Gold a Bubble, to Correct or Go Parabolic, Stagflation Threatens Western Economies

Commodities / Gold and Silver 2011 Aug 16, 2011 - 06:56 AM GMTBy: GoldCore

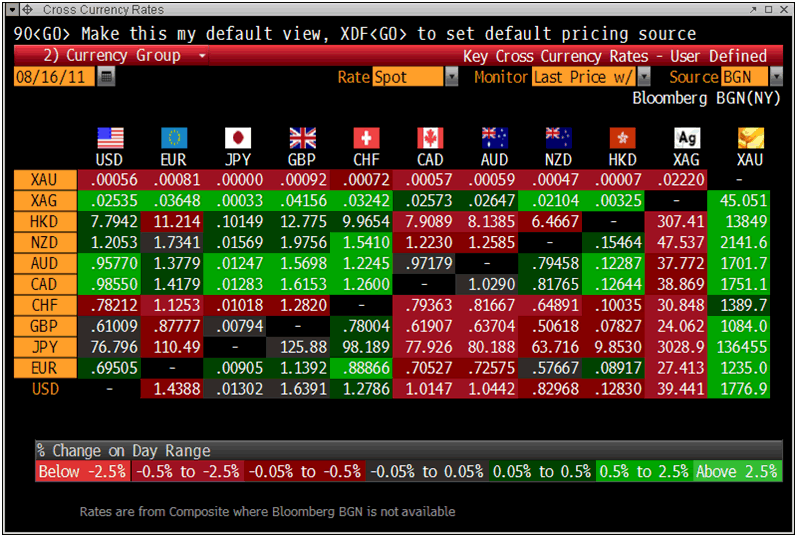

All major currencies have fallen against gold today with the euro down 1% against gold on nervousness ahead of the Franco German summit. Gold is trading at USD 1,776.70, EUR 1,235.10, GBP 1,084.10, CHF 1,389.90 per ounce and 136,450 JPY/oz. Gold’s London AM fix this morning was USD 1,779.00, EUR 1,236.18, GBP 1,086.81 per ounce.

All major currencies have fallen against gold today with the euro down 1% against gold on nervousness ahead of the Franco German summit. Gold is trading at USD 1,776.70, EUR 1,235.10, GBP 1,084.10, CHF 1,389.90 per ounce and 136,450 JPY/oz. Gold’s London AM fix this morning was USD 1,779.00, EUR 1,236.18, GBP 1,086.81 per ounce.

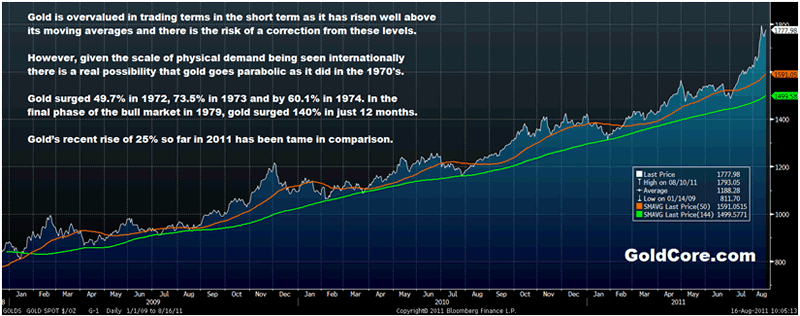

Gold in U.S. Dollars – January 2009 to August 2011 – Daily and 50 and 144 Day Moving Averages

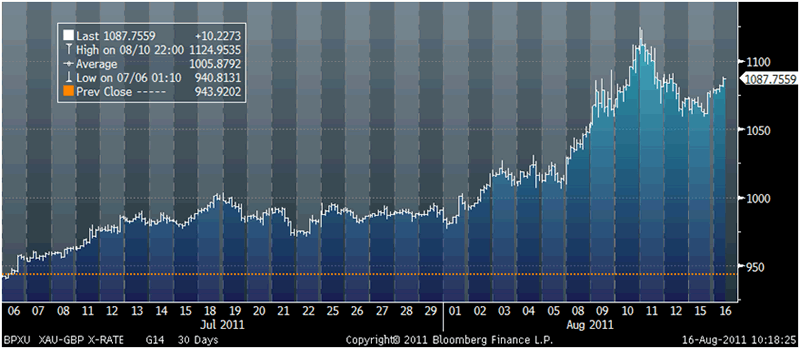

U.K. inflation accelerated more than economists forecast in July, as the cost of food, clothes, footwear, housing maintenance and rent increased. Negative real interest rates are getting worse as the BOE has kept interest rates at a record low of 0.5%.

5% inflation in the UK is expected in the coming months prior to hopes that inflation will abate. UK economic activity grew at just 0.2% in the second quarter of the year suggesting an annual rate of growth of 0.7% over the past twelve months.

Economic growth is faltering in all major economies with data this morning showing Eurozone and German GDP growth slowing.

Eurozone GDP rose 0.2% from the first quarter, when it increased 0.8% while German GDP growth fell by more than expected in the second quarter, dropping to a derisory 0.1%.

Double dip recessions involving inflation and therefore stagflation seem increasingly likely.

Gold in British Pounds – 30 Days (Tick)

Gold is overvalued in trading terms in the short term as it has risen well above its moving averages and there is the risk of a correction from these levels.

The 144 day moving average (identified by Dominic Frisby of Money Week) has provided very strong support to gold since January 2009 and should provide strong support should a material correction materialize.

The 200 day moving average provided support from 2000 to 2008 but more recently the 144 day moving average has been strong support.

As we appear to be entering the second phase of gold’s bull market the 50 and 100 day may become more important support levels.

While acknowledging the risks of a correction, one must also acknowledge that given the scale of physical demand being seen internationally there is a real possibility that gold goes parabolic as it did during the stagflation of the 1970s.

Gold surged 49.7% in 1972, 73.5% in 1973 and by 60.1% in 1974. In the final phase of the bull market in 1979, gold surged 140% in just 12 months.

Gold’s recent rise of 20% per annum since 2000 and 25% rise so far in 2011 has been tame in comparison.

Cross Currency Rates

The conditions today are far more bullish than in the 1970s as in the 1970s the U.S. was the largest creditor nation in the world whereas today the U.S. is the largest debtor nation the world has ever seen.

Gold went parabolic in the 1970s after a period of stagflation. Today, we appear to be on the verge of a period of stagflation.

The 1970s saw significant geopolitical risk with oil crisis, the overthrow of the Shah of Iran and the Russians invading Afghanistan. Today there is significant geopolitical risk in the world, arguably more, and there remains the real risk of a conflagration in the Middle East between Israel and its allies and Iran and its allies.

Today we have a global debt crisis, massive systemic risk in the financial system threatening the solvency of many banks and sovereign governments. This was not the case in the 1970s.

This makes a parabolic move in gold very likely in the coming days, weeks and months. Increasingly, the question is not if we go parabolic rather it is when do we go parabolic – in the weeks and months or in the coming years.

Prudent diversification and owning physical bullion remain key to weathering the coming difficult years.

For the latest news and commentary on gold and financial markets follow us on Twitter.

SILVER

Silver is trading at $39.33/oz, €27.37/oz and £24.02/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,810.50/oz, palladium at $741/oz and rhodium at $1,750/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.