Chorus of Gold Bubble Callers Such as Roubini Out in Force Again

Commodities / Gold and Silver 2011 Aug 25, 2011 - 08:57 AM GMTBy: GoldCore

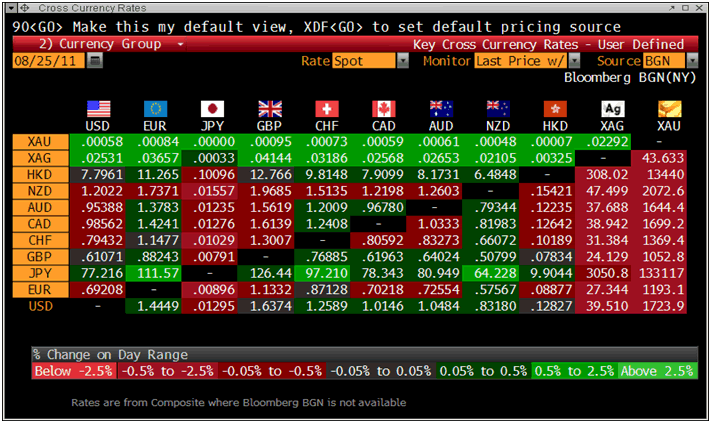

All major currencies have risen against gold again today as the vicious sell off seen on Tuesday and particularly yesterday continued in Asia overnight and in Europe.

All major currencies have risen against gold again today as the vicious sell off seen on Tuesday and particularly yesterday continued in Asia overnight and in Europe.

Gold is trading at USD 1,723.80, EUR 1,192.10, GBP 1,052.90, CHF 1,369.50 and JPY 133,225 per ounce.

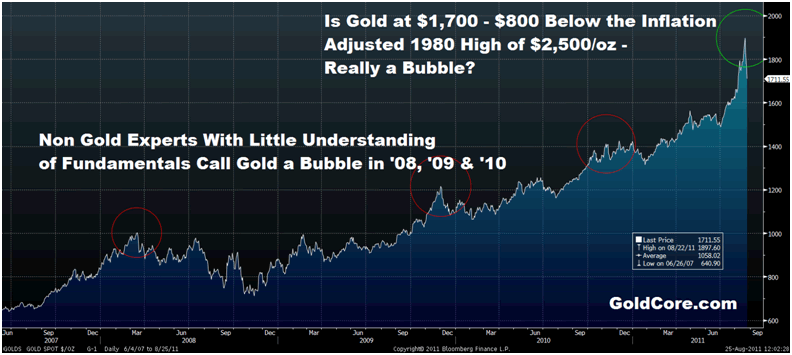

Gold at $1,700/oz Remains $800 Below the Real High (Inflation Adjusted) from 1980

Gold’s London AM fix this morning was USD 1,716.50, EUR 1,191.10, GBP 1,049.59 per ounce (sharply lower from yesterday’s USD 1,850.00, EUR 1,279.30, GBP 1,119.58 per ounce).

The expected correction was due to the very over bought nature of the gold market in the short term.

The catalyst was the mini parabolic spike seen in August, profit taking and the 27% rise in margin requirements set by the Chicago Mercantile Exchange, which followed Shanghai, where margins were also raised on gold futures.

The correction is healthy as the sharp move upwards was making some investors and diversifiers nervous.

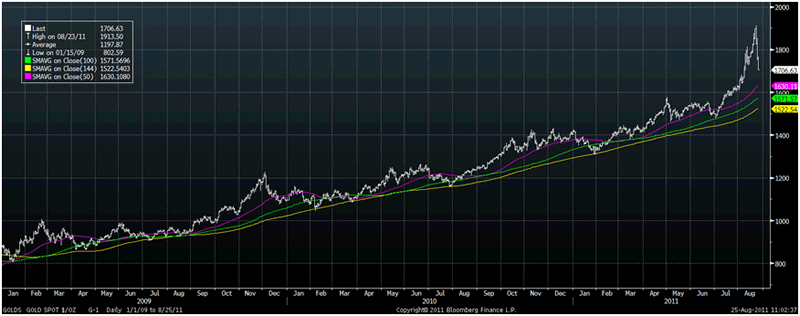

Gold in US Dollars – January 2009 to Today with 50, 100 and 144 Day Moving Averages

In time, this will likely be seen as another paper driven sell off on the COMEX as physical supply remains limited while demand remains robust, particularly from central banks and from China, India and much of Asia.

With gold now down nearly 10% or $200 from its recent ‘peak’ value buyers are getting positioned to buy on the dip. Some may wait until we see a day or two of higher closes and the adage to never catch a falling knife is apposite.

Dollar, euro and pound cost averaging remains prudent especially given the high level of uncertainty regarding the market in the short term.

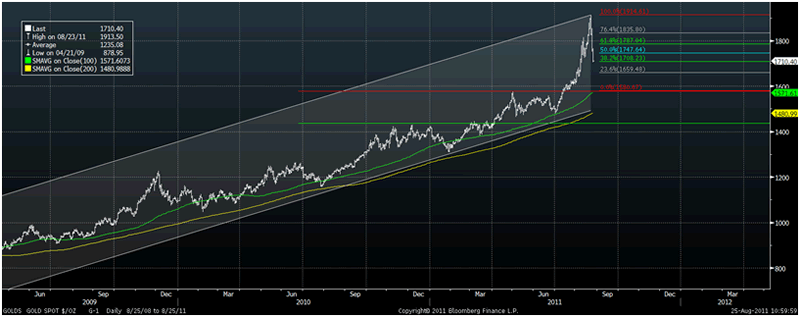

Gold in US Dollars – June 2009 to Today Showing Strong Trend Channel and Possible Fibonacci Retracement

Short term support may be seen at the psychological level of $1,700/oz but momentum traders and Wall Street players with concentrated short positions may press their advantage and manipulate prices to lower levels whereby they may close some of their short positions - pocketing a tidy short term profit.

Strong support can be seen between the 144 day moving average at $1,522/oz and the 100 day moving average at $1,571/oz. Interestingly $1,571/oz was previous resistance and therefore could now become support.

However, given the extent of global demand for physical bullion due to massive macroeconomic, systemic and monetary risk facing us today, there is the real possibility that gold’s correction is more shallow with the 50 day moving average of $1,630/oz providing support.

The gold bears have jumped on the ‘gold bubble bandwagon’ again after a long period of silence.

The most vocal gold bears who are widely followed in the media and accorded guru status are Dennis Gartman and the celebrity economist, and uber Keynesian, Nouriel Roubini.

Both have made bearish calls regarding gold in recent years.

In so doing they have joined a chorus of so called financial and economic experts calling gold a bubble since gold rose above $850/oz in late 2007.

Gold was called a bubble by many in March 2008 (more than 3 years ago) when gold reached a nominal high of over $1,000/oz.

‘Gold bubble’ calls were made in December 2009 when gold reached a nominal high of $1,200/oz.

Further ‘gold bubble’ calls were heard more recently in November and December this year when gold reached $1,400/oz and then consolidated at these levels.

Roubini’s basis for calling gold a bubble is simplistic and somewhat incoherent but simply put he appears to believe that massive debt will create a deflationary depression which will lead to gold falling in value.

Previously Roubini had communicated on twitter that “Spam is a better hedge against inflation than gold: you can eat it and it lasts 1000 years. Gold is, as Keynes aptly said, a barbarous relic.”

However, it is difficult to ascertain his position as he has not backed it up with a research paper, an article or an interview. Rather he has chosen to tweet a series of somewhat conflicting and incoherent messages.

One message suggested that those buying gold were lemmings and sheep.

Another showed a chart from an unnamed Reuters editor which purported to show ‘A Tale of Two Bubbles: attached a Gold vs Nasdaq Chart’.

The chart was a classic example of data mining and looked at only 5 years of data. From 1987 to 2000 the Nasdaq rose 18 fold in 13 years.

Today at $1700/oz gold is up less than 7 times since the 20 year bear market lows of $250/oz seen 11 yrs ago in 1999.

More importantly, comparing like with like, gold rose 24 times from 1971 to 1980.

How can the crystal ball gazers be so certain that gold will not replicate the performance of its last bull market?

Cross Currency Table

Roubini also contradicted himself somewhat when he suggested in a tweet that gold bullion in a safe vault was a safe haven that would protect from “global financial crisis 2.0.”

He tweeted “In inflation tail risk virtual gold (ETF GLD) beats physical gold. But in global financial crisis 2.0 physical gold in safe vault beats GLD.”

It appears Mr Roubini is having his cake and eating it too. We await clarification of his opinion regarding gold and whether it merits an allocation in a diversified investment portfolio or as financial insurance against “global financial crisis 2.0.”

Dr Constantin Gurdgiev, a non executive member of GoldCore’s Investment Committee, has written a considered article overnight looking at gold’s correction and Nouriel and all the other gold bears should inform themselves by reading it.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $39.49/oz, €27.40/oz and £24.13/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,806.50/oz, palladium at $746/oz and rhodium at $1,800/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.