Gold Over $1808 May Be Poised for Parabolic Rise, West Not Prepared for Possible Currency Crisis

Commodities / Gold and Silver 2011 Aug 18, 2011 - 11:53 AM GMTBy: GoldCore

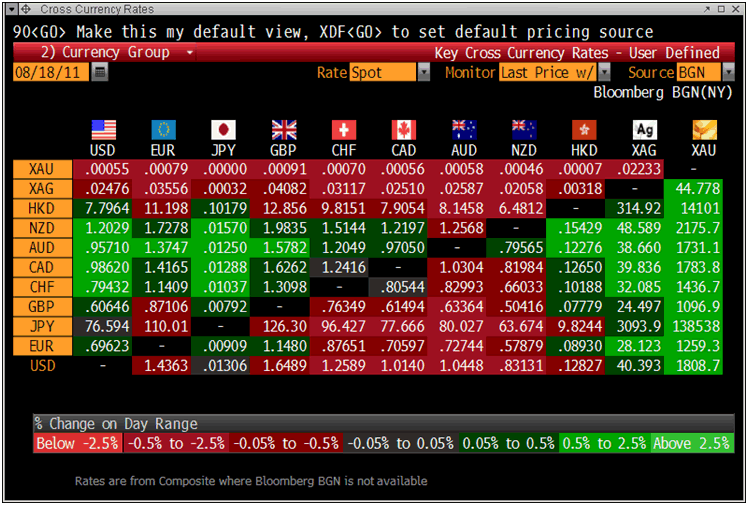

All major currencies have fallen sharply against gold again today but especially the ‘commodity’ fiat currencies of the Australian, New Zealand and Canadian dollar. Swiss francs are also under pressure again today.

All major currencies have fallen sharply against gold again today but especially the ‘commodity’ fiat currencies of the Australian, New Zealand and Canadian dollar. Swiss francs are also under pressure again today.

Gold is trading at 1,808 USD, 1,259.10 EUR, 1,096.40 GBP, 1,436.90 CHF and 138,510 JPY per ounce.

The London AM fix was a second consecutive record nominal high in USD. Gold’s London AM fix this morning was USD 1,794.50, EUR 1,246.44, GBP 1,087.12 per ounce (from yesterday’s USD 1,792.00, EUR 1,240.39, GBP 1,089.96 per ounce).

Cross Currency Table

In my interview this morning on Bloomberg, the interviewer picked up on our recent suggestion that gold could go parabolic soon. Indeed, we said that it is likely not a question of if - but rather when.

A short interview is not conducive to informing people and therefore we wish to elaborate about a possible parabolic move.

Bull markets almost always end in a mania phase where there is a near universal belief that an asset class or security is going to rise and there is no risk involved.

This has been seen throughout history and was seen with the Nikkei, the Nasdaq and more recently with property markets in Ireland, the UK and the U.S.A.

It was also seen with gold in the 1970s when gold increased 128% in 1979 alone. On January 2nd 1979 gold’s London AM Fix was $227/oz. By the 31st of December, gold’s London AM fix was $524/oz.

21 days later gold had increased another 60.9% to $843/oz.

This is parabolic.

Today’s 27% rise year to date in dollar terms is very tame in comparison.

The blind belief that an asset class, security or currency is a one way path to financial nirvana always leads to a bubble and the bursting of that bubble.

Today there is no such blind belief. Gold remains the preserve of the smart money - those who know their financial and economic history.

It is also the preserve of those who understand the importance of real diversification due to the risks posed by currency debasement and inflation.

Bloomberg: Gold Prices May Be Poised for 'Parabolic' Rise

The largest buyers of gold today are institutions seeking to diversify themselves and protect themselves from currency debasement and the risks of depreciation of major currencies such as the dollar, euro and pound.

Sentiment remains muted and every single little scrap of potentially bearish news is greeted as a sign of the top or a bubble – whether it be cryptic statements from George Soros or the odd gold ATM globally.

One article from Bloomberg entitled ‘Gold Demand Falls 17%: World Gold Council’ was sent to me by a large number of clients and associates this morning alone.

Some are genuinely concerned that gold might top out at these levels. Others have been bearish and wrong in recent months and there is a large degree of confirmation bias going on here – and has been for some time.

Others simply do not own the asset class and fear they are missing the boat. Some are envious of others managing to protect themselves as unfortunately they may not be in a financial position to do so.

Other excellent Bloomberg articles this morning that are more bullish such as ‘Venezuela Gold Move Shows Foreign-Storage Discomfort, UBS Says’, ‘Gold Allocation of 10% Will Work in Any Scenario, Goldcore Says’ or ‘China Gold Investment Demand Jumps 44% on Rising Inflation’ were not forwarded.

More nuanced articles in our news section today were not forwarded.

This is a small but relevant sample of the sentiment towards gold. Many are nervous about gold at these record nominal highs and some are downright bearish (and some have been since gold reached the nominal high of $850/oz).

There is not a universal acceptance yet that the majority of people in the western world should own some gold bullion - physical coins and bars owned personally or stored in the safest way possible.

Quite the opposite – Joe and Josephine public have been selling the “family gold’ in the global phenomenon that is ‘cash for gold’.

This is in marked contrast to the Middle Eastern and Asian world where owning gold as a store of wealth is the norm due to their experience of currency debasement.

The emirate of Dubai’s launching of a 5 ounce bullion coin is another indication that demand from the Middle East is set to remain robust and may surprise to the upside.

The conditions today are more bullish than they were in the 1970’s for a whole variety of reasons which we have looked at in recent weeks.

One fundamental reason is the emergence of China and Chinese demand for gold. There was no Chinese demand for gold in the 1970s.

The unrealized, important fact that the people of China were banned from owning gold bullion from 1950 (by Chairman Mao) to 2003, means that the per capita consumption of over 1.3 billion people is rising from a tiny base.

Many market participants and non gold and silver experts tend to focus on the daily fluctuations and “noise” of the market and not see the “big picture” major change in the fundamental supply and demand situation in the gold and silver bullion markets – particularly due to investment and central bank demand from China and the rest of an increasingly wealthy Asia.

Another factor today that was not present in the 1970s is a global debt crisis that is threatening the global financial, economic and monetary system.

The vast majority of people in much of the western world are not prepared for the real possibility of continuing global currency debasement.

Owning gold is like owning car or health insurance. You do not stop buying insurance because the premium goes up. You shop around and get the best insurance at the best price.

The price may fall or rise (although given current conditions it is unlikely to fall in the medium and long term) but one needs to own it in order to protect oneself and one’s families financial future.

With all the focus on the nominal price of gold, the value of gold is still not understood by the majority in the western world today.

It will be soon.

For the latest news and commentary on gold and financial markets please follow us on Twitter.

SILVER

Silver is trading at $40.42/oz, €28.12/oz and £24.48/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,837.00/oz, palladium at $765/oz and rhodium at $1,750/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.