Gold Versus Gold Stocks

Commodities / Gold and Silver 2011 Aug 25, 2011 - 06:33 AM GMTBy: Adam_Brochert

Gold versus Gold stocks. A topic near and dear to my heart. One that I have studied relentlessly for the past several years. I am no mining expert. I am not the one that can point you to the next "ten bagger" in the junior mining sector. But I have been right in insisting that my subscribers favor Gold over Gold stocks and I continue to favor Gold (and silver) over the companies that dig these metals out of the ground. This is sector analysis, not an individual firm analysis.

Gold versus Gold stocks. A topic near and dear to my heart. One that I have studied relentlessly for the past several years. I am no mining expert. I am not the one that can point you to the next "ten bagger" in the junior mining sector. But I have been right in insisting that my subscribers favor Gold over Gold stocks and I continue to favor Gold (and silver) over the companies that dig these metals out of the ground. This is sector analysis, not an individual firm analysis.

Gold stocks are undervalued say the Gold stock bulls. The fundamentals are improving thanks to a rising "real" price of Gold. These things are true. But a "value trap" is believing that things that are cheap can't get cheaper. They can.

Now, I trade Gold stocks, I don't hold them for the long term. My long term investment for this secular precious metals bull market is physical Gold held outside the banking system, and a little bit of silver. Why? Because Gold stocks are not Gold, they are a paper derivative of Gold. And when the poop hits the fan, like it did briefly a few short weeks ago, Gold stocks get thrown out with other stocks. Sure, they may hold up better than base metal stocks or banking stocks, but a break even proposition when Gold is rocketing higher seems like a poor trade to me. I'd rather hold the GLD ETF and make some fiat money rather than be loyal to the Gold stock cause and not make any money.

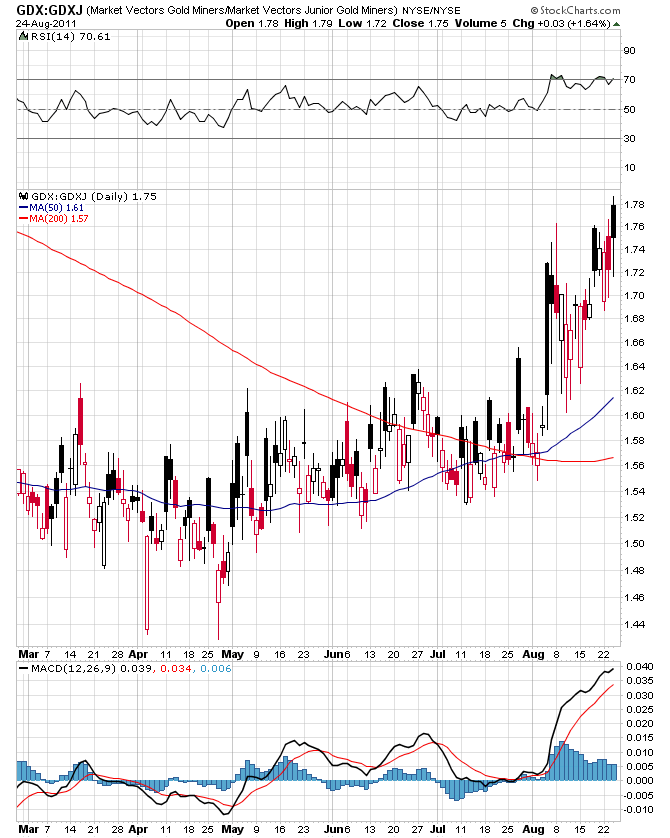

When the Gold sector is healthy and in "proper" alignment, the juniors should be leading the seniors higher. One can use a ratio of the GDX ETF (i.e. the senior miners) to the GDXJ ETF (i.e. the junior miners) to get a sense of whether the seniors or juniors are outperforming. Here's the data during one of the bigger bull runs of this secular Gold bull market (a GDX:GDXJ ratio chart over the past 6 months):

This is the opposite of what a strong Gold stock bull market looks like. Now, the flip side of this argument is that the senior Gold stocks can lead the move and the juniors follow later. Perhaps, but we are not exactly at the beginning of this move in Gold are we? Others would argue that Gold stocks were dragged down by the stock market and thus this is not a fair period to analyze. I would argue that we are headed for a full-on poop storm after this dead cat bounce in common equities completes and that Gold stocks better get used to it!

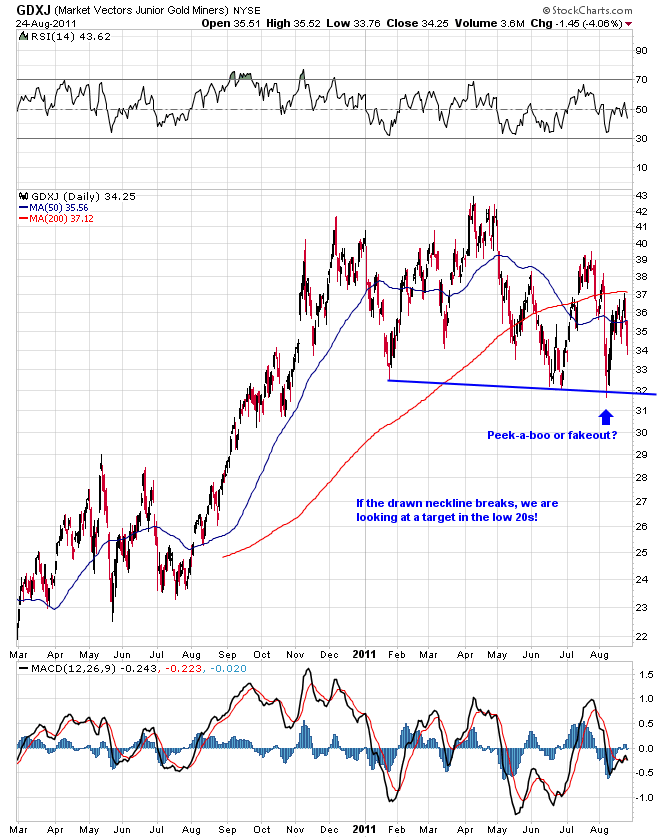

Also, the junior mining sector, as represented by the GDXJ ETF, is clearly showing a big head and shoulders top here, which could of course be negated at any time. For now, though, caution is clearly warranted and hope is not a good strategy. Here's a chart of GDXJ over the past 18 months to show you what I mean:

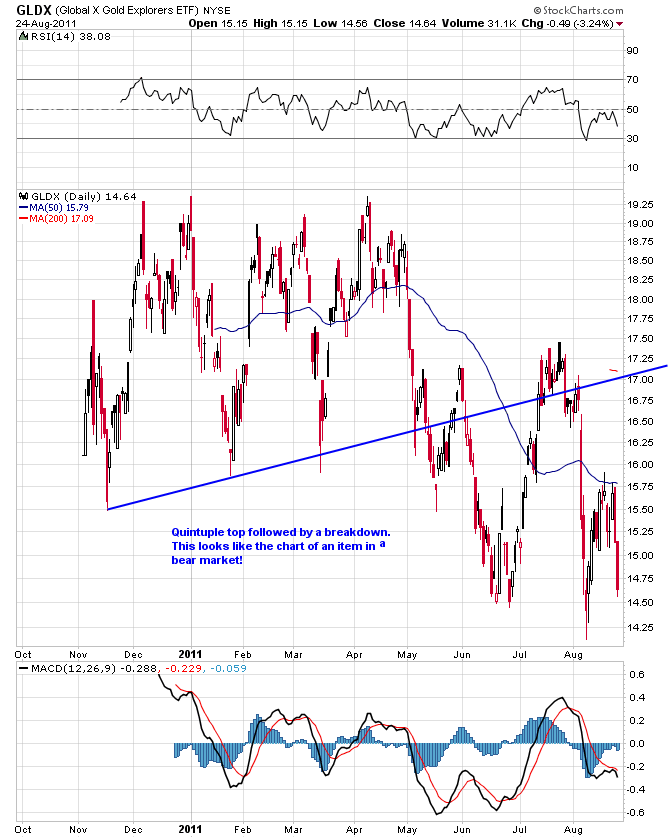

And what of the micro-cap Gold stocks or the explorers? The GLDX ETF, a representation of this sector, looks terrible! Here's a chart of the daily action of GLDX since its inception in early November of 2010:

I am very bearish on the stock market once this bounce in general stock markets completes. I know that this is not 2008, but that is only because the problems are worse and the outcomes in financial markets should be even more severe. Gold is the premier asset class for this cycle. Gold stocks may be on sale again after the carnage is complete and I plan to have some dry powder to buy them if things work out as I think they will. I advise Gold stock bulls to use caution here. If the head and shoulders pattern in the GDXJ ETF reverses, I'll be there to notice and switch to a bullish posture. But for now, I still prefer Gold over Gold stocks.

Few Gold stock bulls realize that some of the best gains in Gold stocks occurred AFTER the Dow to Gold ratio bottomed on a secular basis. It happened in the 1970s and in the 1930s. I am no permabull on the precious metals other than as a long-term buy and hold for the physical metal. Gold and silver stocks are a trade to me, not a religion. Gold, on the other hand, is the anchor of the international monetary system, whether it is officially declared to the sheeple or not. Cash is king during a bear market and there is no better form of cash than that which cannot be conjured up by decree.

If you're crazy enough to trade these dangerous and heavily manipulated markets, consider giving my trading service a try. We trade Gold, silver and Gold and silver stock indices, as well as other markets when opportunities present themselves.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.