Gold Eyes $2,000, Is it a Bubble Ready to Burst?

Commodities / Gold and Silver 2011 Aug 24, 2011 - 02:47 AM GMTBy: Gary_Dorsch

Even the most avid gold bugs, who’ve been stockpiling vast quantities of the barbaric metal for decades, and endured their fair share of panic shakeouts, were probably in a surreal state of “shock and awe,” while watching the price of the yellow metal soar to within 1% of the psychological $2,000 /oz level this week. It’s as if somebody launched a rocket on the Fourth of July. Since then, the price of gold has soared $400 /oz, zooming higher in a parabolic pattern. After all the bullish chatter on the blogosphere over the past decade, Gold, - the so-called barbaric metal, has triumphed over the stock peddlers on Wall Street.

Even the most avid gold bugs, who’ve been stockpiling vast quantities of the barbaric metal for decades, and endured their fair share of panic shakeouts, were probably in a surreal state of “shock and awe,” while watching the price of the yellow metal soar to within 1% of the psychological $2,000 /oz level this week. It’s as if somebody launched a rocket on the Fourth of July. Since then, the price of gold has soared $400 /oz, zooming higher in a parabolic pattern. After all the bullish chatter on the blogosphere over the past decade, Gold, - the so-called barbaric metal, has triumphed over the stock peddlers on Wall Street.

Undoubtedly, there will always be snake oil salesmen, - who will tout blue-chip stocks as an effective hedge against currency debasement, and a hedge against inflation. Money managers, whose livelihood depends upon selling equities have been taken aback by Gold’s historic surge, and are at a loss to explain to their clients, why they missed the move. “Gold doesn’t have any intrinsic value,” a bewildered money manger declared. “Investing in gold is irrational because, compared to buying a blue-chip stock whose value rises and falls based on what the company produces, and the profit that it earns,” the equity salesmen says.

Thus, for all the talk of the Gold market being in some type of speculative bubble, that could burst at a moment’s notice, a contrary argument points to the fact that vast legions of money managers, have yet to participate in Gold’s long-term secular bull market. Furthermore, there seems to be a misunderstanding about what drives the value of Gold, which essentially is the reciprocal of the public’s trust in the world’s central banks, and their paymasters, - the corrupt and inept politicians, who drive their economies deeper into debt.

Undoubtedly, the skeptics who find comfort in holding paper currency will soon be writing articles in the media, warning that Gold’s latest upward explosion of $400 /oz in just seven weeks, to $1,900 /oz has all the characteristics of a classic bubble that’s bound to burst. Late comers to the game would be left holding a bag of “Fool’s Gold,” and could suffer big losses if purchases are made now, and losses that might never be recouped, - the skeptics say. Yet the most recent buyers might not be small retail investors, but rather the powerful Asian central banks, that control more than $5.5-trillion of foreign currency reserves. They might be shifting their portfolio holdings, from troublesome Euros and US-dollars, and into Gold.

On July 28th, Xia Bin, an adviser to the People’s Bank of China (PBoC) said Beijing should speed up reserve diversification away from US-dollars to hedge against risks of the US currency's long-term decline. Chinese officials have long pledged to broaden the mix of the country's $3.2-trillion currency stash -- as much as 70% of which are now in US- dollar assets, but the process has been gradual. “We will continue to diversify the asset allocation of our reserve assets and continue to optimize the holdings based on market conditions,” China’s Administration of Foreign Exchange said on July 28th.

What many reporters in the Western media, and what many money managers on Wall Street, who are wedded to equities fail to realize, is that 57% of the Gold that was sold by miners in the first quarter of 2011, was shipped to anxious buyers in China and India. Asian giants India and China are the world’s two biggest buyers of the precious metal, because paper money is increasingly worthless in economies where there is runaway inflation. India imported 959-tons of gold in 2010, up +72% from a year earlier, while India’s wholesale price index is +9.5% higher than a year ago. China’s gold demand is on pace to increase by +20% this year to around 700-tons, from 570-tons in 2010.

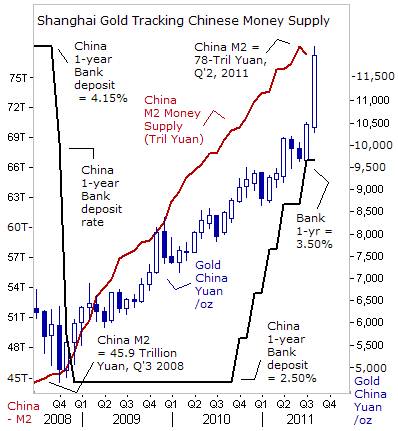

China’s M2 money supply has increased +70% over the past three-years, expanding at an annualized +23%, far exceeding the +9.5% annual growth rate of the Chinese economy. Consumer inflation is reportedly +6.5% higher from a year ago, but China’s citizens say the true rate of inflation is higher than what the government is reporting. Beijing has lifted the 1-year bank deposit rate 125-basis points higher to 3.50%, but that’s still -3% less than the so-called official inflation rate of +6.5%. Therefore, the frenzy for gold has prompted the Chinese central bank to step up sales of gold Panda Coins, to 500,000 1-ounce gold coins, or +66% more than its earlier target of 300,000. It also tripled sales targets for half-ounce, quarter-ounce, 1/10-ounce and 1/20-ounce gold coins to 600,000 each from 200,000 earlier.

Since the near collapse of the Western banking system in 2008, the basic underpinning of the floating currency rate system has been under severe stress, and is still in danger of breaking down. Traders no longer trust central banks to keep their money printing operations running at a slow speed, that’s basically in line with the underlying growth rates of their economies. Instead, central banks in England, Japan, and the US are all heavily addicted to nuclear QE, and the European Central Bank has also joined the club, by agreeing to monetize the debts of five Euro-zone countries, - Greece, Ireland, Italy, Portugal, and Spain.

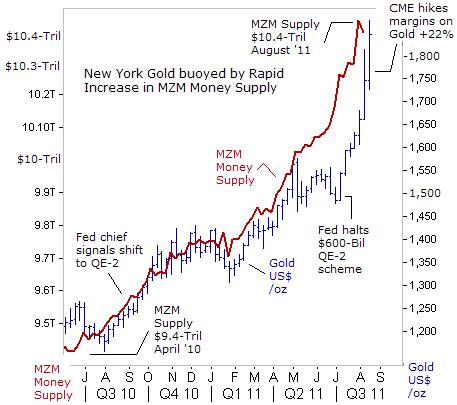

Since the Federal Reserve began to telegraph QE-2 a year ago, the US’s MZM money supply has increased by roughly $1-trillion, buoying the price of Gold. In turn, many central banks in other countries that peg their currencies to the US-dollar were forced to expand their money supplies, in order to keep their currency exchange rate on an even keel with the massively inflated US-dollar. Although the Fed was trying direct most of the high powered money into the US-stock markets, much of it flowed into Gold, Silver, copper, soybeans, corn, rubber, iron-ore, and North Sea Brent crude oil, which is trading around $110 /barrel today.

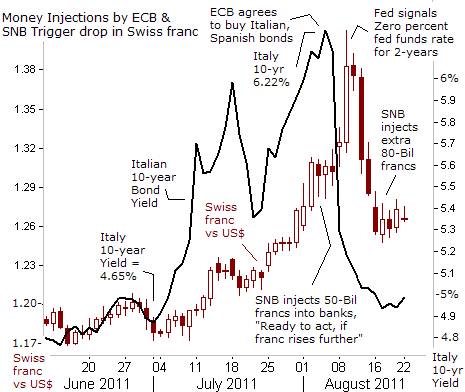

Swiss National Bank Injects 170-Billion Swiss francs into markets

The Swiss franc soared to a once unthinkable $1.40 versus the US-dollar, as traders clamored for a currency that was untainted by the stench of QE. Yet the soaring franc threatens to cause enormous damage to the Swiss economy, which is mostly export oriented, especially sales to the Euro-zone. Upon reaching near parity with the Euro, the Swiss National Bank (SNB) felt compelled to set an upper limit on the value of the franc, and injected an extra 170-billion Swiss francs into the Swiss banking network, thus diluting the value of the franc in relation to other paper currencies, and especially against the price of Gold.

Traders soon found out that trying to find the ultimate safe haven from abusive central bankers is not to be found by hoarding any type of paper currency, no matter how sterling its long-term reputation. After the SNB unleash its plan to dilute the value of the Swiss franc, its currency fell by roughly -10% against the Euro and US-dollar within a matter of a few days. As long as central banks can print endless amounts of paper currency, it can always enforce a ceiling for its currency. The risk of doing so however, is flooding the local economy with a tsunami of paper confetti that could threaten to ignite a new wave of inflation, and in turn, zaps the disposable income of its citizens, and lifts the cost of input prices for local producers.

But with the Swiss economy teetering on the precipice of a recession, an outbreak of inflation is not at the top of the SNB’s list of worries. Instead, the Swiss franc is still perched in a dangerously high territory for the local economy that can hurt companies in all sectors. Already, Swiss export volumes to the European Union, its biggest trading partner, dropped by -14.6% in June. According to a recent study, a 10% appreciation in the franc’s trade weighted value, if sustained, would erode Switzerland’s gross domestic product by roughly -3% after two years. A Swiss Multi-National, with half its earnings in dollars and half its earnings in Euros would see a -15% drop in earnings linked to the effects of the stronger currency.

Helping to take the edge off the Swiss franc, the European Central Bank held an emergency meeting on August 8th, and agreed for the first time to monetize the debts of Italy and Spain, in its boldest attempt yet to tame the sovereign debt crisis. Italian and Spanish bond yields plunged as the ECB entered the market, sending their yields down -1% within a matter of days. That helped to persuade many speculators to lighten-up on the Swiss franc.

Because the ECB will have to spend hundreds of billion of Euros to have an impact on the Italian and Spanish bond markets, it would amount to a huge swelling the Euro money supply, or quantitative easing, which in turn, helped to fuel Gold’s rise to record highs of 1,325 Euro /oz this week. To help cement the Swiss franc’s decline versus the US-dollar and Euro, the SNB said on August 17th, it would inject an extra 80-billion francs into the local banking system, leaving flush with 200-billion francs of excess liquidity.

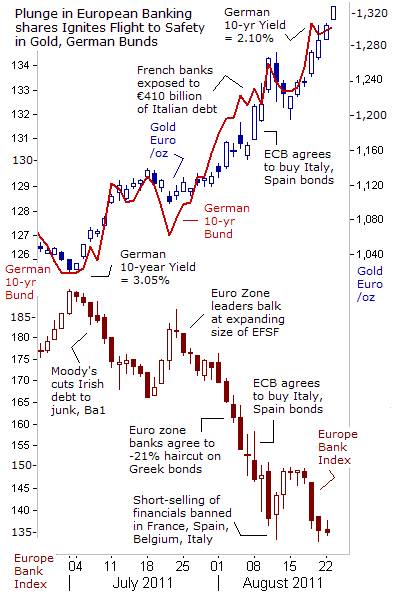

The creditworthiness of European banks is still a major concern because of their heavy exposure to debt in countries such as Spain, Greece and Italy, which are struggling to double digit jobless rates, and buried in economic stagnation. German chancellor Angela Merkel and France’s president Nicolas Sarkozy met in Paris on August 16th, but failed to calm the latest bout of market anxiety. Global equity traders are watching the share prices of European bank stocks slide to their lowest levels since March 2009, and are becoming increasingly alarmed that the Euro-zone crisis could trigger another credit squeeze.

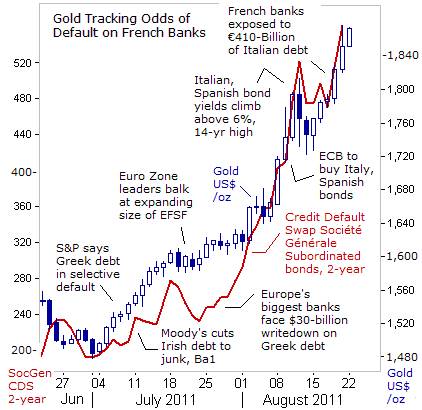

In particular, traders are worried about the exposure of French banks to Greek, Italian, and Spanish debt. French banks own €410-billion of Italian debt, making them the most exposed banks in Europe to the debt crisis in southern Europe. With French banks alone holding more of their debts than the entire €440-billion European Financial Stabilization Fund (EFSF) originally designed to bailout Greece, Ireland, and Portugal, a default by either Italy or Spain would likely bankrupt the French financial system. Under these conditions, French financiers and politicians are insisting that the ECB print Euros to buy Italian and Spanish bonds.

The Euro-Stoxx Banking index has tumbled by -38% in the past six months, led by Britain’s Barclays, Germany’s Commerzbank, and the top French banks. Overall, the Euro-Stoxx banking Index is -75% below its peak value in 2007. Société Générale’s share price has lost -45% over the past 2-½ -weeks, BNP’s share price has plunged -29%, and Credit Agricole has lost -38-percent. Seeking a safe haven from the perceived risk of Euro-zone banks, many Europeans investors are plowing their safe money into both German Bunds and Gold. In a virtuous cycle, as the German Bund’s yield drops further below the Euro-zone’s inflation rate, it makes Gold an increasingly more attractive alternative.

Over the past seven weeks, the price of Gold has also been tracking the cost of insuring the subordinated debt of perceived risky banks, such as Société Générale. The cost of credit default swaps (CDS) to insure €10-billion of SocGen’s debt for the next two-years has soared to €540,000. At the same time, the value of SocGen’s shares has shrunk from €110-billion in April 2007 to just €17.2-billion today, placing it behind companies like cosmetics maker L’Oreal and dairy producer Danone.

And it’s not just the European banks that are in trouble. The cost of insuring Bank of America’s subordinated debt against the odds of default, an indicator of potential trouble, rose to $436,000. BofA’s shares fell to as low as $6 /share on August 23rd, it’s lowest since March 2009. More than $32-billion of the company's market value has been wiped out since August 3rd. President Barack Obama has never understood that there can be no US-recovery until housing prices stabilize. Printing more money will not help when 3.5-million foreclosures are stacked in the pipeline, and continue to depress house prices and create more bad debts. In turn, consumer confidence has plunged to its lowest since the Great Depression.

Tokyo Prepares major Money Printing Operation

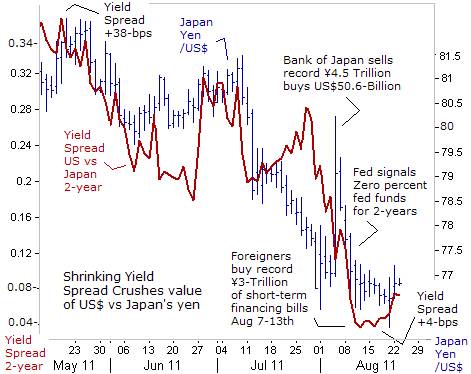

In Tokyo, Japan’s Finance chief Yoshihiko Noda is threatening to take decisive action if needed in foreign-exchange markets, with the US-dollar pinned at ¥76.50, a record post-World War II low, where Japan’s financial warlords have drawn a line in the sand. “I have become more concerned about the worsening of the yen’s one-sided movements. I will take bold actions if necessary and won’t rule out any possible options,” Noda said. However, massive intervention has failed to turn the tide against the beleaguered US-dollar, which is hanging on a thread.

On August 5th, the Bank of Japan injected about ¥4.5-trillion, into the foreign exchange market, its largest intervention operation on record, which for just a brief moment, lifted the US-dollar ¥2.5 higher to above ¥80. However, four days later, the US-dollar tumbled to ¥76.50, after the Fed pledged to keep the federal funds rate locked near zero-percent for the next two years. As a result, the yield on the US Treasury’s 2-year note fell to a record low of basis points above Japanese 2-year yield, weakening the value of the US-dollar.

Ironically, foreign investors bought a record ¥3-trillion of Japanese short-term bills, during the week ending August 16th, negating 2/3’s of the BoJ’s intervention, while their net selling in Japanese equities hit the highest in more than a year. Japan’s economy is buried deep in a recession, contracting for a third straight quarter, at an annualized -1.3% rate. To offset lackluster demand at home Japanese Multi-Nationals have increasingly relied on exports to drive growth. But exports dropped -5% during the latest quarter, the sharpest decline in more than two years, due to a strong yen, and slowing overseas economies.

Another round of QE-3 would be devastating for Japan, and America’s #2 financier will argue strenuously against it at the upcoming festival at Jackson Hole, Wyoming. “We must steer the economy very carefully, because we still have downside risks including the problem of the rising yen,” Noda warned. With the Fed pegging the fed funds rate at zero-percent for the next two years, the BoJ would probably have to dump ¥25-trillion into the money markets in order to prevent the US-dollar from falling below 76-yen. Most likely, the intervention won’t be sterilized, and would help to support the price of Tokyo Gold. Japan’s ministry of finance is expected to recycle its intervention stash into US Treasuries, to help finance America’s budget deficit, yet is might start to surprise the markets, by shifting some funds into Gold.

Is Gold in a Bubble that’s Ready to Burst?

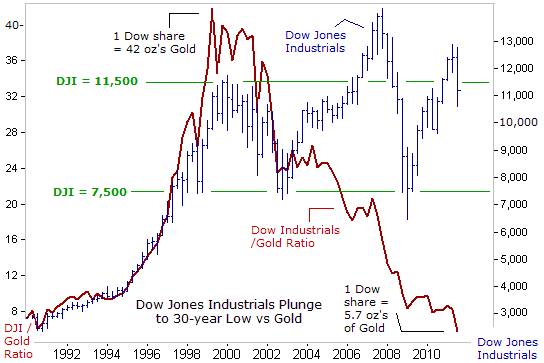

Nowadays, there’s an overload of information that floods into the marketplace each day, - via the internet and other news channels, and it’s easy to become distracted. The average memory span of a S&P-500 trader lasts about 24-hours. Emotions are headline driven, and buying and selling is based on the flavor of the day, with little long-term conviction about anything. But before listening to the naysayers that say the Gold market is a bubble that’s ready to burst, - take a quick look back at history.

It was 12-years ago, when the Dow Jones Industrials first crossed the 11,000-level, roughly where it resides today. During the Dow’s “Lost Decade of Growth,” its been trapped within the confines of a secular bear market, - that is to say, gyrating violently within a sideways trading range, yet ending up, going nowhere. Twelve-years ago, 1-Dow Industrial share could purchase the equivalent of 42-ounces of Gold. Today, 1-Dow Industrial share can only fetch 5.7-oz’s of Gold. When seen through the prism of Gold, the Dow Jones Industrials have failed to act as an effective hedge against monetary debasement by the Federal Reserve, contrary to the traditional sales script on Wall Street.

The historic rise of gold towards $1,900 /oz this month occurred on the 40th anniversary of President Richard Nixon’s decision to end the decades-long fixed relationship between the value of the US-dollar and the price of gold, - at $35 /ounce. When Nixon closed the gold window, the US-dollar was essentially backed by the US Treasury’s willingness to defend the purchasing power of the greenback. Gold began to rise and fall freely, and a system of floating exchange rates tied to the US-dollar was ushered in, - an arrangement that gave the US-dollar a privileged position, due to its economic super power status.

Since then, the US-dollar has lost more than 98% of its purchasing power compared to Gold. Furthermore, global confidence in the US-dollar has progressively eroded as the US has gone from being the world’s biggest creditor nation to its biggest debtor. The recent downgrading of the US Treasury’s debt to A+ by China’s rating agency is a watershed event signaling the inexorable decline of the US-dollar as the world’s reserve currency. America’s industrial base has withered away, and the US is now a food stamp nation - with almost 46-million of its citizens receiving food stamps, equaling 15% of the US-population.

A US-family of four can receive $668 /month for food stamps that cost US-taxpayers about $68-billion /year. The alternative, without food stamps, would be riots in the streets across America, similar to what we’ve seen in Cairo and London this year. Furthermore, one in four Americans receives a check from the US-government each month, and half of its citizens pay no federal income tax at all, while the US’s national debt is scheduled to increase by $2-trillion over the next 18-months to $16.3-trillion, equaling about 110% of its GDP.

On August 8th, Beijing has lashed out at the US’s “addiction to debt,” in a stinging English-language commentary carried by the official Xinhua news agency that it had “every right to demand Washington address its structural debt problems and safeguard China’s dollar assets. Washington needs to come to terms with the painful fact that the good old days when it could just borrow its way out of messes of its own making are finally gone. To cure its addiction to debts, the US has to re-establish the common sense principle that one should live within one's means,” Xinhua said. The fear that China might no longer finance America’s burgeoning debt, prompted US vice president Joe Biden to meet with Chinese leaders this week.

If Beijing balks at financing the US-government’s debt, it would put great pressure on the Fed to begin monetizing more of the US-Treasury’s debt, with several more rounds of QE. “Printing more money to play politics at this particular time in American history is almost treasonous in my opinion. Because we’ve already tried this, and all that it’s doing is devaluing the dollar in your pocket. And we cannot afford that. We have to learn the lessons of the past three years,” said the governor of Texas, Rick Perry on August 16th.

Some traders might view the unleashing of QE-3 as a “Bernanke Put,” or the idea that the Fed will always print more money after a big stock-market decline. On August 17th, Richard Fisher, the Dallas Fed chief, warned the Fed “should never enact such asymmetric policies to protect stock market traders and investors. The policy won’t help spur growth,” he said. Philadelphia Fed chief Charles Plosser said unleashing QE-3 after the S&P-500 tumbled -18%, would “signal that we are in the business of supporting the stock market.”

Wall Street money managers are betting that Bernanke begins to print money again, to help bail them out of risky bets that went sour. Yet if this wish comes true, it could send the price of North Sea Brent crude oil soaring to $150 /barrel, which in turn, could push the world economy into a sharp downturn. In that case, would you rather own Gold or the Dow Jones Industrials? Yet it might be the case that Gold is technically overbought after a parabolic increase to $1,900 /oz, and a sizeable pullback would wipe-out the speculative froth. Long-term Gold bugs have seen that movie before.

Fed chief Bernanke could throw a curve ball, by not hinting at QE-3 at Jackson Hole, Wyoming, causing a shake-out in Gold, but also knocking the S&P-500 into bear market territory. However, looking at the bigger picture, Asian central banks are just beginning to swap out of US-dollars and Euros, and shifting more of their portfolios into Gold. Undoubtedly, the Fed, the Bank of England, the Bank of Japan, and the ECB, will find ways to keep printing money to monetize debts of bankrupt governments, and lock short-term interest rates at near zero-percent, and pegged far below the inflation rate. Thus, Gold is probably still in the midst of a long-term secular bull markets that can last for several more years.

“You have to choose between trusting the natural stability of Gold and the honesty and intelligence of members of the government. With due respect for these gentlemen, I advise you, as long as the capitalist system lasts, to vote for Gold,” George Bernard Shaw, 1928.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2011 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.