Field Of U.S. Economic Dreams

Economics / US Economy Aug 29, 2011 - 05:20 AM GMTBy: Tony_Pallotta

"If you build it he will come." - Field Of Dreams

"If you build it he will come." - Field Of Dreams

"We built it and he did not show." - US economic reality

The consumer driven recession has begun. Keeping it very simple of the four GDP components (consumer, fixed investment, government and net trade) the consumer has simply rolled over. In Q1 2011 the consumer contributed 1.46% to the 0.4% total GDP. In other words if it was not for consumer growth or even if .5% of that growth was removed the economy contracted in Q1 2011.

Fast forward to Q2 where the consumer component is now 0.3%. In other words the trend of the consumer is deteriorating. Representing roughly 70% of total GDP the consumer is the economy. Confidence drives the consumer, the consumer drives demand and demand drives the economy.

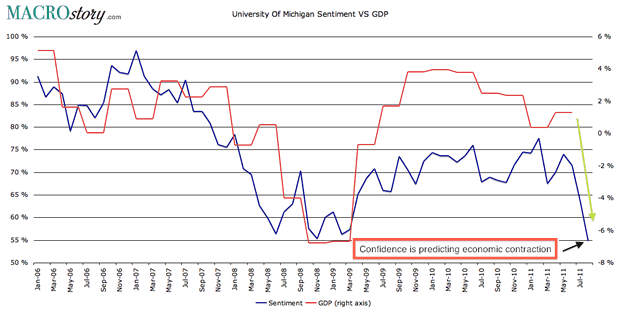

Well judging by the epic fall in University Of Michigan Sentiment, now at multi year lows the economy is in serious trouble. To get a sense of the economic reality facing the US look at the historic correlation between sentiment and real GDP.

As confidence falls so do sales. Who is going to spend money when they are concerned about their job or their ability to provide for their family? Beyond non-discretionary items like food and energy they will cut back on discretionary purchases.

As demand falls in the economy so do inventory levels. Rather than invest in expanding inventory, retailers will simply focus on lowering inventory by depleting shelves. Why have twenty of item A when ten will suffice. The result, the inventory build cycle ends as it is currently.

Companies looking to expand, add capacity, maybe add more retail locations, open a new restaurant whatever will be more risk averse and shelve plans for expansion. The result fixed investment falls.

The negative feedback loop begins. Companies facing falling sales will lay off staff, which in affect further lowers their sales. Faced with higher unemployment the consumer budget is restrained further. They begin to look for lower prices causing imports from China for example to rise while globally demand is falling so are US exports. The trade deficit grows.

To an economist I realize such an oversimplification of a complex $14 trillion economy may seem inaccurate but perhaps the complexity of their analysis is why forecasts are always off. Perhaps one wanting a more complex analysis could answer a rather simple question. If the economy weakened since Q1 2011 how can Q2 GDP at 1% be greater than Q1 of .4%?

Making matters worse as if the economy needs another headwind is the reality of rising non-discretionary inflation. More of the consumer budget is spent on basics like food and energy leaving less available for discretionary items like iPads or dinner out with friends. Combined with rising unemployment and rising inflation the consumer budget is contracting fast and so is demand.

Price Deflator

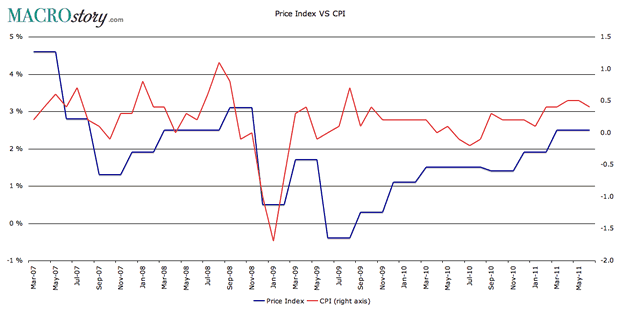

The deflator is used to adjust nominal (non inflation adjusted) GDP to real (inflation adjusted) GDP. This is a very easy way for the BEA to "tweak" GDP by estimating the amount of inflation that contributed to growth versus actual increases in unit sales. Proof of such "tweaking" is shown below by the divergence between CPI or reported consumer inflation versus the BEA "estimate" of inflation. Why they would differ is beyond me.

This raises an important question discussed earlier Is The Price Index Inflating Real GDP. Regardless of the divergence the second revision of Q2 11 GDP shows rising inflation as measured by the price index which was revised from 2.4% to 2.5%. Clearly this trend is not going to aid the economic "recovery."

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.