Common Sense Indicators For Making Money Investing

InvestorEducation / Learning to Invest Dec 07, 2007 - 09:44 AM GMT

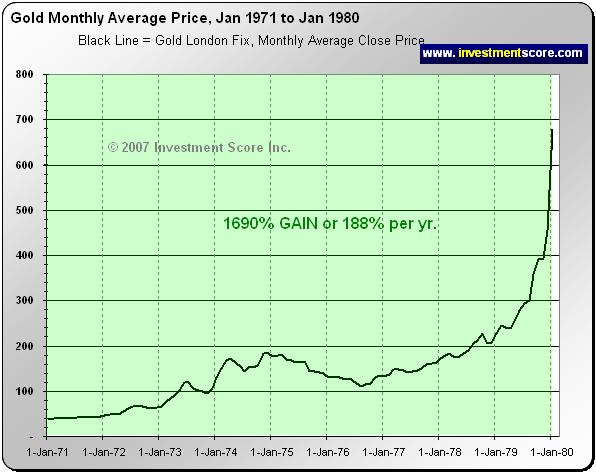

Should we add to our metals positions? To help answer this question we ask ourselves important questions such as "what does the end of a bull market look like"? Clearly gold and silver have been in a bull market as their prices have roughly tripled from their lows earlier this decade. So we want to know, 'What would the end of a mega bull market look like?' to help us gain confidence in our decisions today. If we are in a bull market in precious metals are we likely at the end of this current bull-run?

Should we add to our metals positions? To help answer this question we ask ourselves important questions such as "what does the end of a bull market look like"? Clearly gold and silver have been in a bull market as their prices have roughly tripled from their lows earlier this decade. So we want to know, 'What would the end of a mega bull market look like?' to help us gain confidence in our decisions today. If we are in a bull market in precious metals are we likely at the end of this current bull-run?

Before we continue let us clarify that there are no absolute rules to the financial markets and we are only providing our opinion, however we have found that with common sense analysis and research our probability of successful and profitable investing is greatly improved.

So what kills a bull market? The answer is a lack of buyers. It is our opinion that bull markets die when the mass public believes an investment is such a "can't lose" opportunity that everyone who intends to participate has already bought. If everyone has bought, who is left to buy? And what does this phenomenon look like when charted on a graph?

In the above charts, notice the slope of the graphs as the price heads higher, faster. Notice the vertical peak at the end of the bull market run. As the price of the market heads higher, the public becomes euphoric as money is made, investors tell their friends and justify why the bull market "can't end". Investors feel panicked to buy more in fear of missing out on upside potential.

What does the precious metals bull market look like today?

Prices have been heading higher in gold and silver but not nearly to the same extreme levels that previous bull markets have. In our opinion, when comparing other major bull markets this current bull market is still young. We do not expect a bull market to die with such an unimpressive sideways, wandering chart. We're looking for charts that resemble a NASSA space shuttle launch that excites everyone who looks at it.

We believe it is difficult to call the exact end of a bubble in the financial markets but it is easier to see evidence of a bubble in the real world. Think back to evidence of recent bubbles such as the 90's tech market bubble or the earlier 2000's real-estate bubble. Typical warning signs:

1) Mass public acceptance that the investment is a "can't lose" investment opportunity.

a) 1990's "It's the new economy and things are different now."

b) 2000's "They aren't making anymore land and everyone needs a place

to live." "Real-estate never goes down."

2) Social gatherings consist of constant stories of how investors, friends and relatives have made huge profits from the booming investment class.

3) Individuals are rebuked by their peers for not participating in the popular investment.

4) General discussions about the investment are not about if it will head lower but rather how quickly it will head up and how much higher.

5) Books about the favored asset class cover the shelves in the investment section of popular major book stores and also reach number one on top seller lists.

6) Infomercials, newspaper articles, talk show hosts and nightly newscasts inundate the public about the investments spectacular bull trend.

7) Investors feel nearly panicked to take part in the profitable bull market and rush to invest in fear of missing out on the profits their friends have been making. Think back to how many people you knew did everything they could to buy a home, even if it meant getting a mortgage with a friend. Many did this simply because they did not want to miss out on further appreciation. Home values dropping did not even enter their decision making process.

The signs of a bull market are everywhere and they are not difficult to see for those who are watching. However the exact top of a bubble market can be more difficult to predict. This is why we never pick exact tops and bottoms, but rather use various indicators to help us decide when to generally average in or out of our positions.

But how can this knowledge help us with our investing today? If we know what the end should look like, we can then try to determine if we think this current bull market displays evidence of a bubble.

Although silver and gold have done well over the past several years, long term we do not believe we see evidence of a bubble. Their chart pattern does not display the same parabolic move of many bull markets, we do not see evidence of mass public acceptance and generally speaking our indicators suggest more upside potential exists for long term investors. We believe more and more people are waking up and opening their mind to the idea of investing in precious metals but we do not believe there is wide spread participation.

To us, this means there are a lot of buyers left to buy precious metals. These buyers would push prices higher and therefore we believe this is not yet at a market top.

In addition to common sense analysis, we also consult our proprietary long and intermediate term indicators to help guide us in our investment decisions. Investors can learn more about our strategies and subscribe to our free newsletter at www.investmentscore.com .

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.