Time to Buy the U.S. Dollar?

Currencies / US Dollar Aug 16, 2011 - 04:08 AM GMTBy: Tony_Caldaro

We last reviewed the currencies in early July: http://caldaro.wordpress.com/2011/07/04/foreign-currency-and-usd-update/. Since then, it appears, a lot has changed. The world’s equity markets have entered bear markets, US Bonds have been soaring, commodities have generally weakened, Gold has been making all time new highs, and the Swiss Franc (CHFUSD) has gone parabolic.

We last reviewed the currencies in early July: http://caldaro.wordpress.com/2011/07/04/foreign-currency-and-usd-update/. Since then, it appears, a lot has changed. The world’s equity markets have entered bear markets, US Bonds have been soaring, commodities have generally weakened, Gold has been making all time new highs, and the Swiss Franc (CHFUSD) has gone parabolic.

Based upon our 17-year currency cycle, which is a subset of the 34-year secular equity/commodity cycle and the 68-year deflation/inflation bond cycle, we have been expecting foreign currencies to top, versus the USD, in the year 2012 1 year. With recent world events, a review of the current wave structures, and some price targets being hit, we believe the currency cycle may be topping on the early side of 2012 – in 2011. Let’s review the currency wave structures starting with the Swiss Franc.

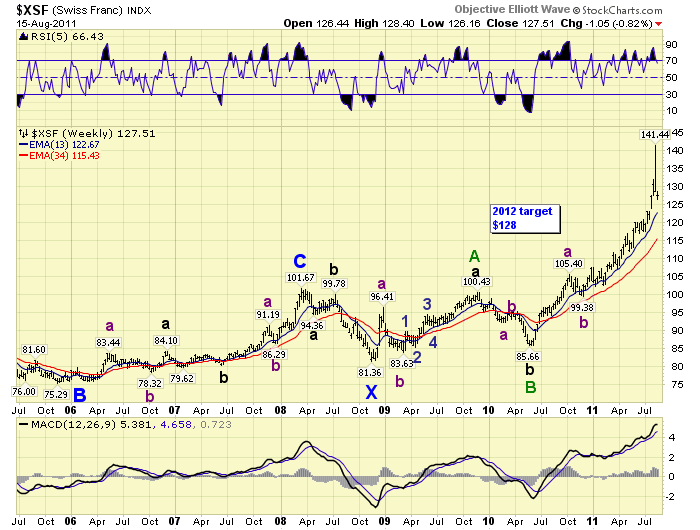

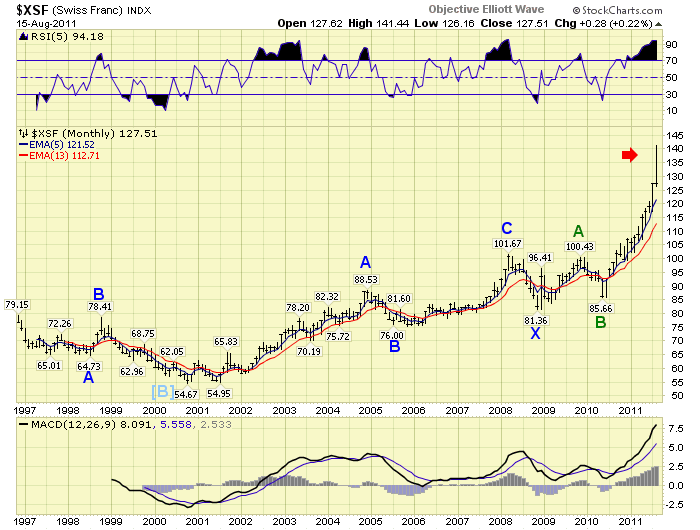

In the last three weeks the CHFUSD has simply gone parabolic.

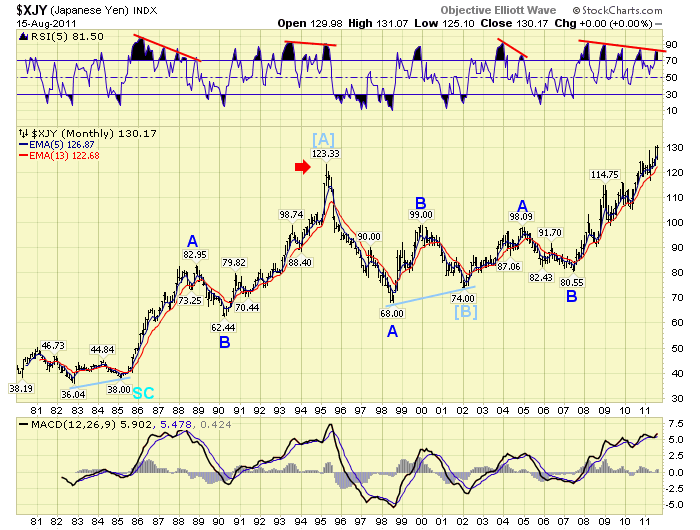

The last time we, historically, observed this type of move in a currency was in the JPYUSD at the end of the 1995 Cycle wave peak sixteen years ago.

Compare the two monthly charts.

This alone may be a signal that the 17-year currency cycle is peaking. When we review the wave structure of the CHFUSD we observe it has been in a powerful last uptrend of its 2008 bull market. When the next downtrend is confirmed by OEW this bull market is likely over.

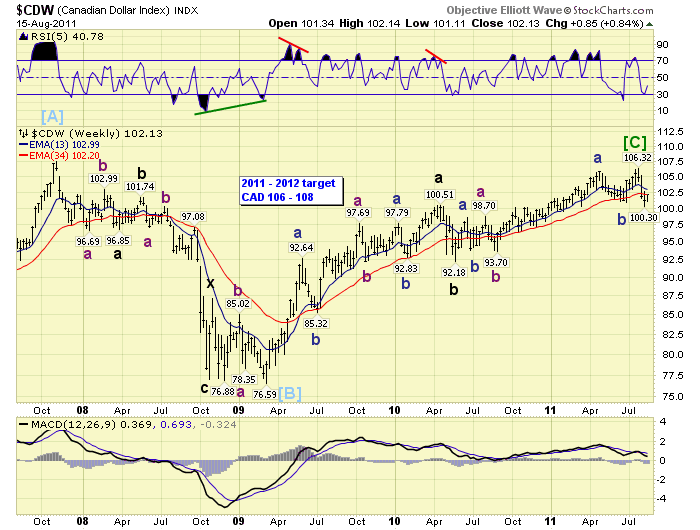

The CADUSD appears to have completed its 2009 bull market wave structure right in the targeted area. We have marked the recent uptrend with a tentative Cycle wave [C].

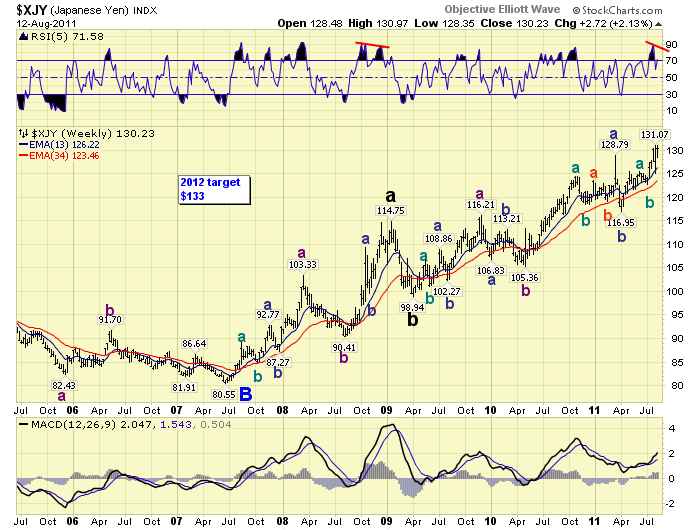

The JPYUSD appears to be in the last uptrend of its 2007 bull market, and it is right near the targeted 133 area.

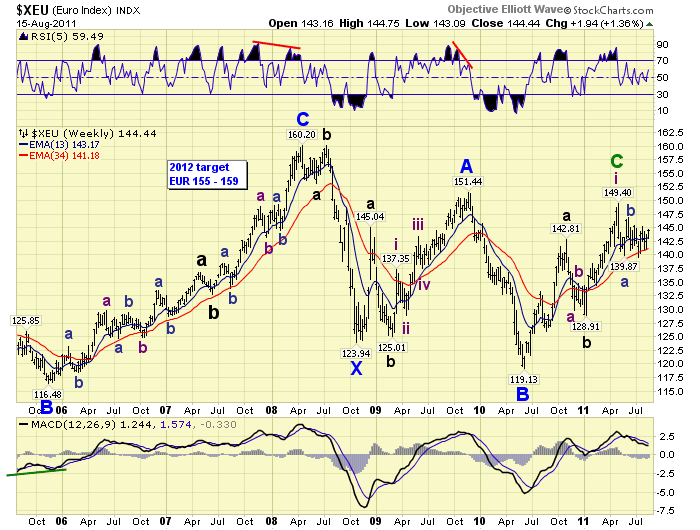

The EURUSD may have completed its pattern well. We’ll need additional price movement, like a drop under 1.40 and the recent lows, to increase that probability.

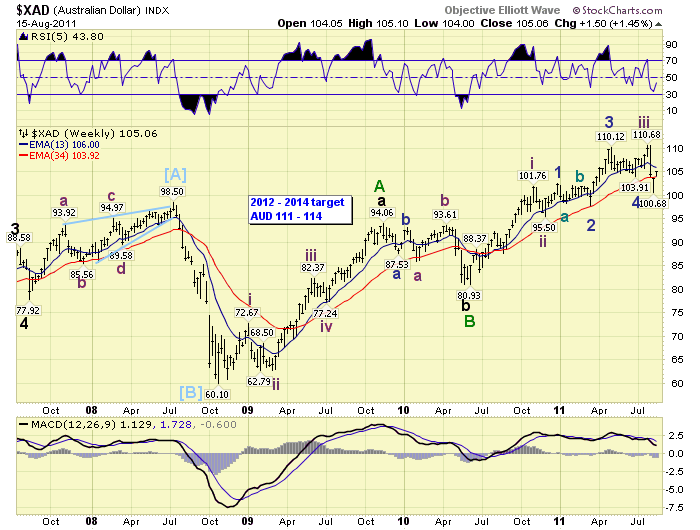

The AUDUSD needs one more confirmed uptrend to complete its bullish pattern from the 2008 low. It is also within the targeted range.

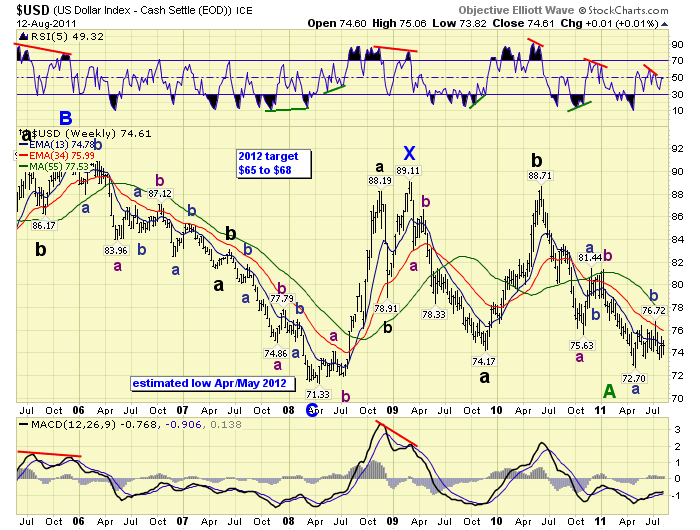

The last currency of importance is of course the USD. The OEW pattern from the 2009 high has two declining waves labeled Major A and C. Notice how similar they are in price (15 and 16), and both divided into three Intermediate waves. This potential bottoming pattern is similar to the bottoming pattern in the first half of 2008. If the DXY takes out the recent high at 76.72 it would greatly increase the probability of a Primary wave A bottom.

Since currencies are traded on a global basis 24/7 they will not all top/bottom at the same time. These events come in stages just like the equity markets recently displayed. Thus far, we count five potential completed patterns and one requiring one more uptrend (AUD). We will keep a close eye on this potential monumental event. Best to your trading!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.