The Market Risk-On Trades Are Back

Stock-Markets / Financial Markets 2011 Aug 25, 2011 - 06:23 AM GMTBy: Chris_Vermeulen

The past month investors have been hit hard from the falling stock market. Those who owned gold and bonds have been rewarded. During times of economic fear which leads to selling of stock shares investors and traders find safety in gold and bonds. It was this surge of money coming out of stocks that propelled the price of gold and bonds sharply higher through-out this selloff.

The past month investors have been hit hard from the falling stock market. Those who owned gold and bonds have been rewarded. During times of economic fear which leads to selling of stock shares investors and traders find safety in gold and bonds. It was this surge of money coming out of stocks that propelled the price of gold and bonds sharply higher through-out this selloff.

On Sunday I warned subscribers that any day now gold should start to correct and there is potential for it to drop all the way back down to the $1640 - $1670 area depending how much of the recent buying volume was investment versus speculative money which will quickly sell out if prices began to fall.

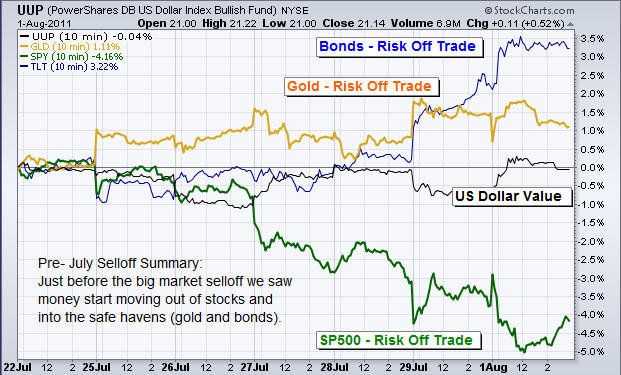

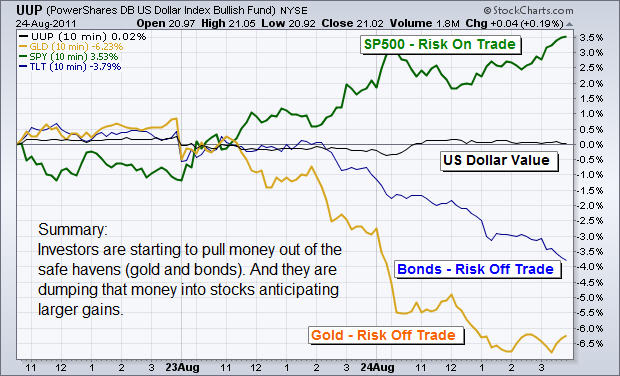

Take a look at the intraday charts below to get a visual of how money is moving around the market and how economic fear plays a roll on investment decisions:

Seven Day 10 Minute Chart Pre-Market Selloff This Past July

Here you can see investors became fearful of the stock market/economic environment. Money started to get pulled out of the high risk (Risk On Trade) equities market and put to work in the Low risk (Risk Off Trade) to earn small but steady income and to help fight inflation (Gold & Bonds).

After this shift the stock market sold off very strong for a couple weeks before finding a bottom.

Three Day 10 Minute Chart Post-Market Selloff – Todays Prices

If you compare these two charts you will notice they are both opposites to each other…

Meaning money is now getting pulled out of the risk off (gold & bonds) and put to work in the potentially high yielding stocks (risk on).This could be the start of a big upside move starting to unfold and I will be keeping my eye on some charts for possible entry points like SPY and TBT.

Mid-Week Trading Conclusion:

In short, the overall market seems to be entering another pivot point. It is likely that another big move is brewing… After this type of technical damage on the charts and heightened fear/emotions out there, it may cause prices to trade sideways in a large trading rage for a few weeks still so I’m not getting overly excited just yet.

Consider subscribing so that you will be consistently informed, have 24/7 Email access to me with questions, and also get Gold, Silver, SP500 and Oil Trend Analysis on a regular basis. Subscribe now http://www.thegoldandoilguy.com/trade-money-emotions.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.