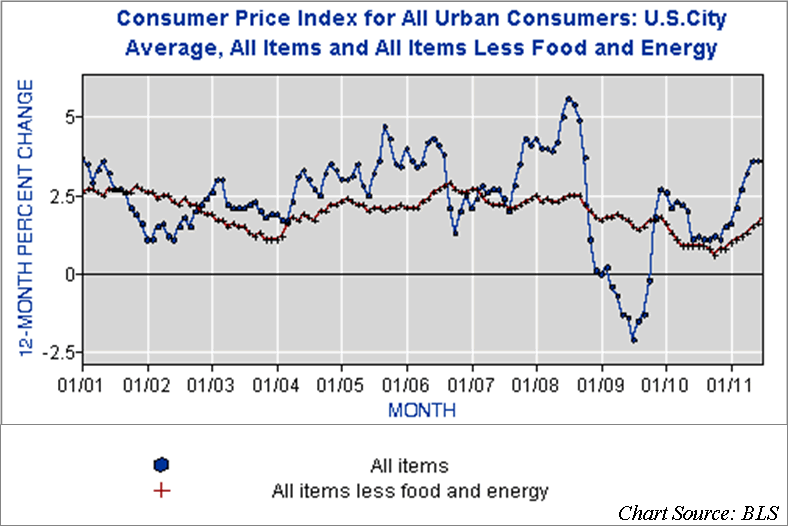

So bottom line this is a bad time to be investing in CDs based strictly on yield. But it gets worse when you factor in the cost of inflation which is running about an annual rate of 3% when you factor in food and energy, and will probably run in the range of 2.5% to 4% at an annual rate over the next two years depending upon fed policy.

So if we take the one year time frame and assume a 3% inflation rate, the CD investor is realizing a negative return of 2.75% on their money. This is not a good scenario for those investors who need a certain fixed return to live on to meet their annual budgetary requirements. So let us explore a way to improve the income generation for these types of investors.

Emergency Base Capital Only in CDs

Now I must mention right here that it is different if the investor is highly likely to need this base capital for some reason during the investing timeframe, this might be the only reason to stay in the CD, but remember penalties may apply to withdrawals made prior to maturity. An alternative is to move a portion of your base capital out of CDs into safe higher yielders, while keeping only the potential emergency capital locked in the safety of CDs.

I am going to recommend a pretty safe high yielding stock that has had a steady stock price over the last couple of years, and provide a conservative entry point, all of which should help the yield investor preserve their base capital.

My Favorite Candidate Is AT&T

The favorite candidate is AT&T, Inc. (T), a really solid company in the telecommunications industry, and a Dow 30 Blue Chip stock, and after being overpriced in 2007, has had a relatively stable price pattern over the last 3 years, maintaining its value and offering investors a plus 5% yield, which certainly keeps your capital ahead of inflation concerns, and today offers an outstanding annual yield of 5.9% which blows the socks off your CD alternatives.

An ideal entry point would be around $25 a share, which the extremely patient investor had about 5 legitimate opportunities over the last two years to pick up this solid company. However, because time might be an issue it is reasonable to assume that a merely patient investor can pick up T at $27 a share sometime in the foreseeable future, just be patient and wait for a market selloff or large investor reallocating capital and you should find your preferred entry point.

Preservation of Capital

At $27 a share your principal base should be safe, given flexibility in your exit point, and you gain a highly attractive 5.9% annual yield on your principal. You will not be alone as many investors like AT&T for this very reason; this is why it holds up better than most stocks in tumultuous market conditions. AT&T currently trades around $29 a share but was as low as $27.70 on August 8th, so just monitor the stock, wait for an overextended selloff, and swoop in and get your preferred price around $27 a share.

Market Overreaction = Buying Opportunity

And if you’re really lucky you might get some negative news where investors overreact and you can pick up this enduring company around $25 a share similarly to how Apple (AAPL) provides excellent buying opportunities regarding over reactions to Steve Jobs retirement news. Just make sure the news isn`t game changing in nature for the company like Congress passes some punitive legislation that negates 30% of the firm`s profits over the next five years.

But other than that when you factor in the attractive yield, every significant pullback in AT&T has been a nice buying opportunity for the conservative investor who seeks a safe return of their capital, and wants to stay ahead of the inflation curve. It sure beats the heck out of Treasuries or CD yields right now, and this appears to be the case for the next couple of years.

Federal Reserve Hedge

The economic downturn and decision by the Fed to maintain an exceedingly low interest rate policy has really put a crimp in CD returns, and for those relying on a fixed income this can be highly problematic, but there are options to protect oneself from these negative realities, and I believe moving at least a portion of your CD base capital into a solid company like AT&T with nearly a 6% yield makes for an ideal hedge against the Federal Reserve and current monetary policy.

By EconMattersThe theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.