Dow Jones-AIG Commodity Index rebalancing Generates Significant Price Movements

Commodities / Resources Investing Dec 06, 2007 - 09:08 AM GMTBy: David_Urban

Every year, the Dow Jones-AIG Commodity Index (DJAIG) rebalances for the upcoming year. This is significant for investors in that the DJAIG is followed by many investors looking to obtain commodity exposure. Exposure can be obtained through various investment vehicles created to mirror the index and rebalancing of the indices can create significant price movement as they occur.

Every year, the Dow Jones-AIG Commodity Index (DJAIG) rebalances for the upcoming year. This is significant for investors in that the DJAIG is followed by many investors looking to obtain commodity exposure. Exposure can be obtained through various investment vehicles created to mirror the index and rebalancing of the indices can create significant price movement as they occur.

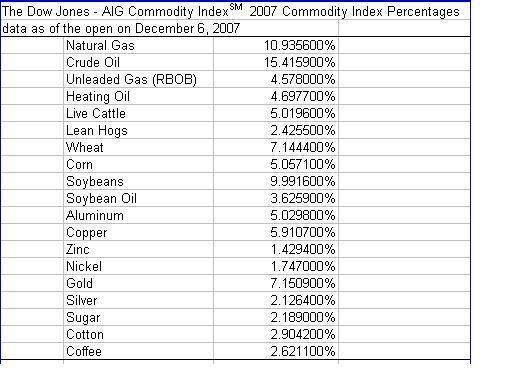

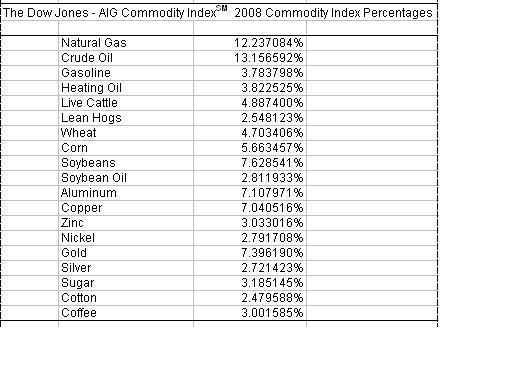

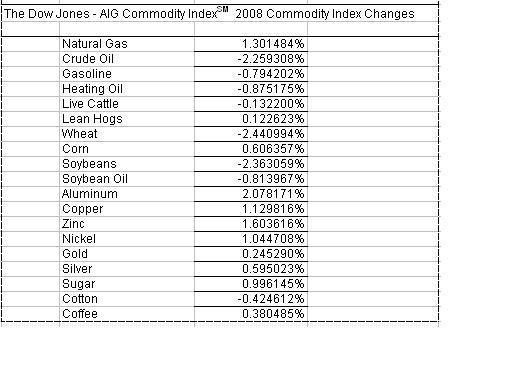

The graph below shows the commodity index percentages for 2007 and 2008 with the changes in the final graph.

As shown above, the index will be rebalancing to more heavily favor aluminum, zinc, and natural gas while wheat, soybeans, and crude oil will see their weightings drop the most. While this may not set a trend for 2008 it is worth noting that the indices will be reweighing over the next month and this may cause some odd and unexplained price moves as positions are rebalanced.

Source: Dow Jones Indexes website

http://www.djindexes.com/mdsidx/?event=showAigHome

http://www.djindexes.com/mdsidx/index.cfm?event=showAigWeightings

By David Urban

http://blog.myspace.com/global112

Communications are intended solely for informational purposes. Statements made should not be construed as an endorsement, either expressed or implied. This blog and the author is not responsible for typographic errors or other inaccuracies in the content. We believe the information contained herein to be accurate and reliable. However, errors may occasionally occur. Therefore, all information and materials are provided "AS IS" without any warranty of any kind. Past results are not indicative of future results.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN THE STOCK, BOND, AND DERIVATIVE MARKETS. WHEN CONSIDERING ANY TYPE OF INVESTMENT, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Before making any type of investment, one should consult with an investment professional to consider whether the investment is appropriate for the individuals risk profile.

David Urban Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.