How the Economic Stimulus Racket Works

Politics / Economic Stimulus Aug 16, 2011 - 12:27 PM GMTBy: MISES

Charlie Virgo writes: Have you ever noticed that the failed policies of politicians never really seem to be brought to light? How is it that despite their obvious shortcomings, the same policies are implemented time and time again? These interventions rarely have the promised effects, but they are somehow still deemed a success. In his book The Vision of the Anointed, Thomas Sowell explains the process by which politicians and their supporters are able to either create or take advantage of crises in order to increase their involvement in society. I thought it would be worthwhile to review this pattern as it applies to a more recent issue: the stimulus and bailout packages.

Charlie Virgo writes: Have you ever noticed that the failed policies of politicians never really seem to be brought to light? How is it that despite their obvious shortcomings, the same policies are implemented time and time again? These interventions rarely have the promised effects, but they are somehow still deemed a success. In his book The Vision of the Anointed, Thomas Sowell explains the process by which politicians and their supporters are able to either create or take advantage of crises in order to increase their involvement in society. I thought it would be worthwhile to review this pattern as it applies to a more recent issue: the stimulus and bailout packages.

Starting with President Bush, and continuing into President Obama's term, the US government has paid out more than $11 trillion in stimulus money. Remarkably, there are many who believe that amount still wasn't sufficient. This article will show that both presidents believed the additional government intervention would solve our economic problems, not realizing that it was exactly that type of thinking that had led to the problems in the first place. The stimulus package has already passed through Dr. Sowell's pattern of failure, making it an excellent example for review. In even more current issues, such as the debt-ceiling increase, we are already beginning to see the early phases of the pattern. It is important that we understand this pattern so that we can identify and oppose measures that are contrary to the principles of true economic progress.

Starting with President Bush, and continuing into President Obama's term, the US government has paid out more than $11 trillion in stimulus money. Remarkably, there are many who believe that amount still wasn't sufficient. This article will show that both presidents believed the additional government intervention would solve our economic problems, not realizing that it was exactly that type of thinking that had led to the problems in the first place. The stimulus package has already passed through Dr. Sowell's pattern of failure, making it an excellent example for review. In even more current issues, such as the debt-ceiling increase, we are already beginning to see the early phases of the pattern. It is important that we understand this pattern so that we can identify and oppose measures that are contrary to the principles of true economic progress.

Dr. Sowell has divided the pattern of policy failure into four sections: the "crisis," the "solution," the results, and the response. He defines them in this way:

Stage One: The "Crisis." Some situation exists, whose negative aspects the anointed propose to eliminate. Such a situation is routinely characterized as a "crisis," even though evidence is seldom asked or given to show how the situation at hand is either uniquely bad or threatening to get worse.

Stage Two: The "Solution." Policies to end the "crisis" are advocated by the anointed, who say that these policies will lead to beneficial result A. Critics say that these policies will lead to detrimental result Z. The anointed dismiss these critical claims as absurd and "simplistic," if not outright dishonest.

Stage Three: The Results. The policies are instituted and lead to detrimental result Z.

Stage Four: The Response. Those who attribute detrimental result Z to the policies instituted are dismissed as "simplistic" for ignoring the "complexities" involved, as "many factors" went into determining the outcome. No burden of proof whatever is put on those who had so confidently predicted improvement. Indeed, it is often asserted that things would have been even worse were it not for the wonderful programs that mitigated the inevitable damage from other factors.

Stage One: The "Crisis"

President Bush introduced his bailout legislation on the grounds that "without immediate action by Congress, America could slip into a financial panic." Banks and other lending institutions possessed "toxic assets" and were either unable or unwilling to lend. By purchasing the assets and providing capital to the troubled banks, President Bush believed that it would steady the economy. In his official address he explained, "In the short term, this will free up banks to resume the flow of credit to American families and businesses, and this will help our economy grow." He claimed to support free enterprise, but then allowed banks to avoid the consequences of their bad investments.

In the case of the stimulus, the "crisis" was twofold: a high unemployment level and a lack of consumption. Neither of these situations actually constituted a crisis, however. In fact, they can be explained as necessary steps toward economic recovery. As the Austrian business-cycle theory explains, the higher unemployment rate is mostly due to malinvestment caused by the previous years of credit expansion. When the credit stream dried up, inefficient and unnecessary businesses were forced to close shop. Barring intervention, the capital that the bankrupt firms held would be freed up and the remaining companies would then be able to expand their operations, leading to hiring.

In this way we can see that unemployment is a byproduct of the healing process for the economy, as we correct what was wrong with it. Focusing on the unemployment rate is putting the cart before the horse. There was never any need for action on the part of the government; everything would have sorted itself out naturally. President Obama didn't see it that way, however. In a February 2009 op-ed defending the stimulus plan, he wrote,

By now, it's clear to everyone that we have inherited an economic crisis as deep and dire as any since the days of the Great Depression.…

And if nothing is done, this recession might linger for years. Our economy will lose 5 million more jobs. Unemployment will approach double digits. Our nation will sink deeper into a crisis that, at some point, we may not be able to reverse.

He wasn't alone in this belief, either. He was merely echoing the words that President Bush spoke six months earlier. Many people believed that if something swift wasn't done, the economy was going to tank indefinitely. These were the same people who didn't see the recession coming in the first place, but that point never seems to have been brought up. To solve the "crisis," the "experts" explained that a stimulus would solve all of our woes. The fact that another stimulus was even being discussed is evidence that President Bush's stimulus and bailout were failures, but again, that seemingly wasn't a point worth mentioning at the time.

Stage Two: The "Solution"

With such dire descriptions of the economy, one might think the goals for the stimulus would be tempered. President Obama defended his position for a $787 billion stimulus in the February 2009 op-ed, saying

We will create or save more than 3 million jobs over the next two years, provide immediate tax relief to 95 percent of American workers, ignite spending by businesses and consumers alike, and take steps to strengthen our country for years to come.…

It's a strategy that will be implemented with unprecedented transparency and accountability, so Americans know where their tax dollars are going and how they are being spent. (emphasis added)

To his credit, President Obama was more specific with his goals than President Bush was, but were they realistic goals? In addition to these promises from President Obama, his top economic advisors guaranteed that the stimulus plan would prevent unemployment from reaching 8 percent. The stimulus plan was to be a cure-all for the economy. Fortunately, there were voices of reason ringing out as well. The Mises Institute put together a "Bailout Reader" providing various articles on the fallibility of the stimulus plan. Opponents of the stimulus and bailout plans were criticized as old-fashioned or ignorant. This is part of the pattern of failure. If you disagree with the leftists and their "solution," you are labeled as simple. Just read the comments section of any article regarding the tea party to see what I mean. Or we can go back to the president's piece.

In recent days, there have been misguided criticisms of this plan that echo the failed theories that helped lead us into this crisis — the notion that tax cuts alone will solve all our problems; that we can meet our enormous tests with half-steps and piecemeal measures …

In other words, the stimulus plan is perfect and therefore any criticisms of it must be misguided echoes of failed theories.

Stage Three: The Results

Before analyzing the results of the stimulus plan, it is beneficial to review the results that were expected from it:

- 5 million jobs created,

- Unemployment won't rise above 8 percent,

- Immediate tax relief to 95 percent of American workers,

- Ignite business and consumer spending,

- Strengthen the economy for years to come, and lastly

- Unprecedented accountability and transparency.

So how did the stimulus plan do?

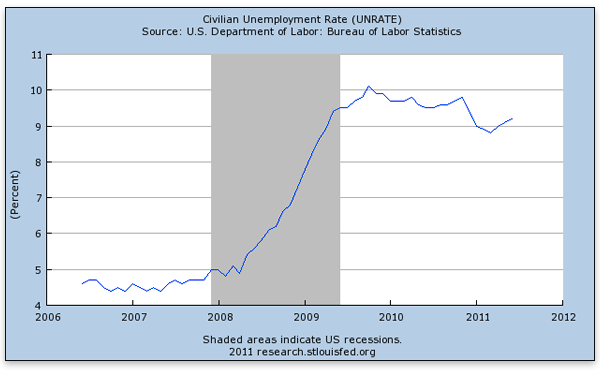

During President Obama's first year in office, 4.2 million jobs were actually lost. This is more an indictment of President Bush's policies, though, because President Obama's ideas still hadn't been fully enacted. However, in the two years since the stimulus plan only 722,200 jobs have been created. In other words, there is a net job loss of 3.5 million within the time frame that President Obama himself established. It was January 2009 when Obama's guarantee regarding the unemployment rate was given. As the following chart shows, the rate had been increasing steadily since early 2008 and was quickly approaching 8 percent by early 2009. It didn't take long for the 8 percent promise to be broken, though, and the unemployment rate has been in the 9 percent range longer than it was in the 8 percent range. The most recent data puts the rate at 9.1 percent.

Of the $787 billion (later to be calculated at $830 billion), 35 percent was dedicated to tax cuts. To the president's credit, 94.3 percent of working Americans saw a decrease in their taxes due to the stimulus plan. This is a faux tax cut, however, since the money that would have been collected in taxes is now being collected through lending. And how will the lending be paid back? Through taxes, of course. While this sounds suspiciously having your cake and eating it too, in our case we are only evaluating whether the stated goal was met, and in this case it was.

Consistent with the Keynesian belief that the government should step in if national consumption dips, it was important for the Obama administration to point out that consumer and business spending would increase with his plan. The stimulus would act as a "spark plug" to "jump-start" the economy. Once again, however, we see that the exact opposite has happened. Instead of increasing the amount of spending, the stimulus actually increased the amount of savings. Legitimate savings are, of course, the true path to recovery, so it's not a bad thing that the savings rate is increasing. Once again, though, my purpose is not to debate whether savings are good or bad, but whether the stimulus supporters' predictions came true.

So far we've seen that of four goals, only one was reached. As we review President Obama's pledge to "strengthen our country for years to come," the tally will decrease further to one of five. The recent debt-ceiling debates have highlighted just how fragile our economy is. Even though the debt burden was increased, all three major rating companies (Standard & Poor's, Moody's, and Fitch) warned of a downgrade if serious efforts weren't made to reduce the deficit. Standard & Poor's acted on that warning, downgrading the United States for the first time in its history.

Staying true to the pattern of failure, however, White House officials blamed "flawed math" for the downgrade, not the $14.5 trillion in debt. The fact that there are record numbers of people receiving food stamps certainly isn't indicative of a strengthening economy either. Passing the stimulus plan didn't strengthen our economy; it simply deadened the country's nerves to numbers that we hadn't seen before. The stimulus plan was the beginning of a spending spree that still hasn't ended. Thus, it's difficult to understand how the stimulus has strengthened our economy for years to come.

Last but not least, President Obama promised that there would be "unprecedented transparency and accountability" while the stimulus dole was being issued. However, Senators John McCain and Tom Coburn issued a report in August 2010 highlighting 100 stimulus projects that surely wouldn't have been approved in a truly transparent government. The projects range from studies on the effects of cocaine on monkeys ($71,623 granted) to replacing a five-year-old, 0.25-mile sidewalk to be more compliant with disability requirements ($90,000 granted). Even if we assumed that the projects were needed, are the price tags really indicative of the projects' value?

Finding the transparency he promised in his campaign has been difficult for President Obama. A recent report on the issue found that "to date only 1 percent of 500,000 meetings from the president's first eight months have been released, and thousands of known visitors (including lobbyists) are missing from the lists." Transparency is promised because transparency sounds good. But unfortunately it is just one more stimulus goal that never came to fruition.

Stage Four: The Response

The final tally of the official goals achieved is one out of five, or 20 percent. It is worth noting that of the four failed goals, three were never even close. The jobs target was a full 8.5 million off, the US credit rating has been downgraded, and only 1 percent of White House visitor logs have been released.

To any normal person, these would be sufficient reasons to acknowledge their mistake and move on. Politicians and pundits are unable to do that, however, and many actually believe the stimulus was a success! This is possible, of course, because the original goals are no longer being considered. In the link above, Harold Meyerson explains that the stimulus was a success because "it manifestly did arrest the slide."

Arresting the slide was not the point of the stimulus. If we were only concerned with arresting the slide, the stimulus wouldn't have needed to be so large. The stimulus was pegged at $787 billion because of the goals that President Obama laid out. Imagine a parent gives his son $20 so he can go to a steakhouse with his friends. Instead, the son goes to the grocery store and sees a cup of ramen on sale for 59 cents. Since the dinner money came from his dad, he ignores the price and spends the entire $20 on the cup of ramen. When his father asks why he didn't spend the $20 on a steak, the son just replies, "What's it matter? I still got dinner, didn't I?"

This is the same logic that Meyerson is using. But paying $20 for Ramen is not the same thing as paying $20 for a steak, even if they both count as dinner. We paid $787 billion dollars for a specific set of goals, and only one of them was achieved. Obama also resorted to this logic: "Now, without relitigating the past, I'm absolutely convinced, and the vast majority of economists are convinced, that the steps we took in the Recovery Act saved millions of people their jobs or created a whole bunch of jobs." Whether he is convinced of it or not doesn't really matter, because the numbers are readily available, and the numbers show that the stimulus plan was a colossal failure.

Conclusion

I realize that the majority of this article focuses on statements and policies related to President Obama. In no way should this be construed as a statement of support for President Bush's policies. President Hoover laid the groundwork for President Roosevelt's New Deal, and I feel that the same thing has happened with Bush and Obama. The fact that the economy was still damaged enough to allow President Obama to pass his newest deal is a clear indication that President Bush's stimulus and bailout failed.

Some may argue that the promises made by President Bush and President Obama were simply political rhetoric, and that they shouldn't be taken too seriously. They might have a point if that rhetoric hadn't been followed up with dangerous legislation. The bailout and the stimulus plans were destined to fail from the beginning. They allowed companies to avoid the consequences of their actions, circumventing a critical component of capitalism and a market economy. By removing the consequences, we have given corporations a green light to do whatever they wish.

Both President Bush and President Obama believed their interventions would heal the economy. You simply can't fix a problem by doing what caused it in the first place. It wasn't the first time the government attempted to replace the market, and unfortunately it probably won't be the last. By recognizing Dr. Sowell's pattern of failure, however, we become better equipped to anticipate and recognize the opposition's plan. Knowing this, we can educate those around us on the true effects of the policy and the proper course of action.

Charlie Virgo is a finance major at the University of Phoenix. His introduction to economics came from reading Economics in One Lesson by Henry Hazlitt. Send Charlie Virgo mail. See Charlie Virgo's article archives.

You can subscribe to future articles by Charlie Virgo via this RSS feed.![]()

© 2011 Copyright Charlie Virgo - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.