Gold Season Starting Soon!

Commodities / Gold and Silver 2011 Aug 18, 2011 - 12:09 PM GMT There is a gold season but it has been changing its character for a while now, being swamped by the structural changes the gold world has experienced particularly over the last few years. To see the impact of the gold season may not be as easy as it was before. What is this gold season and what are the changes that are affecting its impact on the gold price now?

There is a gold season but it has been changing its character for a while now, being swamped by the structural changes the gold world has experienced particularly over the last few years. To see the impact of the gold season may not be as easy as it was before. What is this gold season and what are the changes that are affecting its impact on the gold price now?

Gold Season

The Developed West

At the moment we are finishing gold's year with the doldrums because of the lack of activity in the global gold retail market. It is ending at the end of August once two activities come to a close in the world. In the developed (i.e. northern hemisphere) world the summer holidays are winding down, a season where gold products are low on the priority list of consumers. Their attention will next be focused on gold towards the year's end when the present-giving festive season is underway. By then the shelves must be full of beautiful jewelry for spending consumers. In Asia the Indian harvest is underway; it should be completed by the end of August.

The Developed World

The jewelers returning from holiday must first buy the gold for manufacturers to work on. Agreeing the price/shipping/delivery work on prepared designs, then shipping to the markets and putting on show all follows, so by October/November the shoppers can buy. Of course, working capital constraints and an elongated sales pattern demands that this is an ongoing flow through to that time, not one bulk movement, so the period can start at the end of August through early September and flow right through to the end of December.

Indian Sub-Continent

August is the harvest period for India where, in the past, 70% of demand came from the agricultural sector. Once their harvest is in, their products are sold as quickly as possible -tax free on agricultural products, but not on the investments made from that income--and placed in farmer's hands. Indians deal in cash; they don't like government or taxation and prefer to keep their financial lives to themselves -as far out of sight as possible. The best way in India to squirrel away money is in gold and property, the twin backbones of Indian financial life.

Again gold is not bought in one go, but at auspicious times during September through May of the following year. The high points of this gold buying are when individual festivals are celebrated, with the first peak in October at the Festival of Lights; marriage season, however, runs through this period all the way through May. It is at marriages where gold is given as a dowry to the groom. While the groom owns the new family's assets, it is the bride who brings the working capital to the union, through the gifts of gold.

With the income from the harvest boosting the family's finances arriving from the middle of August onwards, Indian investors turn to the gold market. With the price of gold rising as it has over the last 6 years, poorer farmers now turn to silver -the "poor man's gold"--to fulfill the same purpose.

Differences

These are the prime driving forces in the gold season from global retailers, but they do differ. In the West, gold is simply used to enhance diamonds and precious stones, at the more expensive end of the market. At the cheaper end of the market, in simpler rings, it is 'diluted' with other metals to harden it and to lower the price (i.e. 9 carat or 18 carat jewelry). Used in India as jewelry, expect to find pure gold (i.e. 24 carat) used. An investor would on occasion buy the gold and deliver it to the jeweler who would then work it. Any gold left over, together with the finished product, would be weighed to check that the initial weight of gold delivered to the jeweler was still there.

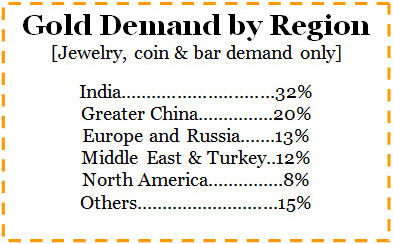

Take a look at the Table above; it helps to give a sense of proportion as to which areas are really the important centers in the gold world. It is thought that there are over 20,000 tonnes of gold in India, built up over time. In the past, India was the center of the gold retail world, but changes are taking place rapidly in the shape of the gold world today.

In summary, September marks the start when gold demand rises fast to include the world's jewelry peak season.

Coming Changes

China

The above picture persisted until around five years ago. Then the red dragon started to rise, and demand from China's retail side and central bank started to appear. It has grown almost exponentially since then, in line with the growth of Chinese middle classes, which is growing at a faster pace than the Chinese economy. What growth can we expect in demand for gold from the Chinese Middle classes? With a population of 1.2 billion Chinese, the middle classes will make up approximately 25% of the nation eventually. This number equates to the entire population of the U.S.A. By far the greater bulk of these are savers who are spending an increasing amount of their savings on gold, intending to hold gold for the long-term as financial security, not as a source of profit. Expect the demand for gold from China to overtake that from India either in 2011 or 2012 from the retail side alone.

Chinese demand has no season; it is an all-year-round demand. It has a tendency to come in when the gold price is on the rise. Indian demand prefers to come in when a 'floor' price has been established after a consolidation period.

Central Banks

The most significant demand to enter the market in the last two years is having a marked effect on the gold price -this is central bank demand. Such demand is long-term and relatively price insensitive. Its aim is to increase the gold content of a nation's reserves. Consequently, it will not chase prices but will react when offered reasonable quantities of gold. That's why we see shallow pull-backs in prices after sharp rises.

Last week has shown at worst a 4% pull back in the gold price when leading equity markets were falling by considerably more. With tradition telling us that gold is volatile, we are watching limited volatility while other traditionally non-volatile markets show considerable volatility. This was due to very large buyers, buying the gold that was put on offer as prices fell. The moment demand returns, the availability of gold drops, forcing buyers to pay up for their gold.

Central bank demand is now global, but excludes the developed world. The developed world is responding to the decay in the value of currencies but a cessation of gold sales. Their grip on the gold is getting tighter. Add the cessation of European central bank gold supplies to new central bank demand and you have a considerable potential force of demand able to dominate the supply of gold.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2011 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazin![]() es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.